The Securities and Exchange Commission is investigating a private-equity firm backed by several ultrarich U.S. families after receiving complaints that its owner was using investor funds to cover personal expenses, documents show.

The firm, One Thousand & One Voices Management, and a unit that manages one of its funds received subpoenas three months ago from the SEC’s Division of Enforcement seeking a range of materials, according to documents viewed by The Wall Street Journal.

The Denver-area private-equity firm is owned and run by Hendrik Jordaan, a South African-born attorney. The firm got its start eight years ago with a fund to invest in sub-Saharan Africa backed by brewing scion John K. Coors and other wealthy families.

The SEC investigation followed complaints to regulators that Mr. Jordaan was using seed money for a new fund to cover personal expenses and was charging fund investors for lavish travel costs, including for his wife, among other matters, according to the documents.

In a statement, a spokesman for Mr. Jordaan’s firm said it is fully cooperating with the SEC investigation. “An ongoing independent forensic accounting examination has found no indicia of fraud or intentional misconduct to date,” the spokesman said.

The SEC declined to comment.

The outside auditor for the funds, BDO LLP, has told the firm that it won’t audit its 2021 financial statements. It couldn’t be learned why the auditor made that decision, and BDO declined to comment.

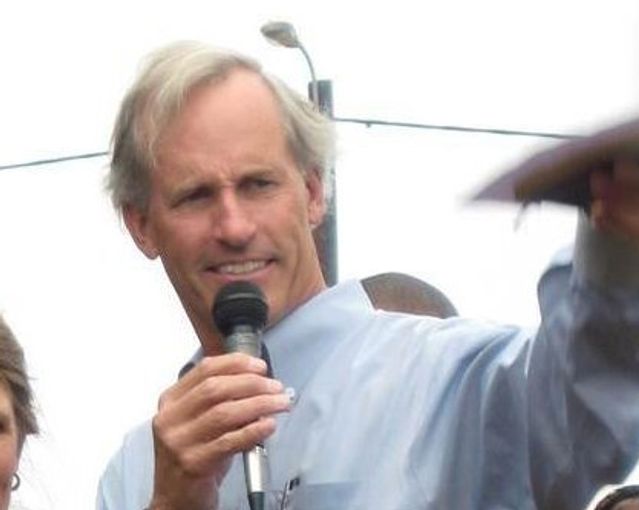

Brewing scion John K. Coors is among the wealthy investors in the 1K1V fund.

Photo: John K. Coors

The firm spokesman said it is in the process of choosing a new auditor and BDO has provided no indication that previous financial statements contained material misstatements.

He added: “The Africa fund’s investments have resulted in the creation or maintenance of thousands of jobs in Africa, and supported the financial well-being of tens of thousands of Africans.”

Mr. Jordaan, 50 years old, came to the U.S. as an undergraduate on a tennis scholarship at Southern Methodist University and stayed on to get his law degree there. He worked as a lawyer, eventually becoming a partner at law firm Morrison & Foerster LLP in Denver, where he was co-chair of the firm’s global private-equity practice.

He left the law firm in 2013 to start One Thousand & One Voices, also known as 1K1V. He and Mr. Coors, whose great-grandfather founded the brewer that is now part of Molson Coors Beverage Co. TAP.A 6.19% , pitched the Africa fund as unique because its wealthy-family backers could lend their business expertise to African entrepreneurs and would be patient enough to let their investments mature for a decade or longer before expecting returns.

Other investors in the Africa fund have included members of the Belk family, the founders of the eponymous department-store chain, and the Leprino family of Denver-based mozzarella-cheese giant Leprino Foods Co., according to fund materials viewed by the Journal.

A representative for Mr. Coors declined to comment and the other two families couldn’t be reached.

In multiple instances over the years, including a radio interview and a speech in 2016, Mr. Jordaan has described the Africa fund as a $300 million vehicle. It only raised $121 million, according to securities filings. The spokesman for Mr. Jordaan said the fund’s marketing materials made clear the targeted amount of $300 million might not be achieved.

Mr. Jordaan recently began raising another fund, the Families-Backing-Families Credit Fund, aimed at tapping its wealthy investors to help family-run businesses in the U.S. with loans and expertise. Its manager is the entity that received a subpoena in addition to 1K1V.

A family that founded retailer Hobby Lobby is among three anchor investors in the Families-Backing-Families Credit Fund.

Photo: John Marshall Mantel/Zuma Press

In April, the credit fund said in a securities filing that it had raised $110 million and was targeting a total of $500 million. The fund has three anchor investors including the Green family, founders of Hobby Lobby Stores Inc., and the Sturm family of Denver, which made its money through telecommunications and banking, according to the documents.

Representatives for the two families couldn’t be reached.

The third anchor investor is Charles Widger, who in 2020 sold Brinker Capital, the Philadelphia-area investment-management company he spent decades building. Mr. Widger also agreed to invest $5 million directly in Mr. Jordaan’s firm, as seed capital to help get the credit fund off the ground, according to the documents.

The complaints to the SEC contend that Mr. Jordaan used a chunk of the money from Mr. Widger to fund his own lifestyle, including $600,000 for clothing, shoes and accessories; $100,000 for vacations; $60,000 for home rent; and $400,000 to cover Internal Revenue Service bills, according to the documents. Some of the money was spent via corporate credit cards issued to both Mr. Jordaan and his wife, the complaints contend.

Mr. Widger declined to comment.

Securities attorneys not involved in the probe said Mr. Jordaan, as sole owner of the firm’s management company through which Mr. Widger’s capital flowed, is free to do whatever he wants with the company’s money. The SEC might be interested, however, in whether the spending was in line with the terms of his agreement with Mr. Widger, the attorneys said.

The spokesman for Mr. Jordaan said the firm believes the seed capital was “handled in accordance with the applicable agreements.”

The complaints to the SEC said that Mr. Jordaan’s wife, Jessica Jordaan, accompanies him on all overnight trips, including business travel. The costs for Ms. Jordaan accompanying her husband on business trips typically were charged to fund investors, the complaints said.

The firm spokesman said Ms. Jordaan often participates in events with family investors and business owners, “in support of the funds.” He said Ms. Jordaan had no comment and she didn’t respond to messages.

“There are many private-equity firms serving family offices and many others who buy family-owned businesses and I have never heard of family-member travel being billed to funds,” said Igor Rozenblit, former co-head of the SEC’s private-funds unit who now advises fund managers at Iron Road Partners. He added that the SEC often considers exaggeration of fund assets a material misstatement because it could be viewed as priming the pump for potential future fundraising.

Write to Mark Maremont at [email protected], Miriam Gottfried at [email protected] and Emily Glazer at [email protected]

Copyright ©2021 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8