Private equity accounted for a record share of Chinese mergers and acquisitions in 2021, and the country’s well-funded buyout firms are likely to be busy this year too, as corporate restructurings and multinational disposals generate more targets.

The industry’s rising influence contrasts with relatively muted overall M&A activity in China, which last year grew far more slowly than a booming global market.

Private-equity-backed transactions in China jumped 26% last year to a record $108 billion, according to Refinitiv data, making up an unprecedented one-fifth of all deals by dollar value. The figures include Western-style buyouts by privately owned financial firms, as well as smaller investments and deals led by state-backed investors.

In contrast, overall M&A with any Chinese involvement edged up 2.8% to $580 billion, lagging behind a nearly two-thirds surge in global deal making.

“You’re starting to get sizable, China-focused, private-equity deals, and that is all fueled by a number of sources including institutional sources which have developed over recent years from within China, ranging from wealth management to insurance companies to municipal government funding and so forth,” said Victor Ho, a Hong Kong-based lawyer specializing in M&A and private equity at Allen & Overy.

“As an asset class, putting money into private equity has taken off for Chinese investors,” he said.

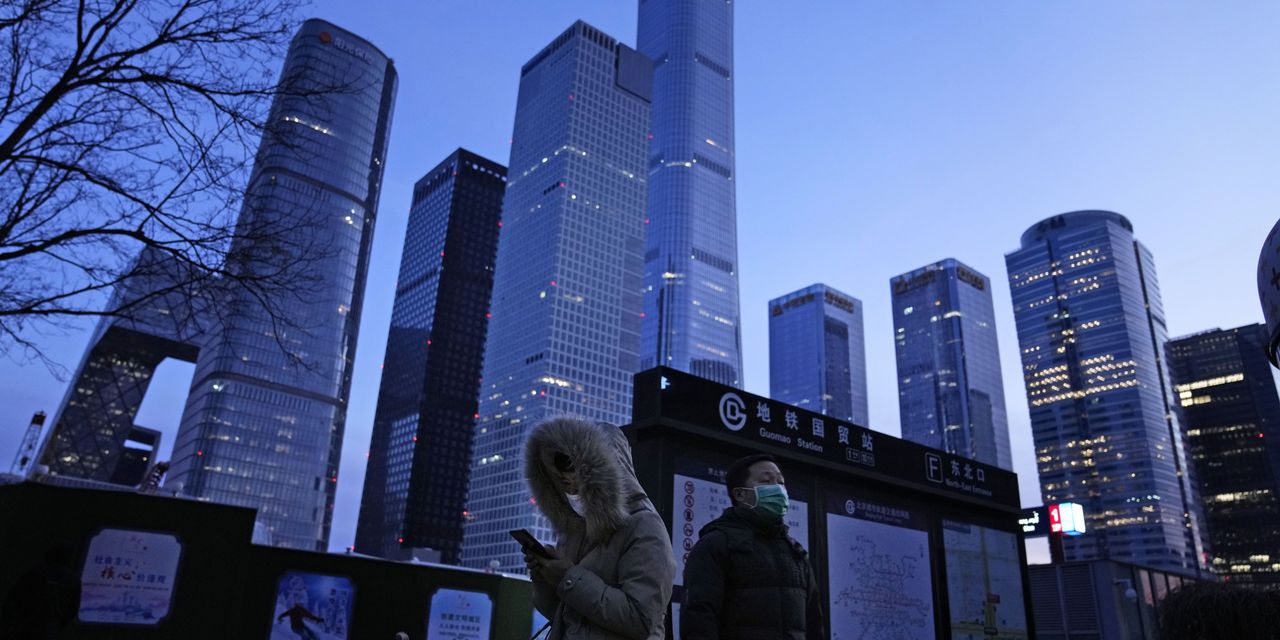

Overall cross-border M&A has been hindered by Beijing’s tough anti-Covid policy and its desire for greater self-sufficiency, in part through a policy of “dual circulation,” or sustaining growth by focusing on a huge domestic market.

“China M&A has been more inward-looking, reflecting the government’s emphasis on its dual-circulation strategy,” said Colin Banfield, head of Asia-Pacific M&A at Citigroup Inc. , adding that China’s stance on Covid-19 had also played a role. “The impact on cross-border travel has made it difficult to undertake some transactions,” he said.

Still, both Chinese and global private-equity firms have been hunting for targets. Homegrown outfits include players such as Primavera Capital Group, which was founded by Fred Hu, a former chairman of Goldman Sachs Group Inc.’s Greater China business, and Hillhouse Capital Group, founded by Zhang Lei. Active international players include buyout giants Blackstone Inc. and KKR & Co.

Asset sales by multinational companies, especially in the consumer sector, have generated some activity. One of the largest last year was a $2.2 billion move into infant formula by Primavera, with its purchase of the China business of Mead Johnson Nutrition Co. from Reckitt Benckiser Group PLC.

“We are seeing increasing opportunities in the divestment and spinoff of Chinese operations by foreign brands in each of the consumer market segments,” said Stephen Zhang, a Beijing-based partner at Primavera. “International brands often have a hard time catching up to the ever-evolving local consumer market,” he said.

Nine out of the top 10 China deals last year were domestic M&A. Many big-ticket transactions are government related. For instance, last year’s largest private-equity-style deal, according to Refinitiv, was a $6.6 billion investment as part of the restructuring of the bad-debt manager China Huarong Asset Management Co., 2799 1.18% involving state investors such as the giant financial conglomerate Citic Group.

In another big transaction, state-backed venture-capital firms Beijing Jianguang Asset Management Co., known as JAC Capital, and Wise Road Capital agreed to back the indebted chip company Tsinghua Unigroup Co.

Renewable energy, electric vehicles and other businesses that appeal for environmental, sustainable and governance reasons are another deal driver. “We see people paying more and more attention to ESG or green sectors in China inbound, outbound and domestic deals,” said Miranda Zhao, head of M&A for Asia-Pacific, at Natixis.

For example, last year a group of investors put $1.6 billion of early-stage funding into the EV battery maker Svolt Energy Technology Co. The industry refers to these deals as growth investments, as opposed to taking control through a buyout.

While cross-border deal making could remain challenging, not least because authorities have shown no signs of relaxing China’s zero-Covid strategy, domestic M&A could be in for a stronger year in 2022.

China appears to be wrapping up a regulatory reset that analysts say should put the country on a more sustainable growth trajectory, even if it has caused pain for a lot of companies and investors. Meanwhile, the central bank has shifted to easing monetary policy to support the economy.

All these factors will bode well for merger volumes, said Richard Wong, head of Asia-Pacific M&A at Morgan Stanley. China private equity “still has a huge runway for both growth and buyout opportunities,” he added.

Write to Jing Yang at [email protected]

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8