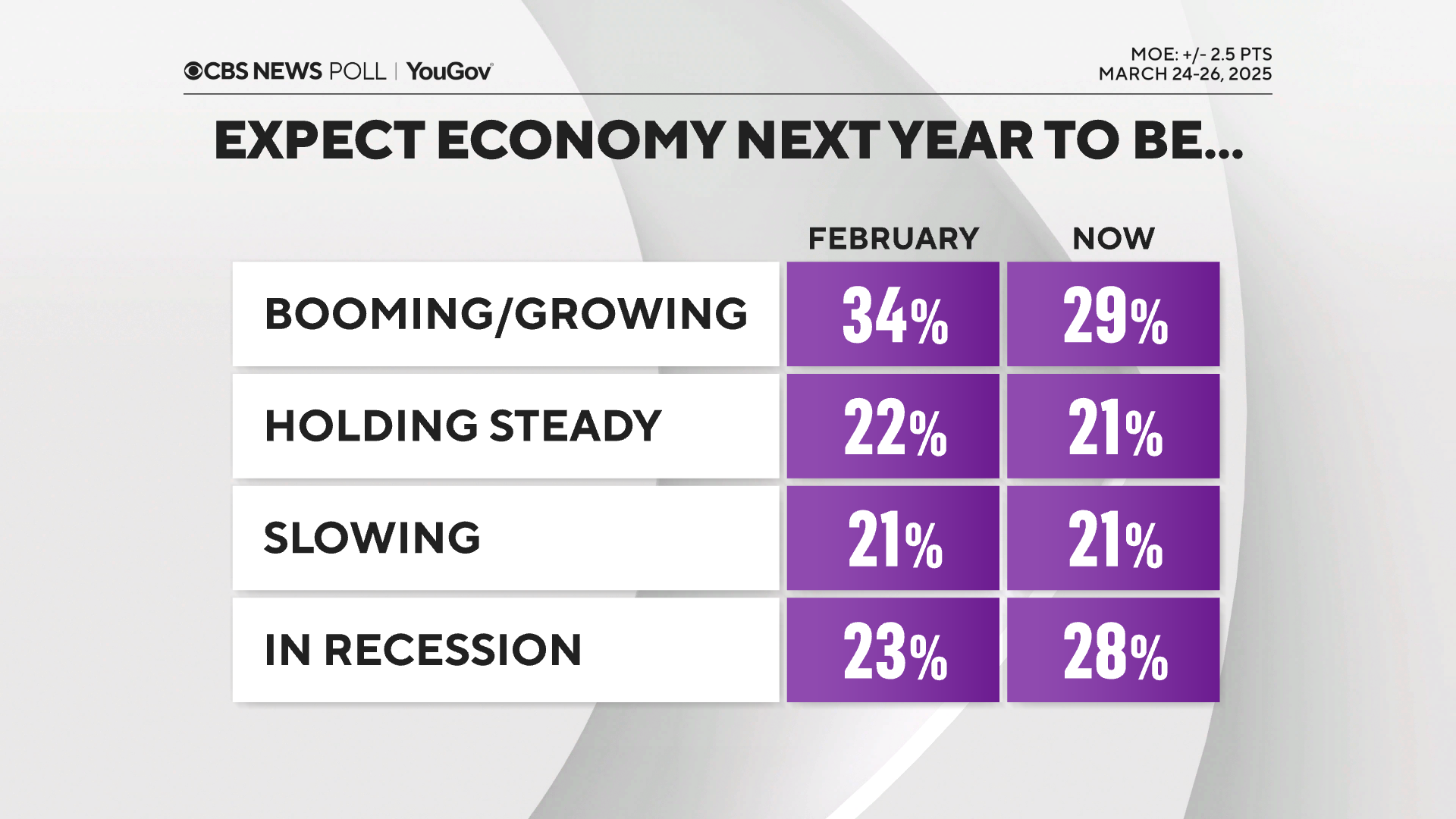

People’ outlook for the economic system is combined and has grown a bit extra pessimistic since final month, with comparatively extra anticipating a slowdown or recession over the following yr. Rankings of at present’s economic system are unchanged total and proceed to be adverse, a lot as they’ve been for years going again to the pandemic.

Costs proceed to weigh on funds: most say they’re nonetheless rising, they usually proceed to be the primary driver in how People are evaluating the economic system.

Costs far outpace job stories, rates of interest and the inventory market within the causes People give for a way they fee issues.

And regardless of inventory market volatility, those that say the market issues to their private funds aren’t very completely different of their outlook for the economic system than People total.

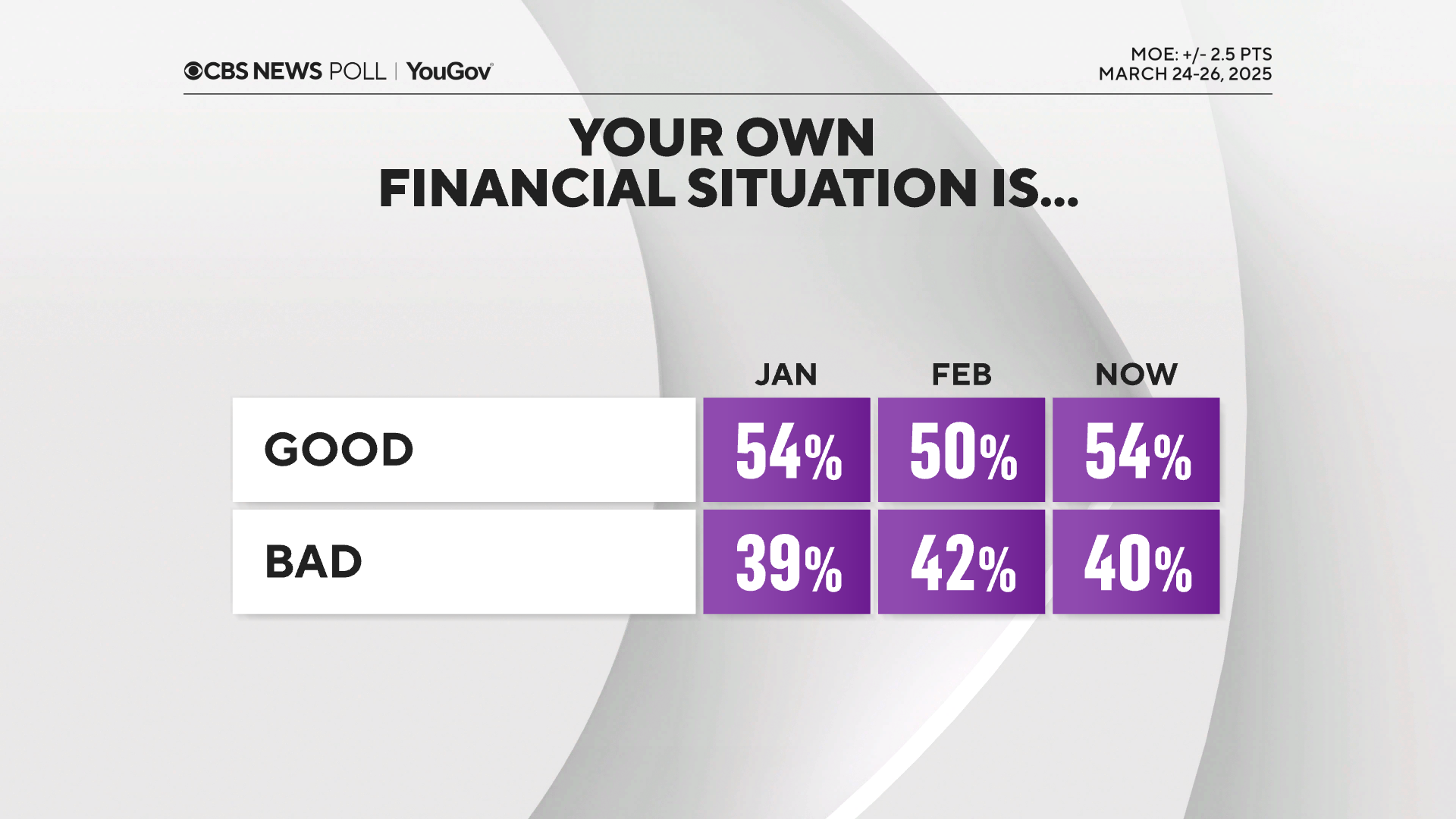

This comes as simply over half say they’re doing at the least pretty properly personally in the mean time, as has additionally usually been the case during the last yr, however inside this group are dramatic variations by earnings. These at increased ranges are much more more likely to say they’re doing okay.

Most People say their incomes nonetheless aren’t protecting tempo with inflation.

They categorical these sentiments as a key shopper confidence index not too long ago hit a multi-year low.

Rankings for their very own monetary state of affairs returned to only over half saying their state of affairs is sweet; these with incomes above $50,000 usually tend to say so. In the meantime, most of these with household incomes underneath $50,000 proceed to say they’re doing badly.

Solely a 3rd fee the general economic system pretty much as good proper now — the identical as final month — and persevering with a years-long development of adverse scores. About half proceed to assume it’s getting worse.

However long run, at the least for a lot of, there’s anxiousness about having sufficient financial savings for retirement.

Toplines

Extra

Supply hyperlink