BMO Capital Markets chief funding strategist Brian Belski discusses whether or not the market pullback is one thing buyers must be involved about on Making Cash.

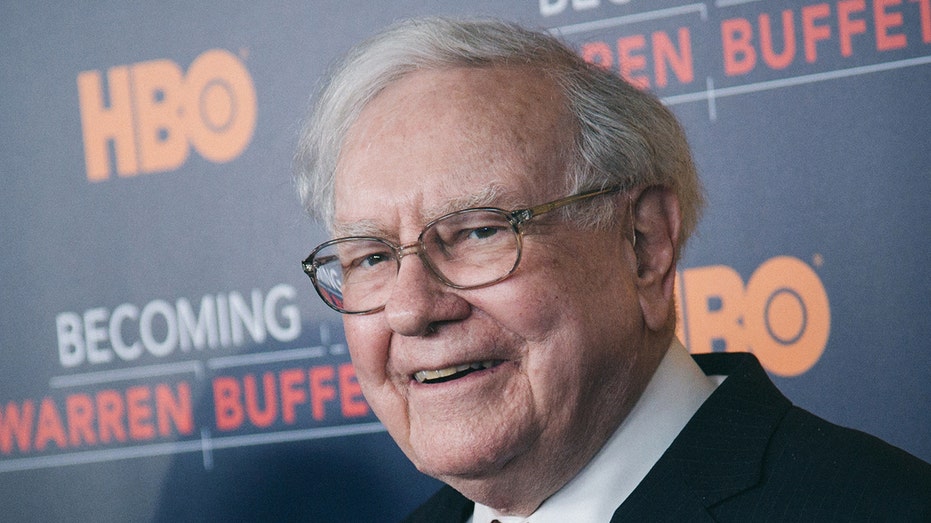

Berkshire Hathaway chairman and CEO Warren Buffett on Saturday launched his annual letter, which touted the corporate’s record-setting tax funds final yr and urged the federal authorities to spend the cash correctly.

Buffett recalled how, when he first purchased Berkshire Hathaway 60 years in the past, his longtime enterprise accomplice Charlie Munger warned him that what was then a big textile enterprise was “headed for extinction,” as indicated by its incapacity to generate earnings and pay taxes on the time.

“The U.S. Treasury, of all places, had already received silent warnings of Berkshire’s destiny,” he wrote. “In 1965, the company did not pay a dime of income tax, an embarrassment that had generally prevailed at the company for a decade. That sort of economic behavior may be understandable for glamorous startups, but it’s a blinking yellow light when it happens at a venerable pillar of American industry. Berkshire was headed for the ash can.”

“Fast forward 60 years and imagine the surprise at the Treasury when that same company – still operating under the name of Berkshire Hathaway – paid far more in corporate income tax than the U.S. government had ever received from any company – even the American tech titans that commanded market values in the trillions,” Buffett wrote.

WARREN BUFFETT’S ANNUAL LETTER TO BERKSHIRE HATHAWAY SHAREHOLDERS: READ HERE

Berkshire Hathaway chairman and CEO Warren Buffett touted the corporate’s report tax funds in his annual letter. (J. Kempin/Getty Photographs / Getty Photographs)

“To be precise, Berkshire last year made four payments to the IRS that totaled $26.8 billion. That’s about 5% of what all of corporate America paid. (In addition, we paid sizable amounts for income taxes to foreign governments and to 44 states.)”

Buffett added that the corporate’s mixture earnings tax funds to the U.S. Treasury over time have reached an mixture $101 billion, and famous that the corporate solely paying out one dividend previously 60 years allowed the conglomerate to construct its base of taxable earnings over time.

BUFFETT’S SURPRISE NOVEMBER LETTER TAKES PERSONAL TONE

The worth investor, identified for holding shares over the long run, additionally touted his prime investments.

“We own a small percentage of a dozen or so very large and highly profitable businesses with household names such as Apple, American Express, Coca-Cola and Moody’s. Many of these companies earn very high returns on the net tangible equity required for their operations”, he mentioned.

Ticker Safety Final Change Change % AAPL APPLE INC. 245.55 -0.28

-0.11%

AXP AMERICAN EXPRESS CO. 295.37 -8.40

-2.77%

KO THE COCA-COLA CO. 71.39 +1.34

+1.91%

MCO MOODY’S CORP. 500.03 -11.54

-2.26%

Buffett went on to debate the worth of capitalism, which he mentioned has faults and abuses that “in certain respects are more egregious now than ever” however “also can work wonders unmatched by other economic systems.”

“True, our country in its infancy sometimes borrowed abroad to supplement our own savings. But, concurrently, we needed many Americans to consistently save and then needed those savers or other Americans to wisely deploy the capital thus made available. If America had consumed all that it produced, the country would have been spinning its wheels.”

BUFFETT SLAMS REGULATORY BURDENS

“The American process has not always been pretty – our country has forever had many scoundrels and promoters who seek to take advantage of those who mistakenly trust them with their savings. But even with such malfeasance – which remains in full force today – and also much deployment of capital that eventually floundered because of brutal competition or disruptive innovation, the savings of Americans has delivered a quantity and quality of output beyond the dreams of any colonist.”

“From a base of only four million people – and despite a brutal internal war early on, pitting one American against another – America changed the world in the blink of a celestial eye,” Buffett wrote.

Buffett urged the federal authorities to spend correctly and guarantee a steady foreign money. (Picture by Kevin Dietsch/Getty Photographs / Getty Photographs)

He defined that in a “very minor way” Berkshire’s shareholders have participated within the American miracle by forgoing dividends. What was initially a “tiny, almost meaningless” reinvestment “mushroomed” over time.

“Berkshire’s activities now impact all corners of our country. And we are not finished. Companies die for many reasons but, unlike the fate of humans, old age itself is not lethal. Berkshire today is far more youthful than it was in 1965,” he wrote.

“However, as Charlie and I have always acknowledged, Berkshire would not have achieved its results in any locale except America whereas America would have been every bit the success it has been if Berkshire never existed.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“So thank you, Uncle Sam. Someday your nieces and nephews at Berkshire hope to send you even larger payments than we did in 2024. Spend it wisely. Take care of the many who, for no fault of their own, get the short straws in life. They deserve better. And never forget that we need you to maintain a stable currency and that result requires both wisdom and vigilance on your part,” Buffett wrote.