Tesla Inc. TSLA -0.03% overcame snarled global supply chains to deliver a record number of vehicles in the third quarter.

The Silicon Valley electric-vehicle maker delivered 241,300 vehicles to customers in the three months ending in September, it said Saturday, up from 139,593 vehicles during the same period last year. Analysts surveyed by FactSet forecast Tesla would deliver roughly 227,000 vehicles in the quarter.

The result positions Tesla to easily achieve its full-year goal of increasing deliveries by more than 50% over last year’s total of nearly half a million vehicles. The company has put a total of roughly 627,000 vehicles in customer hands through the first nine months of the year.

That growth comes despite supply-chain disruptions that have constrained vehicle production across the global auto industry, leaving buyers with fewer options and denting sales. It’s also upended the usual hierarchy in the U.S. auto market, where Toyota Motor Corp. outsold traditional standard-bearer General Motors Co. in the third quarter.

The continuing semiconductor shortage is likely to cost the global auto industry $210 billion in lost revenues this year, consulting firm AlixPartners LLP said. In the U.S., the pace of auto sales was expected to fall in September to an annualized rate of 12.4 million vehicles, the lowest rate since May 2020, according to Wards Intelligence.

Tesla Chief Executive Elon Musk nodded to those headwinds in a note to employees last month, in which he said the company worked around shortages by building cars with missing parts that needed to be added later, according to a person familiar with the matter.

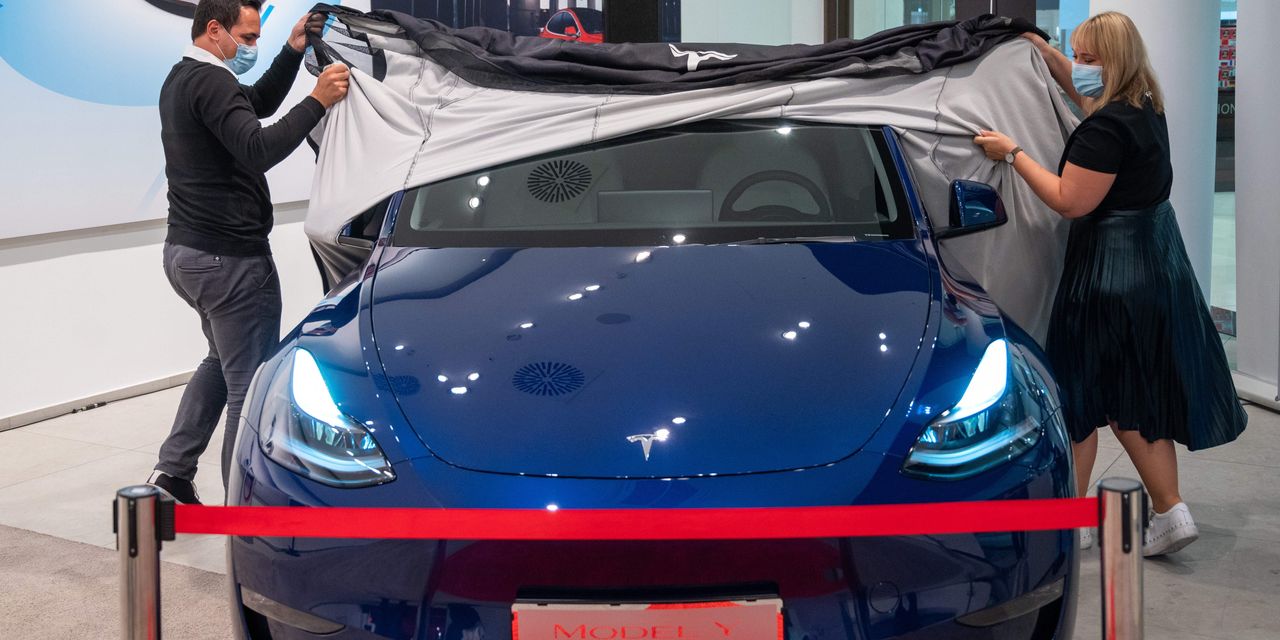

Tesla delivered a combined 232,025 Model 3 sedans and Model Y compact sport-utility vehicles in the third quarter, up from 124,318 of those models a year earlier. It was the first full quarter since Tesla introduced an upgraded version of its Model S luxury sedan, dubbed the Plaid.

The company handed over 9,275 of its higher-end models: Model S sedans and Model X sport-utility vehicles. Tesla delivered a total of 15,275 Model S and Model X vehicles during last year’s third quarter.

As of Friday, analysts surveyed by FactSet expected Tesla to report third-quarter profits of around $1.1 billion on revenue of more than $13 billion. That is up from a $331 million profit on $8.8 billion in revenue during the year-prior period.

Tesla meanwhile has been preparing to expand public access to an advanced driver-assistance tool that is designed to help people navigate cities, adding to a suite of features that has mainly been intended for highway driving.

The promise of Tesla’s advanced driver-assistance software has attracted customers and investors, helping to transform Tesla into the most valuable auto maker in the world. Its shares closed at $775.22 Friday.

“[P]otential for further upside for the stock will be defined by Tesla’s success in endeavors outside vehicle sales—specifically on vehicle autonomy,” Credit Suisse analyst Dan Levy wrote in a recent note to investors.

Yet the company has drawn scrutiny from a chorus of transportation officials and safety advocates who have expressed concern about possible misuse of such tools. The National Highway Traffic Safety Administration opened an investigation in August into advanced driver-assistance features offered by the company after a series of crashes involving Teslas and one or more parked emergency vehicles.

Tesla’s Path and Supply-Chain Woes

Corrections & Amplifications

AlixPartners LLP said the ongoing semiconductor shortage is likely to cost the global auto industry $210 billion in lost revenues this year. An earlier version of this article erroneously said the estimated lost revenues would amount to $210 million. (Oct. 2)

Write to Rebecca Elliott at [email protected]

Copyright ©2021 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8