Payne Capital Administration President Ryan Payne discusses the specter of a recession as President Donald Trump sticks to his tariff plan on Varney & Co.

JPMorgan Chase CEO Jamie Dimon mentioned Monday in a letter to shareholders that President Donald Trump’s tariffs are more likely to “increase inflation” on each overseas and home items, and raised issues over what their affect will likely be on America’s financial alliances.

“Whatever you think of the legitimate reasons for the newly announced tariffs – and, of course, there are some – or the long-term effect, good or bad, there are likely to be important short-term effects,” Dimon wrote in his letter, which marked his first public feedback on Trump’s tariffs.

“As for the short-term, we are likely to see inflationary outcomes, not only on imported goods but on domestic prices, and input costs rise and demand increases on domestic products. How this plays out on different products will partially depend on their substitutability and price elasticity. Whether or not the menu of tariffs causes a recession remains in question, but it will slow growth down,” he defined.

He went on to jot down that there “are many uncertainties surrounding the new tariff policy” together with U.S. buying and selling companions’ retaliatory plans, which might affect the financial outlook, including that a few of these unfavourable results will compound over time in difficult-to-reverse methods and thus ought to be resolved sooner.

BILL ACKMAN CALLS FOR 90-DAY ‘TIME OUT’ ON TARIFFS, OR RISK ‘SELF-INDUCED, ECONOMIC NUCLEAR WINTER’

JPMorgan Chase CEO Jamie Dimon printed his annual letter on Monday, which contained warnings in regards to the affect of tariffs. (Al Drago/Bloomberg through Getty Photos / Getty Photos)

“The potential retaliatory actions, including on services, by other countries, the effect on confidence, the impact on investments and capital flows, the effect on corporate profits and the possible effect on the U.S. dollar,” he mentioned.

“The quicker this issue is resolved, the better because some of the negative effects increase cumulatively over time and would be hard to reverse. In the short run, I see this as one large additional straw on the camel’s back.”

“I am hoping that after negotiations, the long-term effect will have some positive benefits for the United States,” Dimon mentioned. “My most serious concern is how this will affect America’s long-term economic alliances.”

FED CHARI POWELL SAYS TARIFFS LIKELY TO CAUSE INFLATION TO RISE, COULD BE PERSISTENT

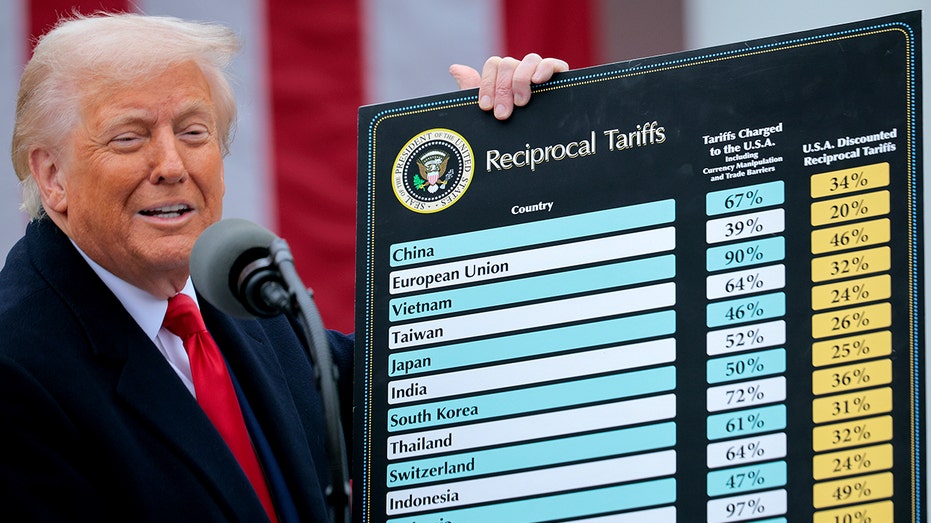

President Donald Trump introduced tariffs on U.S. buying and selling companions final week, inflicting markets to plunge. (Chip Somodevilla/Getty Photos / Getty Photos)

Dimon wrote that the U.S. “should remember that other nations have choices, both in the short term and in the long term, and they will make these choices in their own self-interest based on economics, security and reliability.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“The United States lacks trade agreements with some of its closest allies, many of whom have signed trade deals with China. We should be more actively seeking free (and, of course, fair) trade agreements, particularly with strong allies like Australia, Japan, the United Kingdom and – we hope one day – the European Union,” Dimon wrote. “These can be done in a way that is clearly beneficial to both sides.”