Pennsylvania restaurant proprietor Matt Flinchbaugh discusses how his enterprise fared underneath the Biden administration on The Massive Cash Present.

It hasn’t even been every week since Donald Trump was declared the winner of the 2024 presidential election, and buyers have excessive hopes for the president-elect’s second time period within the White Home. All three main inventory indexes and the worth of bitcoin all hit file highs on Monday, and the greenback surged.

Whereas some consultants are predicting that Trump’s second time period will carry an financial increase to the U.S., others are warning that the president’s agenda may have a various affect relying on industries.

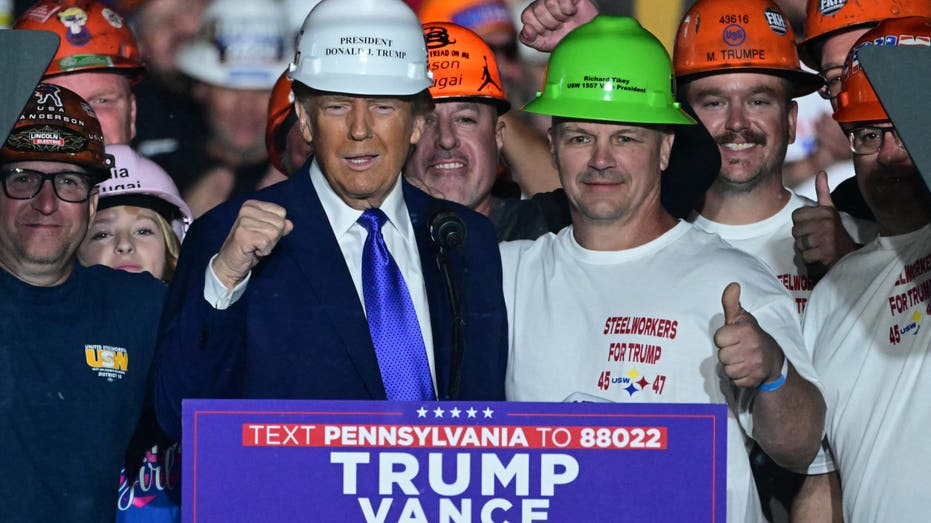

Members of “Steelworkers for Trump” pose with former US President and Republican presidential candidate Donald Trump after they gifted him a tough hat throughout a marketing campaign rally at Arnold Palmer Regional Airport in Latrobe, Pennsylvania, October 19, 2024

Eric Stein, the pinnacle investor at main asset supervisor Voya Funding Administration, says there can be winners and losers ensuing from Trump’s varied insurance policies:

Taxes

Stein says the everlasting extension of Trump’s 2017 tax cuts and a decrease company tax fee because the president-elect has proposed are more likely to spur development (and inflation), benefiting shares whereas pressuring bonds as long-term yields rise.

Winners: US ManufacturersLosers: Bonds, Overseas Subsidiaries

CATHIE WOOD PREDICTS TRUMP POLICIES WILL ‘TURBOCHARGE’ US ECONOMY MORE THAN REAGAN REVOLUTION

Lexington Institute nationwide safety analyst Rebecca Grant explains why tariffs are ‘right here to remain’ on ‘Making Cash.’

Tariffs

Stein says threats of common 10-20% tariffs could also be a negotiating ploy to develop U.S. entry to overseas markets, however increased tariffs on China are possible and Congress might revoke its most-favored-nation standing, shifting provide chains and growing inflation pressures. Voya estimates tariffs and tighter immigration controls could scale back GDP by 0.5% in 2025.”

“Tariffs are essential to look at and I do count on Trump and [potential returning trade chief Robert] Lighthizer will push tariffs, however I count on at the very least most of them gained’t final that lengthy as they’re largely negotiating instruments,” Stein told FOX Business. “There’ll possible be some volatility across the tariffs however I count on them to be largely used as a negotiating tactic.”

Winners: US Manufacturers, India, MexicoLosers: Retailers, Appliances, Electronics, Packaged Goods, Multinationals

FED’S KASHKARI WARNS MASS DEPORTATIONS COULD DISRUPT LABOR AT SOME BUSINESSES

Deregulation

Broader executive powers over enforcement will bring a wave of deregulation, potentially boosting economic growth, corporate earnings and small business profits by lowering compliance costs and clearing the path for strategic mergers and acquisitions, Stein argues. He said the downside is the potential for further inflation risk.

“I believe the largest affect would be the deregulation push, which can unleash animal spirits and be very optimistic to drive financial development,” Stein told FOX Business of Trump’s overall impact.

Winners: Banks, Energy, Tech, Industrials, Consumer, ProductsLosers: RenewablesEnergy

Stein says accelerated oil and gas lease sales and immediate drilling permit approvals by the next Trump administration may lift short-term sentiment, but will have little effect on earnings over the next four years.

“Regardless of Trump’s dismissal of renewables, clear power stays firmly entrenched with robust state backing and clear financial benefits over thermal,” he said.

Winners: Oil & Gas, CoalLosers: Renewables, EVs

THERE’S ‘GROWING OPTIMISM’ FOR EARNINGS AND THE CONSUMER: INVESTOR JAMIE COX

Stein believes inflation may have some volatility during the Trump administration but will likely remain close to where it is today, which is to say a little bit above 2% but way down from 9% a few years ago. He says Trump’s supply side deregulation is deflationary and that should help bring inflation down though tariffs are inflationary.

Elon Musk, chief executive officer of Tesla Inc., left, and former US President Donald Trump, prior to a campaign event at the Butler Farm Show in Butler, Pennsylvania, US, on Saturday, Oct. 5, 2024. (Justin Merriman/Bloomberg via Getty Images / Getty Images)

When asked about the potential impact if Trump follows through with an Elon Musk-led commission to slash government spending, Stein said, “This might doubtlessly be transformational.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“Nevertheless,” he added, “It might be difficult to do all the things that will get proposed given varied circumstances associated to a big authorities comparable to ours compounded by exterior components such because the financial system and world politics.”