Nice Hill Capital Chairman Thomas Hayes analyzes new retail gross sales information and discusses whether or not Fed price cuts matter to the market on Varney & Co.

Intel Corp. was as soon as probably the most precious semiconductor firm on this planet, however the chipmaker’s regular decline in recent times has put it in a weak spot.

The corporate, which is now price lower than half its worth from three years in the past, has now reportedly turn out to be a takeover goal after being approached just lately by Qualcomm with an acquisition provide, in response to a number of experiences.

Intel has fallen from the world’s most useful chipmaker to a takeover goal, in response to a number of experiences. (Reuters/Dado Ruvic/Illustration / Reuters Pictures)

In accordance with The Wall Road Journal, which first reported the takeover bid, a collection of missteps by Intel have led to the corporate’s weakened place, together with the corporate’s failure to anticipate how the rise of synthetic intelligence would reshape the business.

“Over the past two to three years, the shift to AI was really the nail in the coffin for them,” CFRA Analysis analyst Angelo Zino advised the outlet. “They just didn’t have the right capabilities.”

INTEL’S FINANCIAL STRUGGLES THREATEN BIDEN ADMIN CHIP STRATEGY

As soon as the dominant pressure in chipmaking, Intel ceded its manufacturing edge to Taiwanese rival TSMC and failed to provide a broadly desired chip for the generative AI increase capitalized on by Nvidia and AMD.

Intel has been making an attempt to show its enterprise round by specializing in AI processors and making a chip contract manufacturing enterprise, often called a foundry. However the firm has confronted headwinds in each these endeavors.

The U.S.-based chipmaker was anticipated to be the chief beneficiary of the tens of billions in taxpayer subsidies allotted beneath the bipartisan CHIPS and Science Act handed two years in the past. However to date, the corporate has not acquired any funds as it really works to satisfy the federal government’s necessities, and as a substitute of making the roles promised beneath the coverage, it has slashed its workforce by 15%.

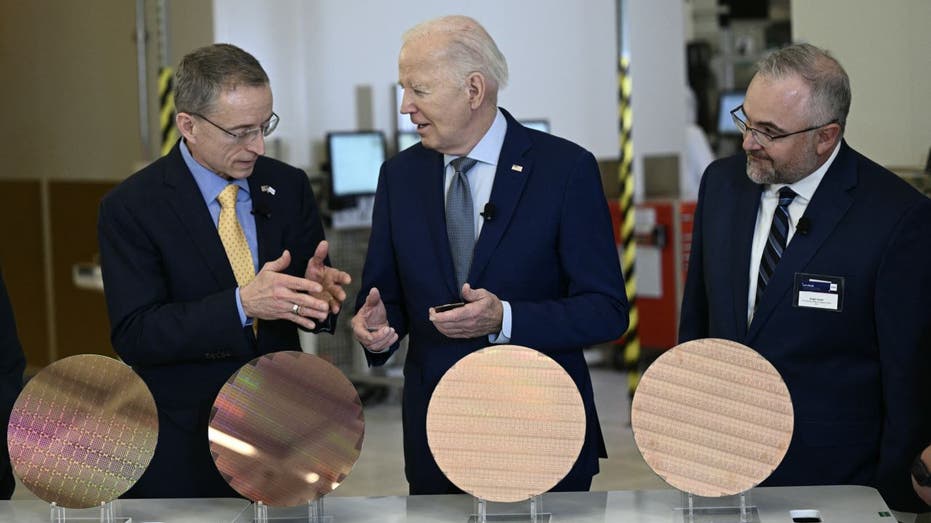

President Biden (C) talks to Intel CEO Pat Gelsinger (L) as manufacturing facility supervisor Hugh Inexperienced (R) seems to be on as Biden excursions the Intel Ocotillo Campus in Chandler, Arizona, on March 20, 2024. (Picture by BRENDAN SMIALOWSKI/AFP by way of Getty Pictures / Getty Pictures)

Then earlier this month, Reuters reported that, in response to three sources acquainted with the matter, Intel suffered a setback in its contract manufacturing with current failures of its most superior chip-making course of.

INTEL HAS ITS ‘WORK CUT OUT’ DESPITE LAUNCH OF NEW CHIPS: BETH KINDIG

As a part of a memo from CEO Pat Gelsinger, Intel launched a collection of bulletins that stemmed from a board assembly final week. Gelsinger and different executives offered a plan to shave off companies and restructure the corporate.

Ticker Safety Final Change Change % INTC INTEL CORP. 22.56 +0.72

+3.28%

The corporate plans to pause development on factories in Poland and Germany, and cut back its actual property holdings. Intel additionally mentioned it had reached a deal to make a customized networking chip for Amazon’s AWS.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In the meantime, Intel’s inventory is down practically 60% 12 months so far, however ended up 3.3% on Friday with a lift following the Journal’s report of Qualcomm’s potential bid.

Reuters contributed to this report.