Chancellor Rachel Reeves is broadly anticipated to interrupt Labour’s manifesto promise to not increase revenue tax within the upcoming Autumn Funds, with a speech set to be delivered later this morning concerning the subject.

Anxiousness about potential revenue tax will increase has emerged as the first concern forward of the Funds, with 16% of the general public figuring out it as their largest fear, in response to a Hargreaves Lansdown.

The apprehension is especially pronounced amongst youthful demographics and wealthier people, affecting 20 per cent of Millennials and 25 per cent of these paying increased fee tax.

Outdoors of revenue tax, what different methods may HM Income and Customs (HMRC) generate extra income for the Treasury and who in Britian might be anticipated to pay the invoice.

Rachel Reeves is making ready to lift taxes – what’s going to you must pay?

|

GETTY / PA

Revenue tax rise on foundation fee

Sarah Coles, head of non-public finance at Hargreaves Lansdown, mentioned: “An income tax hike is the most feared change in the Budget worrying 16 per cent of people, 20 per cent of Millennials, and 25 per cent of higher rate taxpayers. As the speech creeps ever-closer, the chatter around income tax has intensified.”

Treasury modelling from June 2025 signifies that including a single penny to the fundamental fee would generate £6.9billion in 2026/7, rising to £8.25billion the next yr.

For typical earners, such a rise would show pricey. These on £35,000 yearly would pay an extra £224, while somebody incomes £55,000 would contribute £377 extra every year.

The prospect of revenue tax producing practically a 3rd of Authorities income makes even modest changes doubtlessly profitable for the Treasury.

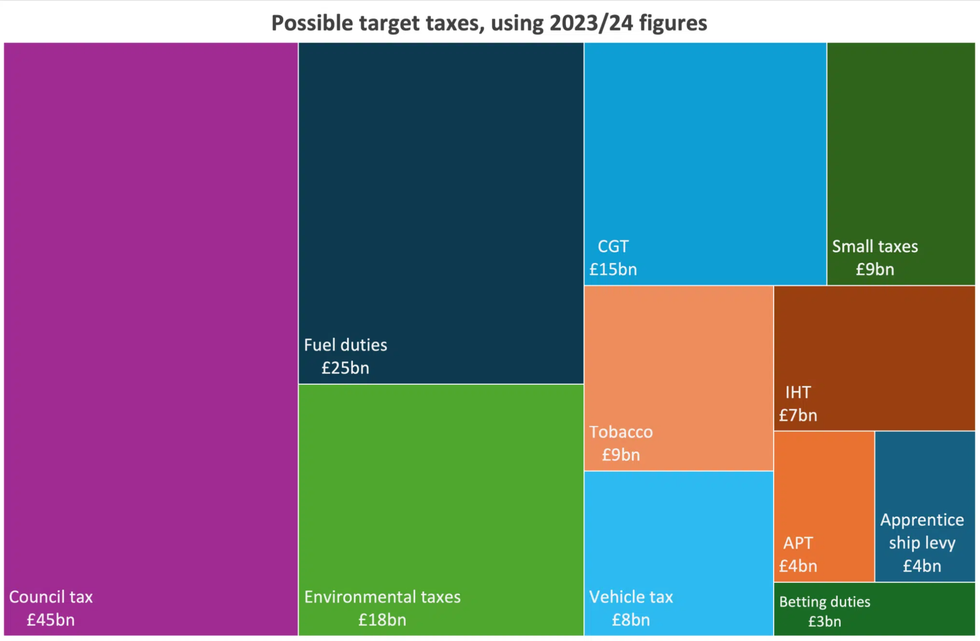

Potential goal taxes the Authorities may use to fill the “£22 billion black hole” in public funds | Tax Coverage Associates

Potential goal taxes the Authorities may use to fill the “£22 billion black hole” in public funds | Tax Coverage Associates

Revenue tax rise on increased fee

Concentrating on solely increased earners presents a distinct state of affairs, with Treasury estimates displaying an extra penny on the upper fee would yield £1.6billion in 2026/7, growing to £2.15billion by 2027/28.

These incomes under £35,000 would stay unaffected, while somebody on £55,000 would pay £47 extra yearly.

Studies recommend the Treasury would possibly outline working folks as these incomes below £46,000, doubtlessly permitting increased fee will increase with out breaching manifesto commitments.

Common revenue tax rise

A common penny enhance throughout all bands would price a £35,000 earner £224, rising to £424 for these on £55,000, based mostly on Hargreaves Lansdown’s analysis.

Frozen tax allowances

Present preparations already assure rising tax payments, with thresholds frozen till 2028, although hypothesis suggests this freeze could possibly be prolonged additional.

Ought to wage progress proceed at 4 per cent, a person incomes £51,000 by April 2028 would face an extra £1,530 in tax funds if bands stay static for 2 further years.

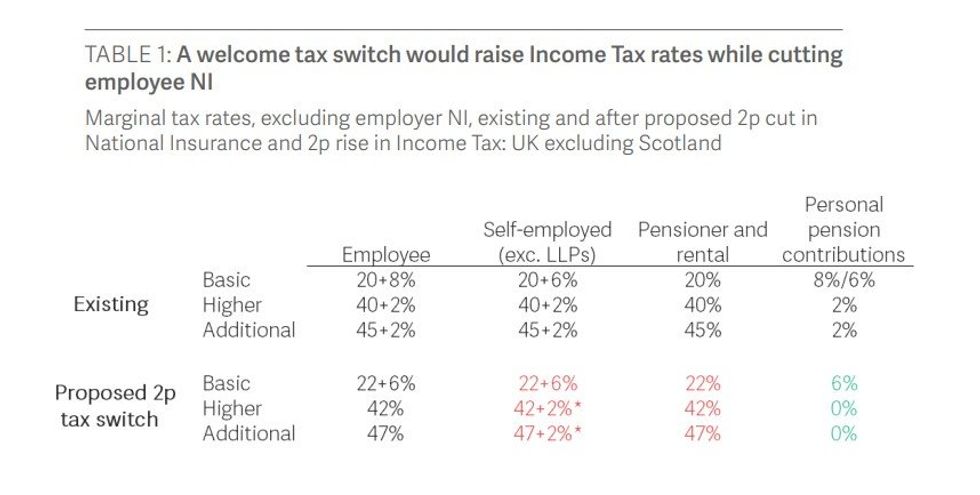

Taking 2p off Nationwide Insurance coverage and including to revenue tax

The Decision Basis has proposed transferring 2p from Nationwide Insurance coverage to revenue tax, doubtlessly elevating £6billion while technically avoiding impression on working-age workers.

Nonetheless, this could have an effect on pensioners, landlords and the self-employed, with somebody receiving £35,000 in pension revenue dealing with an extra £449 yearly.

The Authorities is being known as to chop Nationwide Insurance coverage, whereas elevating revenue tax

|

RESOLUTION FOUNDATION

How ought to taxpayers put together?

Hargreaves Lansdown recommends growing pension or SIPP contributions affords an efficient technique for decreasing general taxable revenue, doubtlessly maintaining earners under crucial tax thresholds.

This method not solely cuts present tax legal responsibility however strengthens retirement provisions, with contributions benefiting from reduction on the contributor’s highest tax fee.

Money ISAs present shelter for financial savings curiosity from any elevated tax charges, while strategic planning utilizing each money and shares and shares ISAs alongside pensions creates flexibility for managing retirement revenue. Since ISA withdrawals stay tax-free, they provide worthwhile choices for controlling future tax publicity.

Married {couples} and civil companions can cut back their mixed tax burden by transferring income-generating belongings to the accomplice paying decrease charges, making certain each people maximise their private allowances.