Our aim right here at Credible Operations, Inc., NMLS Quantity 1681276, known as “Credible” beneath, is to provide the instruments and confidence it is advisable enhance your funds. Though we do promote merchandise from our accomplice lenders who compensate us for our providers, all opinions are our personal.

The most recent non-public pupil mortgage rates of interest from the Credible market, up to date weekly. (iStock)

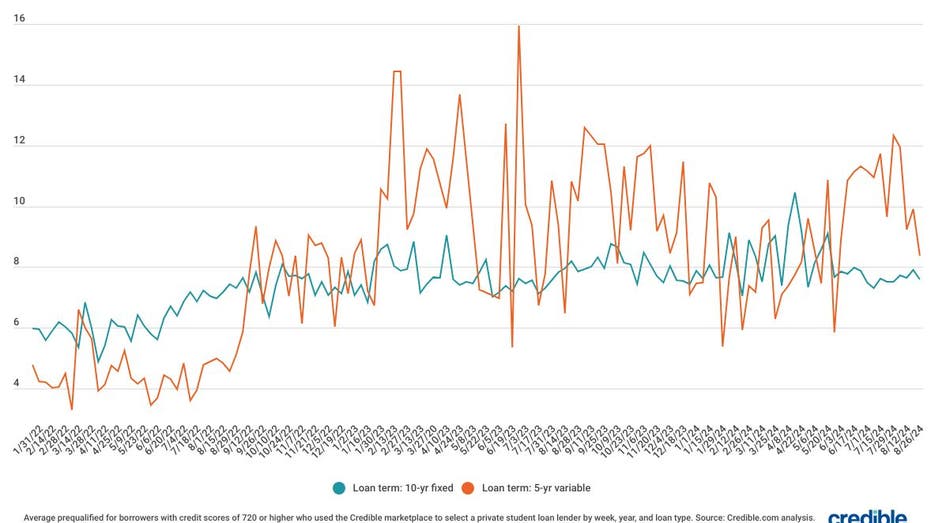

In the course of the week of Sept. 16, 2024, common non-public pupil mortgage charges spiked for debtors with credit score scores of 720 or greater who used the Credible market to take out 5-year variable-rate loans and dropped for 10-year fixed-rate loans.

10-year mounted fee: 7.99%, down from 8.57% the week earlier than, -0.585-year variable fee: 10.31%, up from 8.61% the week earlier than, +1.70

Via Credible, you possibly can examine non-public pupil mortgage charges from a number of lenders.

For 10-year mounted non-public pupil loans, rates of interest dropped by 0.58 share factors, whereas 5-year variable pupil mortgage curiosity elevated by 1.70 share factors.

Debtors with good credit score could discover a decrease fee with a non-public pupil mortgage than with some federal loans. For the 2024-25 educational college 12 months, federal pupil mortgage charges will vary from 6.53% to 9.08%. Personal pupil mortgage charges for debtors with good-to-excellent credit score could be decrease proper now.

As a result of federal loans include sure advantages, like entry to income-driven reimbursement plans, you need to at all times exhaust federal pupil mortgage choices first earlier than turning to non-public pupil loans to cowl any funding gaps. Personal lenders similar to banks, credit score unions, and on-line lenders present non-public pupil loans. You should utilize non-public loans to pay for schooling prices and residing bills, which could not be coated by your federal schooling loans.

Rates of interest and phrases on non-public pupil loans can fluctuate relying in your monetary state of affairs, credit score historical past, and the lender you select.

Personal pupil mortgage charges (graduate and undergraduate)  Who units federal and personal rates of interest?

Who units federal and personal rates of interest?

Congress units federal pupil mortgage rates of interest annually. These mounted rates of interest rely on the kind of federal mortgage you’re taking out, your dependency standing and your 12 months in class.

Personal pupil mortgage rates of interest could be mounted or variable and rely in your credit score, reimbursement time period and different elements. As a basic rule, the higher your credit score rating, the decrease your rate of interest is more likely to be.

You possibly can examine charges from a number of pupil mortgage lenders utilizing Credible.

How does pupil mortgage curiosity work?

An rate of interest is a share of the mortgage periodically tacked onto your stability — basically the price of borrowing cash. Curiosity is a technique lenders can generate profits from loans. Your month-to-month fee typically pays curiosity first, with the remainder going to the quantity you initially borrowed (the principal).

Getting a low rate of interest may provide help to get monetary savings over the lifetime of the mortgage and repay your debt sooner.

What’s a fixed- vs. variable-rate mortgage?

Right here’s the distinction between a hard and fast and variable fee:

With a hard and fast fee, your month-to-month fee quantity will keep the identical over the course of your mortgage time period.With a variable fee, your funds may rise or fall primarily based on altering rates of interest.

Comparability searching for non-public pupil mortgage charges is simple if you use Credible.

Calculate your financial savings

Utilizing a pupil mortgage curiosity calculator will provide help to estimate your month-to-month funds and the entire quantity you’ll owe over the lifetime of your federal or non-public pupil loans.

When you enter your data, you’ll have the ability to see what your estimated month-to-month fee can be, the entire you’ll pay in curiosity over the lifetime of the mortgage and the entire quantity you’ll pay again.

About Credible

Credible is a multi-lender market that empowers customers to find monetary merchandise which are the perfect match for his or her distinctive circumstances. Credible’s integrations with main lenders and credit score bureaus permit customers to shortly examine correct, personalised mortgage choices – with out placing their private data in danger or affecting their credit score rating. The Credible market supplies an unmatched buyer expertise, as mirrored by over 7,700 optimistic Trustpilot critiques and a TrustScore of 4.8/5.