U.S. inflation climbed to a 39-year high in November, as strong consumer demand collided with supply constraints. Overall, the level of consumer prices leapt 6.8% last month from a year earlier, the Labor Department said.

But prices didn’t change at the same rate for all goods and services. A surge in prices for gasoline and other energy sources, along with prices for cars, have been the primary drivers of this year’s inflation burst. Meanwhile, prices for services like education and medical care rose just slightly.

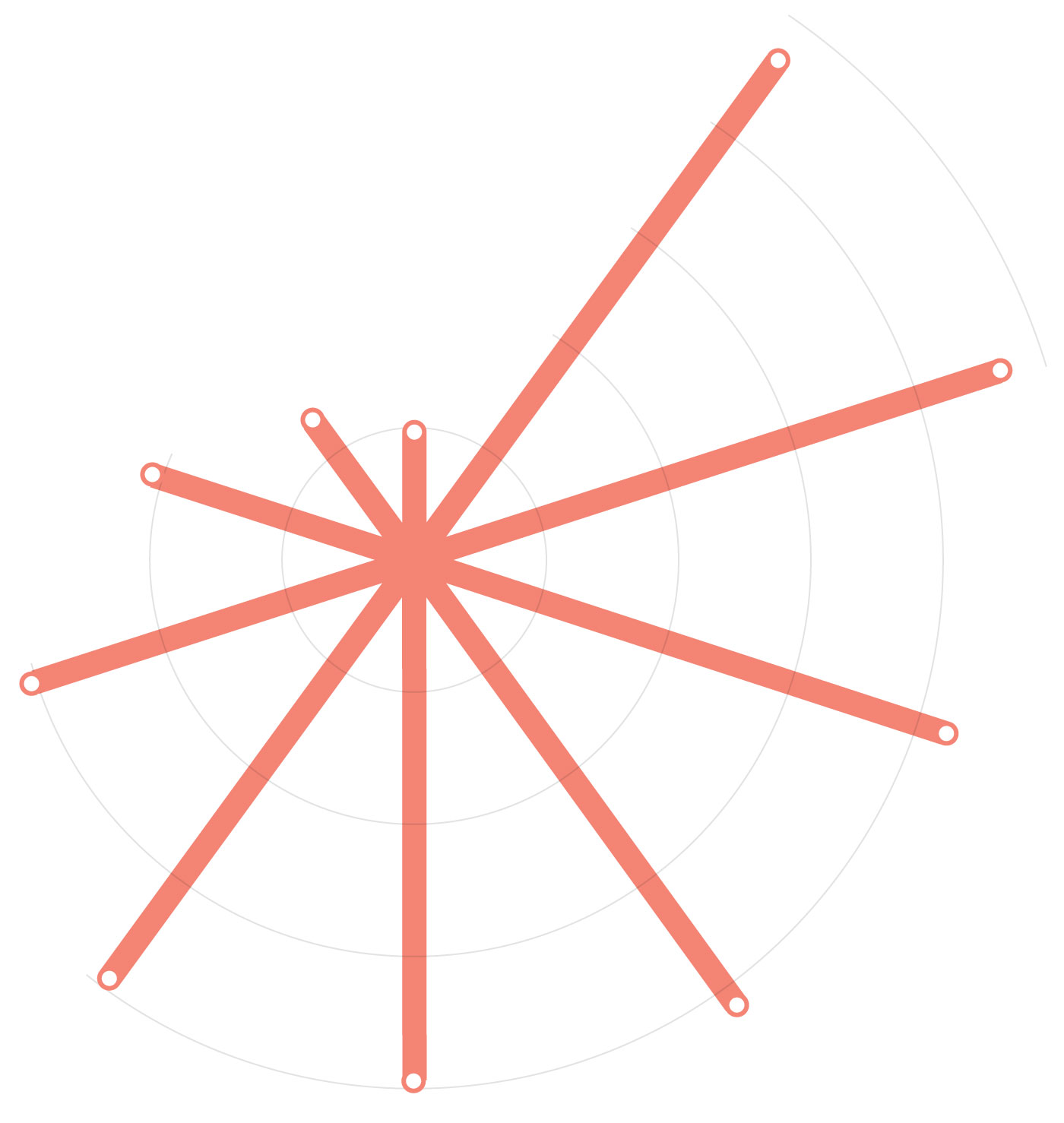

Consumer-price index, 12-month change

Source: Bureau of Labor Statistics

The consumer-price index rose 6.8% in November from the same month a year ago. The core index, which excludes the more-volatile food and energy categories, increased by 4.9%. Prices for energy and transportation made the biggest jumps among the broad categories shown here.

Drilling down into some subcategories related to energy and transportation, we need to expand the range of our color scale to capture wider swings. Prices for vehicles have risen sharply and those for gasoline are nearly 60% higher than a year ago.

Moving on to food and tightening the range of the scale, we can see that price gains for beef and pork are at the top of the items shown here.

A snapshot of some apparel and other wearable items shows prices declined early in the pandemic but this year have been moving steadily higher than those levels.

Much of these differences are the result, in one way or another, of the Covid-19 pandemic. This year’s explosive growth in auto prices is due largely to a semiconductor shortage, which was caused in part by the pandemic but also by trade policy. Much of the rise in food and energy prices comes down to pandemic-related production problems, though also to weather and geopolitical factors. Prices for airline fares and hotels have tended to swing with Covid-19 infection rates, as consumers adjust travel plans to their risk of getting sick.

Still, inflation in prices of many goods and services hit multidecade highs in November, regardless of the differing underlying factors.

Number of years since 12-month inflation

was as high as November, by category

Men/boys apparel +7.8%

(Largest jump in 46 years)

Source: Labor Department

Coffee +7.5% (9)

Food +6.1% (13)

New cars +10.9% (46 years)

Housing +4.8% (20)

Core CPI +4.9% (30)

Meat, poultry and fish +13.1% (42)

Auto body work +8.0% (39)

Gasoline, all types +58.1% (41)

Consumer-price index +6.8% (39)

Men/boys apparel +7.8%

(Largest jump in 46 years)

Number of years since 12-month inflation

was as high as November, by category

Source: Labor Department

Coffee +7.5% (9)

Food +6.1% (13)

New cars +10.9% (46 years)

Housing +4.8% (20)

Core CPI +4.9% (30)

Meat, poultry and fish +13.1% (42)

Auto body work +8.0% (39)

Gasoline, all types +58.1% (41)

Consumer-price index +6.8% (39)

Men/boys apparel +7.8%

(Largest jump in 46 years)

Number of years since 12-month inflation

was as high as November, by category

Source: Labor Department

Coffee +7.5% (9)

Food +6.1% (13)

New cars +10.9% (46 years)

Housing +4.8% (20)

Core CPI +4.9% (30)

Meat, poultry and fish +13.1% (42)

Auto body work +8.0% (39)

Gasoline, all types +58.1% (41)

Consumer-price index +6.8% (39)

Number of years since 12-month inflation

was as high as November, by category

Men/boys apparel

Largest in 46 years

Coffee (9)

New cars (46 years)

Housing (20)

Meat, poultry and fish (42)

Core CPI (30)

Consumer-price index (39)

Auto body work (39)

Gasoline, all types (41)

Source: Labor Department

Number of years since 12-month inflation was as high as November, by category

Men/boys apparel

Largest in 46 years

Coffee (9)

New cars (46 years)

Housing (20)

Meat, poultry and fish (42)

Core CPI (30)

Auto body work (39)

Gasoline, all types (41)

Consumer-price index (39)

Source: Labor Department

The highs signal that price pressures are broadening beyond the goods and services directly affected by Covid and related supply-chain bottlenecks. For example, apparel prices began picking up early in the pandemic, after a long deflationary stint. Housing costs are also climbing, driven by a leap in prices for home energy, furniture and, increasingly, rent.

This broadening of price pressures is important because it could signal that inflation will remain elevated into 2022 and beyond—even after Covid-related disruptions abate.

Economists generally expect price pressure caused by supply constraints to ease next year as sidelined workers return to the labor force, consumer demand for goods calms down and production ramps up. However, those sources of price pressures may be replaced by more persistent ones. For instance, many economists are closely watching the rise in rent, since it makes up nearly one-third of the consumer-price index and tends to influence inflation’s future path.

Write to Gwynn Guilford at [email protected]

Copyright ©2021 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared in the December 18, 2021, print edition as ‘Price Increases Have Varied Widely.’