BlackRock chairman and CEO Larry Fink offers his tackle tariff negotiations with China and market volatility on ‘The Claman Countdown.’

U.S. monetary markets wrapped up certainly one of their most risky weeks for the reason that COVID-19 pandemic as President Donald Trump performs quick and livid along with his tariff plan that prompted retaliation from China.

When the mud settled, all three of the main benchmarks recorded features on Friday, which added to the weekly advance.

Ticker Safety Final Change Change % I:DJI DOW JONES AVERAGES 40212.71 +619.05

+1.56%

SP500 S&P 500 5363.36 +95.31

+1.81%

I:COMP NASDAQ COMPOSITE INDEX 16724.45559 +337.14

+2.06%

The Dow Jones Industrial Common gained 5% for the week, the S&P 500 almost 6% and the Nasdaq Composite 7%.

Market Stats 2025

Weekly Good points YTD

DJIA: +5% -5.5%

S&P 500: +5.7% -8.8%

Nasdaq Composite: +7.3 -13.4%

Nonetheless, the three main indexes stay unfavorable for the 12 months.

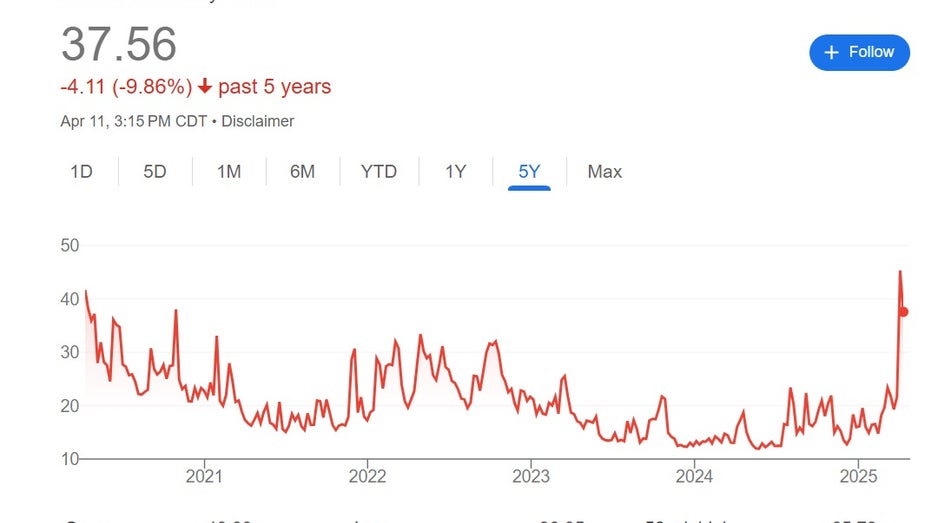

VOLUME AND VOLATILITY

The ultimate numbers didn’t come with out nail-biting. The CBOE’s Volatility Index, also referred to as Wall Avenue’s worry gauge, hit a five-year excessive because the Dow noticed swings of greater than 2,000 factors throughout a number of periods.

CBOE’s Volatility Index (Courtesy: Google )

AMID STOCK SELL-OFFS, DON’T PANIC, EXPERTS SAY

The Dow gained 2,692 factors on Wednesday, the most important one-day level rise in historical past. Whole buying and selling quantity on at the present time neared $30 trillion, the very best since not less than Could 2019, as tracked by Dow Jones Market Information Group. This is similar day that Trump, in a shock pivot, paused tariffs on some international locations.

Dow Jones Industrial Common

.

BlackRock CEO Larry Fink famous the market’s resiliency on a convention name with traders Friday, and mentioned he stays optimistic about capital markets.

Ticker Safety Final Change Change % BLK BLACKROCK INC. 878.78 +20.00

+2.33%

“We do not see systemic risks that there is not a pandemic,” Fink mentioned. “The financial system is shown safe and sound, and the resiliency. The markets are trading more, more volume with the liquidity than any other time. With all this volatility, the markets have proven to be quite successful and work quite well. “Clearly, there’s near-term uncertainty.”

TARIFF PROGRESS

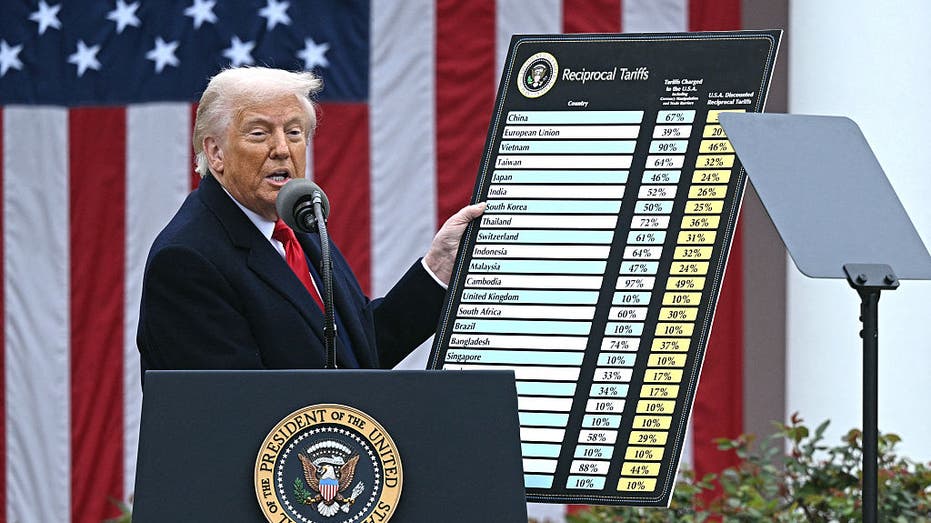

While uncertainty around tariffs tested investor resolve, the White House insists deals are being hammered out by U.S. Trade Representative Jamieson Greer.

“He confirmed that greater than 15 provides are already on the desk, which is outstanding in only a mere matter of days. And, as I mentioned earlier, we have heard from greater than 75 international locations all over the world,” White Home press secretary Karoline Leavitt mentioned on Friday.

President Donald Trump holds a chart as he delivers remarks on reciprocal tariffs throughout an occasion within the Rose Backyard entitled “Make America Rich Once more” at the White House in Washington, D.C., on April 2, 2025. (BRENDAN SMIALOWSKI/AFP via Getty Images))

BOND MARKET: 10-year Treasury Yield 4.5%

Government bonds are flashing a more troubling signal as investors pull money out over concerns of a looming recession. When yields rise, prices fall. The 10-year Treasury, the benchmark for borrowing costs such as mortgages and personal loans, hit 4.5%, the highest since February. The weekly 50-plus basis point jump was the biggest in over 40 years.

Treasury Secretary Scott Bessent was asked about this trend on Wednesday.

“There’s some very giant, leveraged gamers who’re experiencing losses which are having to do leverage,” he told Maria Bartiromo during an interview on “Mornings With Maria.” “I imagine that there’s nothing systemic about this. I feel that it’s an uncomfortable however regular deleveraging that is happening within the bond market.”

BIG BANKS CEOS WEIGH IN ON TRUMP’S TARIFFS: ‘CONSIDERABLE TURBULENCE’

Bessent was also asked about the weakening U.S. dollar and actions by the Chinese.

“They’ve really been weakening their forex, which is a loser for everybody. And once more, after I hear all these tales that the greenback is not going to be the reserve forex, if you find yourself with the Chinese language who’re keen to make use of their forex as a commerce device, that does not seem to be an excellent reserve asset to me,” Bessent mentioned.

The euro and the Japanese yen are up 8% vs. the dollar.

U.S. RECESSION?

A handful of Wall Avenue corporations are dialing up odds {that a} U.S. recession is feasible. JPMorgan Chase CEO Jamie Dimon shared his view this week.

Ticker Safety Final Change Change % JPM JPMORGAN CHASE & CO. 236.13 +9.39

+4.14%

“I hear it from just everybody now. ‘I’m going to cut back a little bit, I’m gonna wait, see what happens.’ That is kind of recessionary talk,” Dimon mentioned Wednesday in an unique interview on “Mornings with Maria.” When requested if he’s personally anticipating a recession, Dimon responded: “I am going to defer to my economists at this point, but I think probably that’s a likely outcome.”

His agency ratcheted up recession odds to 60%, whereas Goldman Sachs now sees a forty five% probability of 1 hitting America.

CONSUMER FEARS

The College of Michigan’s Surveys of Shoppers on Friday reported that its Shopper Sentiment Index dropped to 50.8 this month from 57 in April, the fourth straight month-to-month drop.

“This decline was pervasive and unanimous across age, income, education, geographic region and political affiliation,” mentioned Surveys of Shoppers Director Joanne Hsu.

Shopper sentiment plunged in April. (Photographer: Patrick T. Fallon/Bloomberg through Getty Photos / Getty Photos)

RECESSION FEARS, TARIFF UNCERTAINTY PROMPT PLUNGE IN CONSUMER SENTIMENT

“Sentiment has now lost more than 30% since December 2024 amid growing worries about trade war developments that have oscillated over the course of the year. Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month,” Hsu added.

INFLATION

The patron worth index for March dropped 0.1% vs. February however remained up 2.4% yearly, nonetheless above the Federal Reserve’s 2% mandate.

Whereas prices are easing, costs for gadgets comparable to eggs and raw floor beef stay elevated, up 60% and 10%, respectively.

GOLD SAFE HAVEN

The valuable steel noticed some volatility this week however rebounded to an all-time excessive of $3,222.20 an oz.. The 7% weekly acquire was the most important since March 2020. Even earlier than the tariff wars escalated, a number of strategists conveyed bullish views on the yellow steel, additionally an inflation hedge and a conventional secure haven.

Gold rebounded to an all-time excessive of $3,222.20 an oz. this week. (Photograph by ARNE DEDERT/dpa/AFP through Getty Photos / Getty Photos)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“While traditionally inflation and real yields have been the main drivers of gold prices, recently central bank buying has emerged as the primary catalyst behind the current gold price increase,” in keeping with an early April analysis word by Financial institution of America’s World Commodity Analysis’s Franciso Blanch and Irina Shaorshadze. The group sees gold reaching $3,500.

Ticker Safety Final Change Change % GLD SPDR GOLD SHARES TRUST – USD ACC 297.93 +5.62

+1.92%

BITCOIN

The biggest cryptocurrency by market worth rose Friday, hovering simply above $83,000. Nonetheless, its down 21% from its all-time excessive of $106,734.51 reached in December 2024.