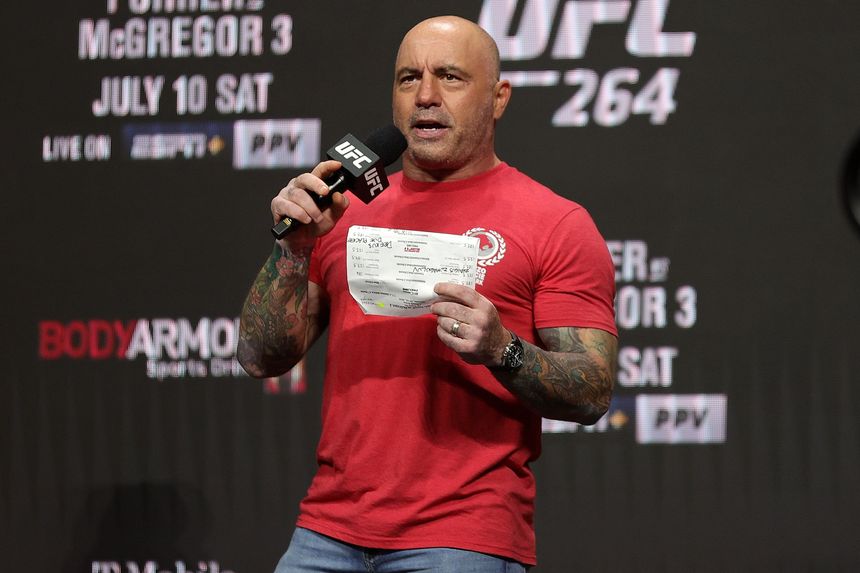

Spotify’s latest results indicate the service needs all the podcasters it can get—especially ones like Joe Rogan, who draws listeners by the millions.

Photo: Stacy Revere/Getty Images

It is unclear if Spotify Technology SPOT -16.76% is feeling any business impact from the Joe Rogan controversy so far. It is clear why the streaming platform is unlikely to pull the plug on him or any of its other podcast stars.

The streaming platform’s outlook that was included with its fourth-quarter results late Wednesday left the question of the controversy’s impact unanswered. Spotify’s projection of adding 3 million paid subscribers in the current quarter was 1 million shy of Wall Street’s forecasts. But it was identical to the 3 million added in last year’s first quarter, and in line with long-term trends showing the first quarter of the year to be the company’s weakest seasonal period for growth. The company’s revenue projection for the period was in line with analysts’ forecasts.

‘The more creators we have, the more [advertising] inventory we have to place against it,’ Chief Executive Daniel Ek said on Spotify’s earnings call Wednesday.

Photo: lucas jackson/Reuters

Spotify’s shares slid anyway, plunging 16% Thursday morning and putting them in line for their worst daily selloff since going public in 2018.

An unforgiving market mood didn’t help. Facebook parent Meta Platforms shed one-quarter of its massive market value after reporting its first-ever decline in daily active users. But Spotify’s gross-margin projection for the first quarter also was 1.5 percentage points below Wall Street’s estimates, and the company said it would cease giving projections for the full year, with the explanation that the “vast majority of our initiatives are multiyear in nature and measured as such.”

Spotify executives said on the company’s earnings call that they expect a “favorable gross-margin trend” this year similar to 2021, when that key metric grew to 26.8% from 25.6% the previous year. Indeed, Wall Street expects Spotify’s gross margin line to keep expanding, hitting close to 30% in 2024. And that reflects why the company’s sharp pivot to podcasts that began in 2020 is so important. Unlike recorded music—which is controlled by three large labels with a lot of leverage over royalty rates—podcasts live in an unstructured market that still has a lot of untapped advertising potential. “The more creators we have, the more [advertising] inventory we have to place against it,” Spotify Chief Executive Daniel Ek said on Wednesday’s call.

Said another way, Spotify’s business needs all the podcasters it can get. Especially ones like Mr. Rogan, who draws listeners by the millions. But the threat of popular musicians drawing listeners off the platform in protest of Mr. Rogan or any other controversial podcast content can’t be dismissed, either. Revenue from premium subscribers still accounts for 85% of Spotify’s total business, and the majority of subscribers were there before Mr. Rogan became exclusive to the platform in late 2020.

Facebook has now shown a stark example of how investors treat technology platforms with shrinking user bases. Hopefully, Spotify’s many years in the music business have taught it how to dance well.

—Dan Gallagher

Write to Dan Gallagher at [email protected]

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared in the February 4, 2022, print edition as ‘Spotify Needs Music Fans And Rogan.’