Circle Squared Various Investments founder Jeff Sica discusses what Moodys score minimize means for rates of interest on Varney & Co.

Morgan Stanley’s prime inventory market strategist stated in a notice that any inventory market decline that is linked to Moody’s downgrade of the U.S. credit standing would probably create a shopping for state of affairs for the agency.

Mike Wilson, chief inventory market strategist at Morgan Stanley, stated in his weekly analysis notice that the short-term discount of tariffs between the U.S. and China was one merchandise that might result in a extra sturdy rally. A inventory market decline following Moody’s downgrade would current a possibility to purchase the dip.

Wilson stated that the equity-return-to-bond-yield correlation is at the moment near 0 on a scale of -1 to 1. “In our view, a breakout of the 10-year yield above 4.50% would take this correlation negative, and drive more rate sensitivity for equities,” he stated.

“Moody’s late-day downgrade of the U.S. credit rating last Friday is also worth considering in this conversation, though Moody’s is the last ratings agency to downgrade the U.S. credit rating, a process that began 14 years ago in the summer of 2011,” Wilson wrote.

MOODY’S DOWNGRADES US CREDIT RATING OVER RISING DEBT

Morgan Stanley’s chief market strategist stated a inventory dip on the Moody’s downgrade may current a shopping for alternative. (Shannon Stapleton/Reuters / Reuters Photographs)

“In short, a break above 4.50% in the 10-year yield can lead to modest valuation compression (5% compression is around what we’ve gotten in prior historical analogs) — we would be buyers of such a dip,” he stated.

Wilson’s notice stated that Morgan Stanley economists are much less optimistic about two different objects on their guidelines for a sturdy market rally, together with circumstances that may permit the Federal Reserve to start out reducing rates of interest and a decrease yield on the 10-year Treasury notice.

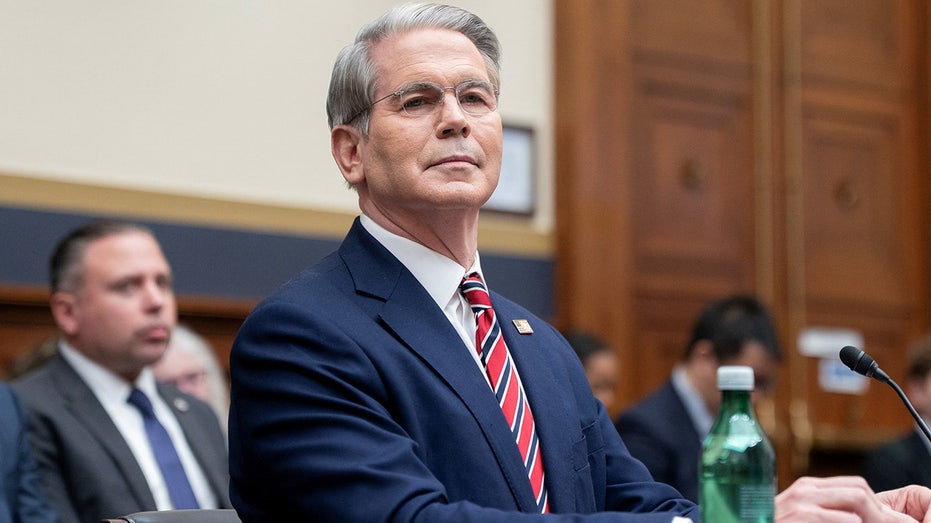

TREASURY SECRETARY BESSENT DISMISSES MOODY’S US CREDIT DOWNGRADE AS ‘LAGGING INDICATOR’

Treasury Secretary Scott Bessent dismissed the downgrade as a lagging indicator for the economic system. (Nathan Howard/Reuters / Reuters Photographs)

The agency’s forecast initiatives that the core private consumption expenditure (PCE) index, a key inflation gauge, is projected to rise in Might and proceed to extend over the summer time. Core PCE was 2.6% in April whereas the usual PCE index was 2.3% final month — each figures are above the Fed’s 2% goal price.

“In short, we’re unlikely to see near-term progress on the last two items on our check list for a more sustained rally — a more dovish Fed and the 10-year yield below 4.0% without recessionary data,” Wilson wrote.

CBO SAYS US BUDGET DEFICITS TO WIDEN, NATIONAL DEBT TO SURGE TO 156% OF GDP

Moody’s downgraded the U.S. credit standing over the rising nationwide debt. (SAUL LOEB/AFP through Getty Photographs / Getty Photographs)

Moody’s Rankings on Friday downgraded the U.S. credit standing one notch from its prime tier of Aaa to Aa1, explaining that the transfer “reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.”

“Successive U.S. administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs,” the agency stated. “We do not believe that material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals under consideration.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Moody’s added that it sees the federal authorities’s fiscal outlook worsening within the years forward, with spending on entitlement packages like Medicare and Social Safety persevering with to rise amid the getting older of the U.S. inhabitants and curiosity funds on the debt rising attributable to greater rates of interest and widening deficits.