U.S. stocks rose and government-bond yields fell Wednesday following a recent climb, potentially easing some pressure on technology shares.

The S&P 500 was up 65.64 points, or 1.5%, to 4587.18. The broad index had also risen Tuesday as investors snapped up shares of companies across industries. The Dow Jones Industrial Average climbed 305.28 points, or 0.9%, to 35768.06, while the Nasdaq Composite added 295.92 points, or 2.1%, to 14490.37. While all three indexes are up this week so far, they are in negative territory year to date.

Wednesday’s advance came as all 11 sectors within the S&P 500 rose. Six were up at least 1%.

Markets had been hurt in recent days by a rout in tech stocks. Investors have been unloading shares of tech companies with lofty valuations ahead of a potential increase in interest rates by the Federal Reserve. Analysts said the volatility could continue until investors get clear guidance from the Fed about the increases ahead.

“We could potentially see bouts of volatility throughout this year, especially as the Fed starts its tightening cycle. That’s usually when markets have a little bit of indigestion,” said Mona Mahajan, a senior investment strategist at Edward Jones.

Fresh inflation data due Thursday is expected to give investors additional clues as to how quickly the Fed may raise rates after slashing them in 2020 to cushion the economy from the impact of Covid-19. Matt Weller, global head of market research at Forex.com, said a notable jump in core inflation data could persuade the Fed to act more aggressively and raise rates by 0.5 percentage point. Other global central banks are weighing their own policy changes.

Analysts said a more aggressive Fed could hurt tech companies even more. Technology companies tend to benefit from low bond yields as some investors will pay more for shares that they expect to churn out outsize profits in the future.

Shares of Facebook parent Meta Platforms rose $11.82 on Wednesday, or 5.4%, to $232, the largest percent increase in about 10 months, after plunging last week. Google parent Alphabet added $43.86, or 1.6%, to $2,831.84.

“Don’t necessarily assume this is the worst it can get, and if you’re feeling uneasy, I would consider lightening up on risky exposure,” said Mr. Weller.

The yield on the benchmark 10-year U.S. Treasury note ticked down to 1.928% Wednesday from 1.954% Tuesday, its highest closing level since July 2019. Yields move inversely to prices.

European bonds yields also fell Wednesday, with the yield on the 10-year German bund ticking down to 0.218% from 0.264% Tuesday, according to Tradeweb.

“All market participants are now trying to gather more information on how this global turnaround of central banks will happen,” said Carsten Brzeski, ING Groep’s global head of macro research. “There is a question of how stock markets will adjust to this new normal.”

Shares of Chipotle Mexican Grill rose $148.39, or 10%, to $1,608.74 after it said it had increased menu prices again and was likely to raise them further this year. Lyft rose $2.8, or 6.8%, to $44 after the ride-hailing company posted weaker-than-expected ridership numbers. CVS Health fell $6.04, or 5.5%, to $104.79 after the drugstore chain reported quarterly results that beat expectations, but provided a mixed full-year outlook.

Investors are monitoring factors that could affect earnings, including the anticipated increase in interest rates, elevated inflation and supply-chain disruptions. As of late last week, 34 companies in the S&P 500 had given lower earnings guidance than analysts expected, while 13 companies had issued higher guidance, according to FactSet.

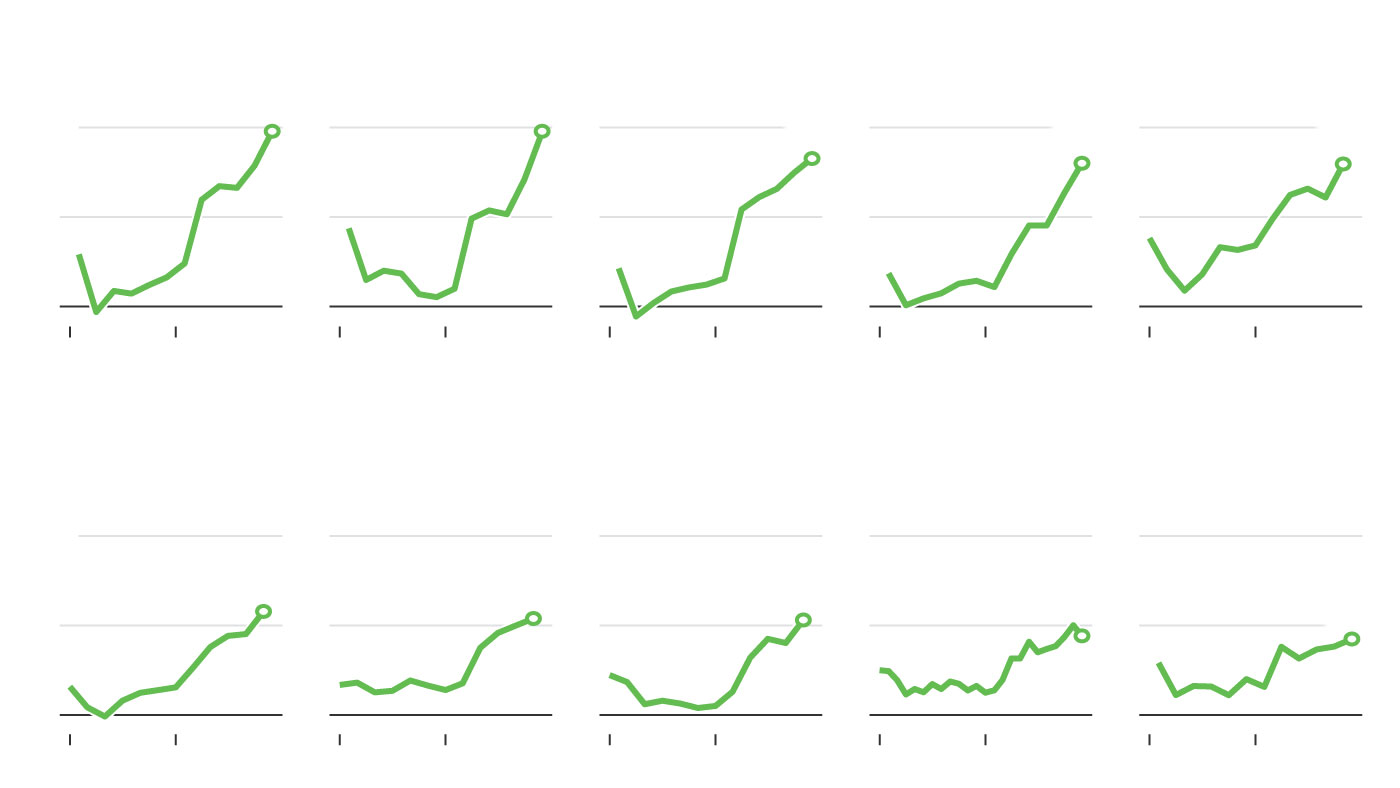

The prospect of higher borrowing costs globally has heightened volatility in stocks this year.

Photo: David L. Nemec/Associated Press

Brent crude, the global oil benchmark, gained 77 cents per barrel, or 0.8% to $91.55.

Overseas, the pan-continental Stoxx Europe 600 rose 1.7%. Shares of Dutch payment company Adyen jumped around 12% after it reported a profit rise that beat market expectations.

In Asia, major stock indexes closed with gains. Hong Kong’s Hang Seng jumped 2.1% and Japan’s Nikkei 225 added 1.1%. China’s Shanghai Composite and South Korea’s Kospi gained 0.8% each.

Write to Hardika Singh at [email protected] and Caitlin Ostroff at [email protected]

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8