The most recent traits in rates of interest for private loans from the Credible market, up to date weekly. (iStock)

Debtors with good credit score in search of private loans through the previous seven days prequalified for charges that have been larger for 3- and 5-year loans when in comparison with fixed-rate loans for the seven days earlier than.

For debtors with credit score scores of 720 or larger who used the Credible market to pick out a lender between August 19 and August 25:

Charges on 3-year fixed-rate loans averaged 16.14%, up from 16.06% the seven days earlier than and from 15.20% a 12 months in the past.Charges on 5-year fixed-rate loans averaged 21.64%, up from 21.23% the earlier seven days and from 19.90% a 12 months in the past.

Private loans have turn out to be a preferred technique to consolidate debt and repay bank card debt and different loans. They may also be used to cowl surprising and emergency bills like medical payments, handle a serious buy, or fund residence enchancment tasks.

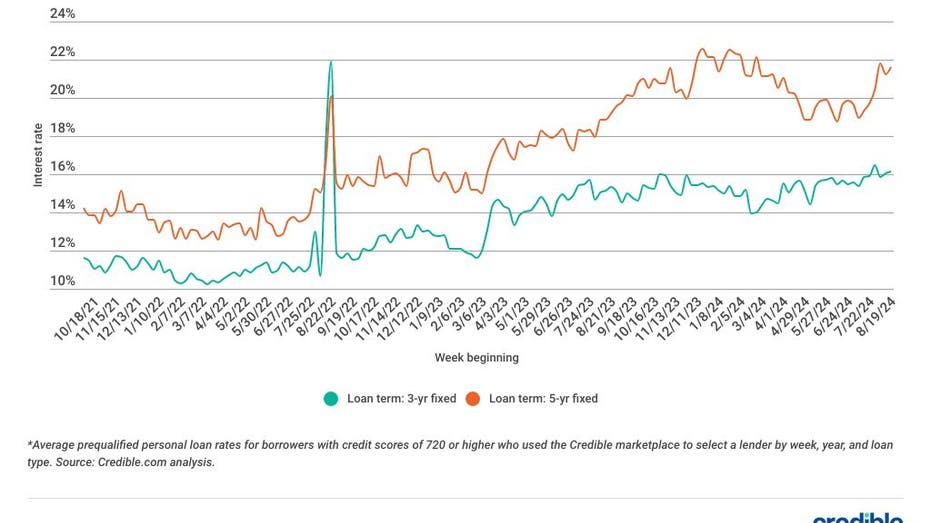

Common private mortgage rates of interest

Common private mortgage rates of interest have elevated during the last seven days for 3- and 5-year loans. Whereas 3-year mortgage charges edged up by 0.08 share factors, charges on 5-year loans rose by 0.41 share factors. Rates of interest for 3- and 5-year phrases stay larger than they have been this time final 12 months, up 0.94 share factors for 3-year phrases and up 1.74 share factors for 5-year phrases.

Nonetheless, debtors can reap the benefits of curiosity financial savings with a 3- or 5-year private mortgage, as each mortgage phrases provide decrease rates of interest on common than higher-cost borrowing choices similar to bank cards.

However whether or not a private mortgage is best for you depends upon a number of elements, together with what price you possibly can qualify for, which is basically based mostly in your credit score rating. Evaluating a number of lenders and their charges helps make sure you get the very best private mortgage in your wants.

Earlier than making use of for a private mortgage, use a private mortgage market like Credible to comparability store.

Private mortgage weekly price traits

Listed here are the newest traits in private mortgage rates of interest from the Credible market, up to date weekly.

The chart above exhibits common prequalified charges for debtors with credit score scores of 720 or larger who used the Credible market to pick out a lender.

For the month of July 2024:

Charges on 3-year private loans averaged 23.60%, up from 23.02% in June.Charges on 5-year private loans averaged 25.06%, up from 24.81% in June.

Charges on private loans fluctuate significantly by credit score rating and mortgage time period. In the event you’re interested in what sort of private mortgage charges you could qualify for, you should use an internet instrument like Credible to check choices from completely different non-public lenders.

All Credible market lenders provide fixed-rate loans at aggressive charges. As a result of lenders use completely different strategies to judge debtors, it’s a good suggestion to request private mortgage charges from a number of lenders so you possibly can evaluate your choices.

Present private mortgage charges by credit score rating

In July, the common prequalified price chosen by debtors was:

13.38% for debtors with credit score scores of 780 or above selecting a 3-year loan32.38% for debtors with credit score scores under 600 selecting a 5-year mortgage

Relying on elements similar to your credit score rating, which kind of non-public mortgage you’re in search of and the mortgage reimbursement time period, the rate of interest can differ.

As proven within the chart above, credit score rating can imply a decrease rate of interest, and charges are typically larger on loans with mounted rates of interest and longer reimbursement phrases.

The place are rates of interest headed?

The Bureau of Labor Statistics (BLS) reported that inflation slowed in Might, elevating hopes for a number of rate of interest cuts in 2024. When the Fed concluded its June assembly, it signaled one lower by the tip of the 12 months whereas holding charges regular. As of now, we anticipate one 25 foundation level (0.25 share factors) lower this 12 months, and a 100 foundation level (1 share level) lower in 2025.

Find out how to get a decrease rate of interest

Many elements affect the rate of interest a lender would possibly give you on a private mortgage. However you possibly can take some steps to spice up your possibilities of getting a decrease rate of interest. Listed here are some techniques to strive.

Enhance credit score rating

Typically, folks with larger credit score scores qualify for decrease rates of interest. Steps that may enable you to enhance your credit score rating over time embody:

Pay payments on time: Fee historical past is crucial consider your credit score rating. Pay all of your payments on time for the quantity due.Verify your credit score report: Take a look at your credit score report to make sure there aren’t any errors on it. In the event you discover errors, dispute them with the credit score bureau.Decrease your credit score utilization ratio: Paying down bank card debt can enhance this necessary credit-scoring issue.Keep away from opening new credit score accounts: Solely apply for and open credit score accounts you really want. Too many exhausting inquiries in your credit score report in a brief period of time may decrease your credit score rating.Select a shorter mortgage time period

Private mortgage reimbursement phrases can fluctuate from one to a number of years. Typically, shorter phrases include decrease rates of interest, for the reason that lender’s cash is in danger for a shorter time frame.

In case your monetary state of affairs permits, making use of for a shorter time period may enable you to rating a decrease rate of interest. Have in mind the shorter time period doesn’t simply profit the lender – by selecting a shorter reimbursement time period, you’ll pay much less curiosity over the lifetime of the mortgage.

Get a cosigner

You might be accustomed to the idea of a cosigner in case you have pupil loans. In case your credit score isn’t adequate to qualify for the very best private mortgage rates of interest, discovering a cosigner with good credit score may enable you to safe a decrease rate of interest.

Simply bear in mind, if you happen to default on the mortgage, your cosigner will likely be on the hook to repay it. And cosigning for a mortgage may additionally have an effect on their credit score rating.

Evaluate charges from completely different lenders

Earlier than making use of for a private mortgage, it’s a good suggestion to buy round and evaluate presents from a number of completely different lenders to get the bottom charges. On-line lenders usually provide probably the most aggressive charges – and may be faster to disburse your mortgage than a brick-and-mortar institution.

However don’t fear, evaluating charges and phrases doesn’t should be a time-consuming course of.

Credible makes it straightforward. Simply enter how a lot you wish to borrow and also you’ll be capable to evaluate a number of lenders to decide on the one which makes probably the most sense for you.

About Credible

Credible is a multi-lender market that empowers customers to find monetary merchandise which are the very best match for his or her distinctive circumstances. Credible’s integrations with main lenders and credit score bureaus permit customers to rapidly evaluate correct, customized mortgage choices – with out placing their private info in danger or affecting their credit score rating. The Credible market offers an unmatched buyer expertise, as mirrored by over 7,500 optimistic Trustpilot opinions and a TrustScore of 4.8/5.