Woodshaw Monetary Group principal D.R. Barton discusses whether or not the Federal Reserve’s price minimize will cease the financial slowdown and result in a market rally on ‘Varney & Co.’

It’s a September to recollect courtesy of the Federal Reserve, which delivered a super-sized price minimize for traders on Wednesday.

The Dow Jones Industrial Common jumped over 500 factors, closing above 42,000 for the primary time. It took simply 45 days for the reason that final 1,000-point milestone, as tracked by Dow Jones Market Information Group.

Dow Jones Industrial Common

THE FED CUT RATES FOR FIRST TIME SINCE 2020: WHAT TO KNOW

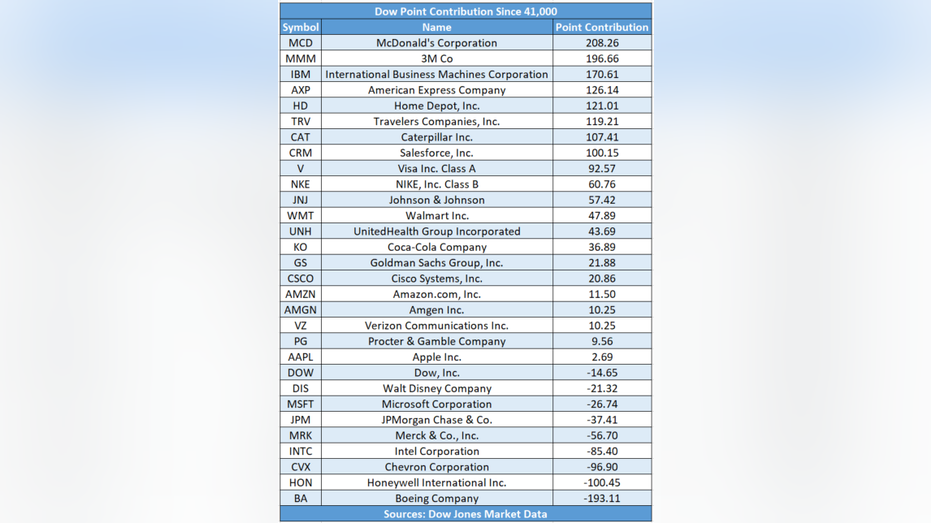

McDonald’s served up probably the most level good points at over 208, with 3M second, whereas embattled Boeing was the most important drag, subtracting over 193, adopted by Honeywell Worldwide.

Ticker Safety Final Change Change % MCD MCDONALD’S CORP. 293.85 +1.82

+0.62%

KO THE COCA-COLA CO. 70.63 -1.13

-1.57%

BA THE BOEING CO. 154.64 -0.53

-0.34%

HON HONEYWELL INTERNATIONAL INC. 203.70 +2.06

+1.02%

IBM, American Categorical and Residence Depot additionally helped carry the Dow to the recent milestone.

Prime & Backside Dow Level Strikes from 41,00 (Dow Jones Market Information Group )

The S&P 500 notched one other recent report led by know-how, client discretionary and industrial names.

Ticker Safety Final Change Change % SP500 S&P 500 5713.64 +95.38

+1.70%

XLK TECHNOLOGY SELECT SECTOR SPDR ETF 223.62 +6.45

+2.97%

XLY CONSUMER DISCRETIONARY SELECT SECTOR SPDR ETF 197.14 +4.39

+2.28%

XLI INDUSTRIAL SELECT SECTOR SPDR ETF 134.11 +2.27

+1.72%

Apple, Salesforce.com and Meta helped carry the tech-heavy Nasdaq Composite.

Ticker Safety Final Change Change % AAPL APPLE INC. 228.87 +8.18

+3.71%

CRM SALESFORCE INC. 266.04 +13.62

+5.40%

META META PLATFORMS INC. 559.10 +21.15

+3.93%

I:COMP NASDAQ COMPOSITE INDEX 18013.981137 +440.68

+2.51%

The Fed, on Wednesday, introduced its first price minimize since March 2020, taking the goal vary to 4.75% to five% with Chairman Jerome Powell signaling the importance of the recent shift.

“This recalibration of our policy stance will help maintain the strength of the economy and the labor market and will continue to enable further progress on inflation as we begin the process of moving toward a more neutral stance, we are not on any pre-set course. We will continue to make our decisions meeting by meeting” he stated.

Policymakers, of their projections, outlined charges might fall to 4.4% by year-end, 3.4% by 2025 and a couple of.9% by 2026. Nonetheless, the crew at Wells Fargo Funding Institute says the outlook could also be too optimistic.

“Our expectation of two more rate cuts in 2024 is in line with the Fed’s current view, but we find that the FOMC is still priced for a more optimistic outcome regarding future Fed rate cuts in 2025. As the economic recovery resumes in the second half of 2025, we think it will prove difficult for inflation to decline further toward the Fed’s 2.0% inflation target” they wrote.

MORTAGE RATES SLIDE POST FED CUT

Decrease borrowing prices are favorable for firms and shoppers in search of mortgages, private and auto loans, in addition to different lending levers.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The speed for a 30-year fastened mortgage fell to six.09% on Thursday. A yr in the past it averaged 7.19%.