SEC Chairman Paul Atkins tells ‘Mornings with Maria’ that President Donald Trump’s push to finish quarterly earnings stories is a ‘timely call’ as regulators weigh long-term development over Wall Road ‘short-termism.’

Securities and Alternate Fee (SEC) Paul Atkins stated Tuesday that the Trump administration’s plan to open 401(ok) retirement accounts to personal market investments would give abnormal Individuals protected entry to alternatives which might be presently restricted.

Atkins stated that the SEC will work with the Labor Division to broaden entry to investments in personal funds for abnormal traders who presently would not meet regulatory thresholds that would offer them entry.

“Individual investors need to be diversified and the private markets have developed so much because there’s a lot of capital available in the private markets,” Atkins stated Tuesday on FOX Enterprise Community’s “Mornings with Maria.”

“And frankly, it’s uncool to be a public company, or it has become so, and I want to make IPOs great again,” Atkins stated. “Thirty or so years ago, when I was a young lawyer starting out in New York, companies like Apple and Microsoft – they had to go public to get capital to build their companies and new products.”

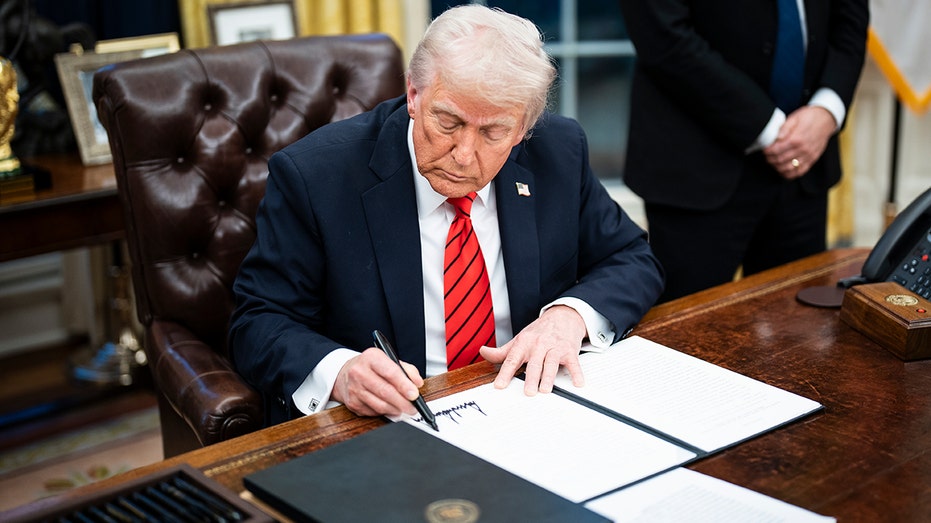

TRUMP SIGNS ORDER TO OPEN 401(Okay)S TO PRIVATE MARKETS: WHAT IT MEANS FOR YOUR RETIREMENT

SEC Chairman Paul Atkins stated that regulatory guardrails will assist abnormal traders safely spend money on personal funds. (Stefani Reynolds/Bloomberg by way of Getty Pictures / Getty Pictures)

“Today it’s [the] opposite. Companies can stay private longer, and there being so many issues in the public markets between litigation and the short-termism that we were talking about before, the weight of the regulatory apparatus on reporting and that sort of thing, compliance,” Atkins stated.

“Then finally, the weaponization of corporate governance, so those issues have really decreased the attractiveness of being a public company,” he stated. “We aim to make that better again.”

At present, investments in personal corporations are restricted to individuals who fulfill the “accredited investor” threshold. The rule goals to guard unsophisticated traders from monetary dangers related to investments in personal corporations, which could be illiquid and are not topic to public monetary reporting necessities.

SENATE CONFIRMS TRUMP’S SEC CHAIR PICK PAUL ATKINS

The SEC and Labor Division are engaged on rules to permit personal market funds in 401(ok) plans. (Reuters/Jonathan Ernst / Reuters Pictures)

The rule stipulates that certified accredited traders should have a web value over $1 million excluding their major residence, or revenue over $200,000 individually (or $300,000 as a pair) in every of the previous two years, with the affordable expectation of the identical within the present 12 months.

It additionally consists of skilled standards to fulfill the rule, together with funding professionals with Collection 7, Collection 65, or Collection 82 licenses, executives of the corporate promoting the safety, or household purchasers of household places of work and educated staff of a non-public fund they wish to spend money on.

Atkins defined that personal market investments might help traders diversify their portfolios as public markets develop into extra concentrated, noting the rise of the so-called “Magnificent Seven” shares which have pushed a lot of the market’s good points in recent times.

LABOR SECRETARY UNVEILS UNPRECEDENTED PLAN TO SLASH 63 ‘OUTDATED AND BURDENSOME’ RULES

President Donald Trump signed an government order this summer time that will enable personal funds in 401(ok) plans. (Jabin Botsford/The Washington Submit by way of Getty Pictures / Getty Pictures)

“We only have half the number of public companies as we had 30 years ago, and if you look at the S&P 500 it’s rather top-heavy with respect to the ‘Magnificent Seven,'” Atkins stated. “What industry are they in? IT basically, technology, and we saw what has happened in the past when the market gets too concentrated.”

The SEC chairman famous that work stays to be accomplished in placing up regulatory guardrails for opening personal market investments to retail traders earlier than they are going to be accessible as choices of their retirement plans or different funding accounts.

“The key word here is diversification, and so we have to put in guardrails for retail investors to have exposure to these sorts of investments because they can be illiquid, the valuations can be off,” Atkins stated. “There are a whole host of things – where the retail investor fits in the capital stack of the company, and then finally what the liquidity is of the investment.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“We have to put guardrails around them, have ‘most favored nation status’ for those sorts of investments. Their advisors will obviously have fiduciary duty and that sort of thing. So we’ll put the protections in to make sure that we guard against bad outcomes to the extent that we can,” Atkins stated.