Coalition for a Affluent America chief economist Jeff Ferry discusses the panic over President Donald Trump’s tariffs on ‘Making Cash.’

President Trump’s tariffs on cars and car components are going to hit some automakers tougher than others, significantly amongst these with a decrease share of their U.S.-sold automobiles assembled outdoors the US.

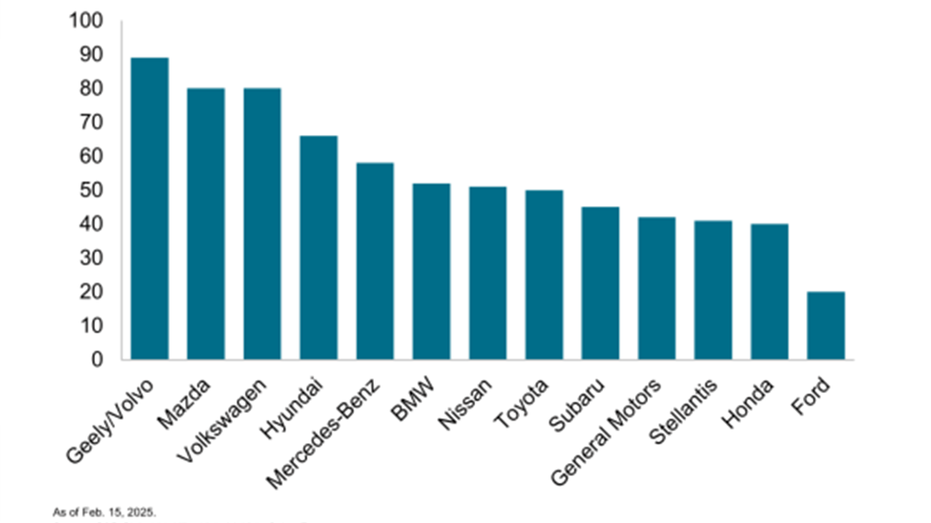

As an example, Volvo, Mazda, Volkswagen and Hyundai Motor, which embody the manufacturers Genesis and Kia, imported not less than 60% of their respective U.S. gross sales in 2024, in line with S&P World Mobility.

Comparatively, Ford, Honda, Stellantis and Normal Motors have essentially the most automobiles made in the US, the S&P World Mobility report confirmed.

Trump, who views tariffs as a manner to usher in tax income to finance his plans for tax cuts whereas spurring a revitalization of home manufacturing, introduced on Wednesday plans to impose a 25% tariff on all imported autos.

He indicated that these tariffs, up from the two.5% beforehand introduced, would take impact on April 2, when he expects to announce his reciprocal tariff plans.

WHEN TO START CAR SHOPPING, DOING REPAIRS AS AUTO TARIFFS LOOM

The Trump administration mentioned Thursday that the president’s transfer to implement such tariffs “will protect and strengthen the U.S. automotive sector.” The administration argued that overseas car industries have expanded as a consequence of “unfair subsidies and aggressive industrial policies” whereas “U.S. production has stagnated.”

Ford signage at a dealership in Richmond, California, US, on Friday, June 21, 2024. (David Paul Morris/Bloomberg through Getty Photos / Getty Photos)

Nevertheless, whereas “some contend that tariffs on the auto industry may boost US manufacturing, only GM, Ford and Stellantis have excess capacity to increase US production, and automakers are not likely to be able to make such a change quickly or cost-effectively,” in line with the March S&P World Mobility report. “A production shift would also require suppliers to relocate.”

HYUNDAI MOTOR COMPANY CEO TALKS $21 BILLION INVESTMENT IN US

Automotive specialists have argued that tariffs will exacerbate affordability points, particularly since no automobiles are constructed or assembled with 100% domestically made components, in line with the Nationwide Vehicle Sellers Affiliation.

In terms of automobile costs, a wide range of market forces,apart from tariffs, will decide how a lot a automobile’s worth will fluctuate, in line with Autotrader’s govt editor Brian Moody.

Used automobiles on the market at a dealership in Colma, California, US, on Tuesday, Feb. 21, 2023. (Photographer: David Paul Morris/Bloomberg through Getty Photos / Getty Photos)

Moreover, it may rely upon what number of fashions are made within the U.S. in comparison with different international locations. If a producer makes one mannequin within the U.S., and others outdoors, they could increase the costs equally to soak up the tariffs with out having a big hit on one explicit mannequin, in line with Moody. Which means that automakers may unfold the rise out over a number of fashions, Moody mentioned.

Here’s a breakdown of the share of automakers with the proportion of gross sales imported

S&P World knowledge on share of US gross sales imported (S&P World Mobility)