Under Chancellor Angela Merkel, Germany has played an outsize role in determining the economic and political direction of the European Union. Now, the makeup of a new German government will be critical in deciding a series of key issues, from the area’s post-Covid-19 economic policy to its relations with the U.S., Russia and China.

In the coming months, the EU will have to decide whether to loosen budget rules for members, a change that could affect the economic trajectory of the bloc. It is also under pressure from France to establish its own security and defense capabilities, in part in response to the U.S.’s chaotic withdrawal from Afghanistan and Washington’s growing focus on Asia.

As the EU’s largest member, Germany inevitably helps shape the bloc’s plans and decisions. Yet Sunday’s election gave little clue as to who would lead the next government or what its agenda will be. Olaf Scholz, the Social Democrat who scored a narrow victory on Sunday, said he was optimistic that a new administration could be formed by Christmas.

This means there could be little time to settle the bloc’s most urgent decisions before its second-largest economy, France, enters its own political freeze ahead of an election in April.

On the plus side, few big decisions have to be made in the next weeks, and neither is the bloc confronting a Greek- or Brexit-style crisis requiring immediate action. Yet the breathing space for a new German government is likely to end abruptly.

Brussels officials are already considering proposals to revamp the EU’s deficit and debt rule—a debate with major consequences as the bloc tries to emerge from the pandemic-driven economic crisis.

The rules, which seek to keep a country’s budget deficit and debt in check, were suspended during the pandemic. Now an alliance of southern countries is pushing to have the rules modified before they come back in 2023 to facilitate debt-financed investment.

The discussion is urgent: When governments submit their budget plans to Brussels next spring, they will need to know what the 2023 rules will be. Without certainty, governments may curtail spending plans.

The issue could cut through the next German coalition. While Mr. Scholz has opposed easing the rules, party officials close to him have signaled there may be room for maneuver.

Mr. Scholz hasn’t been shy about ramping up public spending during the pandemic. He played a key role in setting up the EU’s 750-billion-euro Covid-19 recovery fund, equivalent to $880 billion, and as German finance minister he has deployed one of Europe’s largest national stimulus efforts. His Social Democratic Party, or SPD, wants to increase public investment in green and digitization projects.

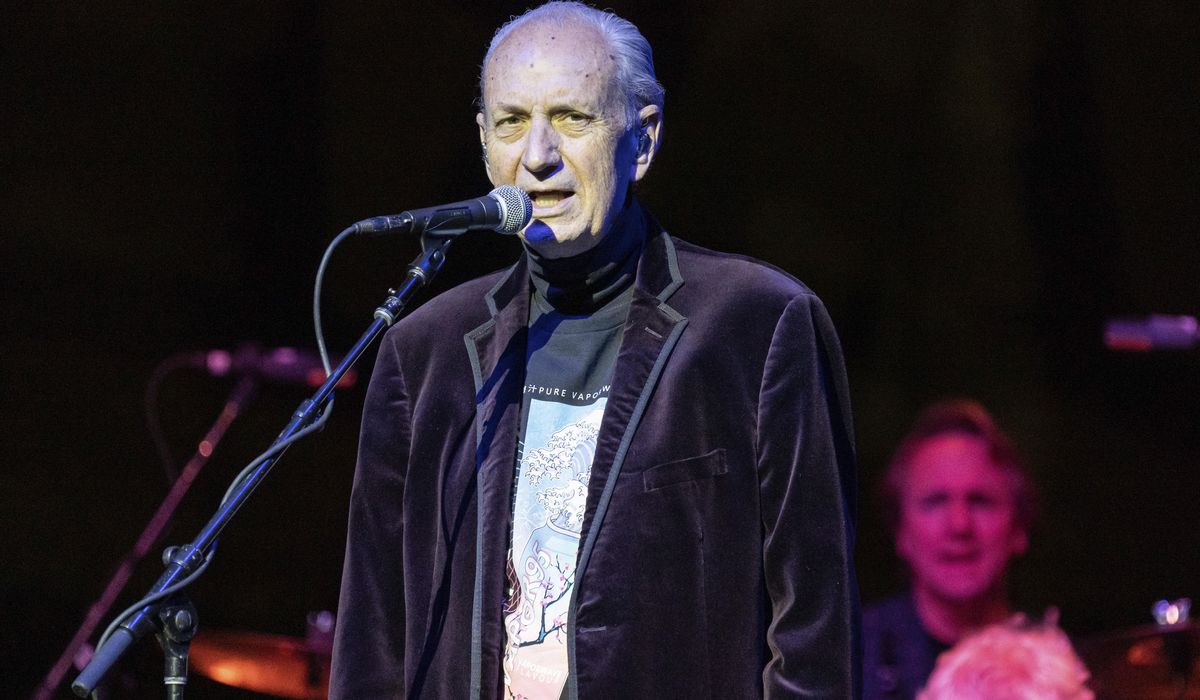

Olaf Scholz, the Social Democrat who scored a narrow victory in the election, said he was optimistic a new administration could be formed by Christmas

Photo: Krisztian Bocsi/Bloomberg News

So do the Greens, who are likely to end up in Germany’s first three-party coalition. Yet the Free Democratic Party, the prospective third partner, is fiscally hawkish, as is the conservative Christian Democratic Union, which narrowly lost the election but wants to hold its own rival coalition negotiations.

Jacob F. Kirkegaard, senior fellow at the Peterson Institute for International Economics, said since the two parties who gained the most in Sunday’s vote have big spending plans, the new coalition might not veto reforms.

“I belong in a camp that thinks the election will mean significant shifts in domestic German economic policy that will spill over also onto European economic issues,” he said. “Otherwise, both the SPD and Green voters will feel let down.”

Others are less sure, especially with FDP leader Christian Lindner tipped for the Finance Ministry. “It really depends on the precise coalition agreement and on the individuals who sit in the individual ministries,” said Guntram Wolff, director of Brussels-based think tank Bruegel.

Another area that will need Germany to weigh in is France’s push for a more autonomous EU defense policy.

French President Emmanuel Macron will assume the EU’s rotating presidency in January, giving him a platform to shape the bloc’s plans ahead of his own election. Still bristling after its clash with Washington over a defense pact between the U.S., the U.K. and Australia, French officials are determined to make progress in advancing the EU’s defense and security capabilities.

Germany remains torn between its support for deeper defense cooperation in the EU and its desire to avoid weakening the trans-Atlantic partnership and the North Atlantic Treaty Organization. While the Greens are pushing for a more assertive policy toward China and Russia, the SPD has consistently opposed raising Germany’s modest military spending, an obstacle in advancing EU ambitions.

Prodded by France, the EU is working up a list of the bloc’s key defense capabilities needs in coming years. Brussels has floated plans for a 5,000-strong rapid reaction force and France will host a European defense summit in the spring.

Some, particularly in Europe’s east, are uneasy about Mr. Macron’s strategic autonomy plans potentially weakening NATO, and are looking to Berlin for support.

Piotr Buras, head of the European Council on Foreign Relations’ Warsaw office, said an SPD-led coalition could frustrate Paris. He said SPD positions on spending, doubts about armed military drones and its questioning of NATO’s nuclear-sharing policy suggest another German government wary of projecting power.

“Here, I think Germany would become a less reliable partner than it was under Merkel,” Mr. Buras said.

In addition to the uncertainties surrounding the positions of the next German government, there is also some trepidation as to whether Mr. Scholz—or whoever becomes chancellor—will show the negotiating skills or have the domestic political power Ms. Merkel used to regularly cajole EU-wide agreements out of the fractious 27-country club.

For some, this skill was crucial to keeping the EU together. Others hope her exit will recast the bloc’s balance of power, allowing less-cautious supporters of deeper economic and security integration like Mr. Macron and Italian Prime Minister Mario Draghi to seize the agenda. Mr. Scholz, in particular, has repeatedly talked about his support for a more integrated and sovereign EU.

Yet many current and former officials believe that while it may become more difficult to forge consensus on climate targets, rule-of-law concerns in Poland and Hungary, defense and economic policy, talk of a power shift from Berlin to Paris is overplayed.

“I don’t think the disappearance of Merkel means we will have a French or Italian-led Europe,” said Shahin Vallée, former European Council President Herman Van Rompuy’s economic adviser, now at the German Council on Foreign Relations. “It means we’re going to have a somewhat leaderless Europe until a German government beds in.”

Germany’s Election

Write to Laurence Norman at [email protected]

Copyright ©2021 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8