U.S. stocks beat shares elsewhere in the world by the widest margin in almost a quarter-century last year, powered by big technology companies. Some investors are betting that rising interest rates and a tech swoon could bring America’s winning streak to an end in 2022.

The selloff came after a gangbuster year for the U.S. market. The victory for U.S. stocks was, by one gauge, the biggest since 1997. Including dividends, the MSCI USA index posted a return of 27%. That is 19 percentage points more than the total return on an MSCI index that tracks stocks in 49 developed and emerging markets, excluding the U.S., when measured in dollar terms.

Hammered by a regulatory clampdown on tech companies and worries about the property sector, Chinese stocks trailed the pack. As measured by MSCI, the market returned minus 22% in dollars.

Europe fared better but, for U.S.-based investors, was held back by a weakening euro. The total return on European stocks was almost level with that of U.S. stocks in local-currency terms. After converting into dollars, it fell 10 percentage points short.

BNP Paribas Asset Management is positioning itself to benefit from a revival in stocks outside the U.S. tech sector. The Paris-based fund manager has allocated more money to small-cap U.S. stocks and shares in Europe and Japan.

“If we’re expecting U.S. rates to go up, in particular that should, on a relative basis, hinder tech,” said Daniel Morris, the firm’s chief market strategist.

The direction of government-bond yields will help determine whether the U.S. market streaks ahead again this year, investors and analysts say. U.S. stocks pulled away from European stocks at the start of last summer after the Delta wave of coronavirus, among other factors, dragged down Treasury yields.

Rising interest rates ding the share prices of companies with profits far in the future, by making bonds relatively more attractive to own than more speculative investments. The Fed has positioned itself to raise rates faster than most other rich-world central banks, which some investors and analysts say could boost yields in the U.S. and puncture tech valuations.

Andrew Sheets, chief cross-asset strategist at Morgan Stanley, sees Europe and Japan outperforming this year. “When investors look at those markets they don’t see them as markets that should be punished if interest rates were higher,” he said.

The Tokyo Stock Exchange at a ceremony marking the close of the end-of-year trading session in Tokyo.

Photo: kazuhiro nogi/Agence France-Presse/Getty Images

Real yields on 10-year Treasury notes, which factor in the effect of inflation on investor returns, ended 2021 almost unchanged. In 2018, the last time they rose, MSCI’s gauge of U.S. stocks dropped but by less than shares in Europe, Japan and China.

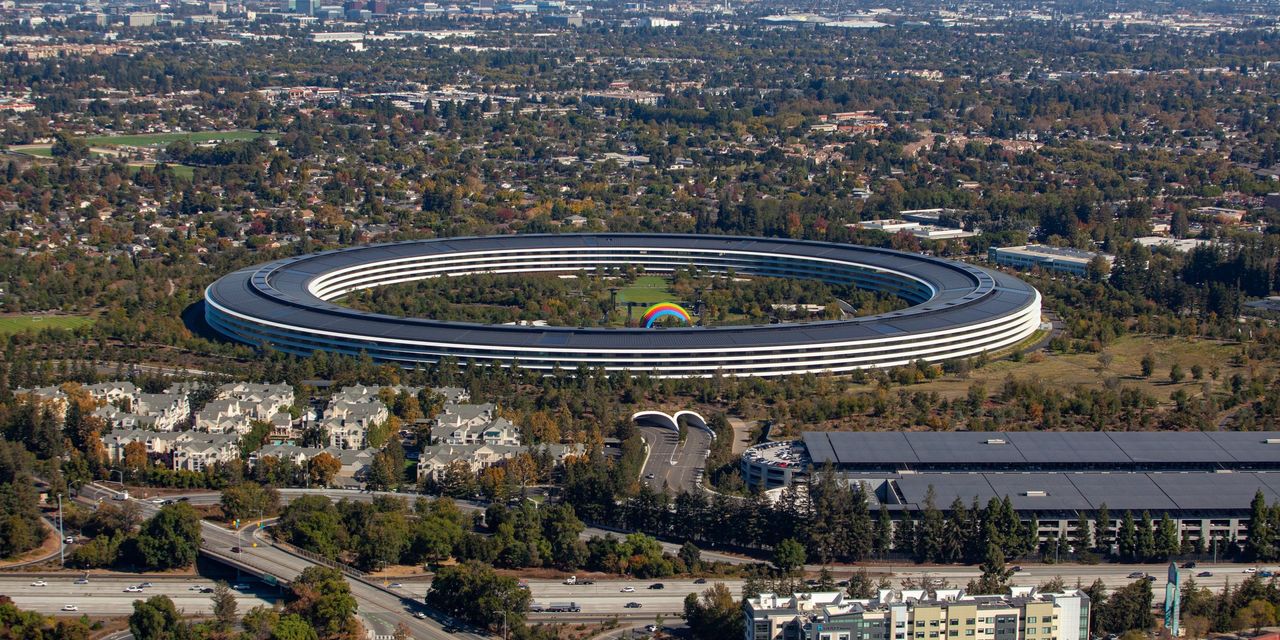

The U.S. market has outpaced the rest of the world for four consecutive years and some investors say it will extend that streak to a fifth despite the obstacles. The main reason: The tech companies such as Apple Inc. and momentum stocks like Tesla Inc. that proliferate in the U.S. are lesser-spotted species overseas.

When Apple crossed $3 trillion in market value this week it had roughly the same valuation as all the companies on London’s FTSE 100 combined.

“I think they can continue to outperform,” said Shep Perkins, chief investment officer for equities at Putnam Investments, of U.S. stocks. “The earnings underpinning the fundamentals have been very good. If the earnings were to slow materially it would be a different story.”

Although energy stocks were the best performers on the S&P 500 in 2021, the sector has shrunk to a sliver of the broad market and large tech companies led the year’s gains. “Huge mega caps outperformed the S&P 500, and that helped drive the S&P 500’s performance,” Mr. Perkins said.

U.S. investors who stuck with domestic stocks were rewarded. Vanguard Group’s FTSE Europe ETF, which trades in New York and counts Nestlé SA and ASML Holding NV among its biggest holdings, rose 13% in 2021, according to FactSet. The SPDR S&P 500 ETF rose 27%.

Ronald Temple, co-head of multiasset at Lazard Asset Management, said timing when to deploy money in the U.S. or shift into overseas stocks is tricky. Mr. Temple prefers to hunt for what he calls high-quality companies, or those with high and rising returns on capital. He finds more in the U.S., partly because of the country’s bigger tech sector.

“Because there are so many more quality companies in the U.S., you tend to pay less for them,” Mr. Temple said.

Write to Joe Wallace at [email protected]

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8