Of the highest 12 insurance coverage corporations in CA, solely 5 are nonetheless writing new insurance policies.

Wildfires have burned a couple of million acres in California to this point this 12 months. That’s bigger than all the state of Rhode Island.

Pure disasters like which have insurance coverage corporations abandoning some areas solely, not simply in California, but in addition in states together with Texas, Florida, Oregon and Colorado.

“Our premiums more than doubled, but our coverage was cut in half. So, this was the perfect storm of bad,” stated Steve Archer, president of the HOA for his group in La Cañada Flintridge, California.

Archer says of us in his group have tried to guard the world from catastrophe.

HURRICANE MILTON HAS FLORIDA HOMEOWNERS AND THE INSURANCE MARKET BRACING FOR IMPACT

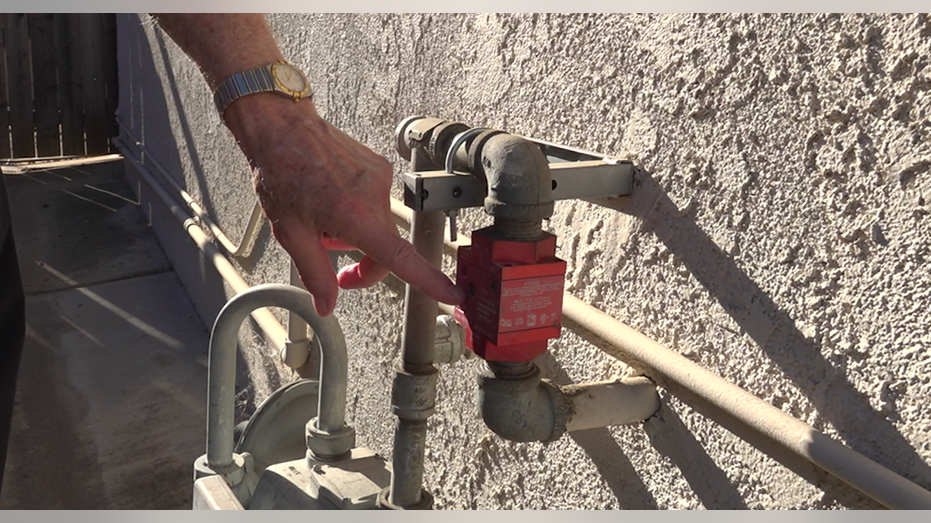

“We have new roofs on every one of our buildings here. We’ve done a lot of extensive tree trimming. We have inspected every fireplace …to install spark registers. We’ve installed seismic shut-off valves that are tripped by an earthquake in order to stop the gas flow,” stated Archer.

Farmers Insurance coverage has lined the group for 20 years. However in July, the corporate known as it quits. That left the group scrambling for protection.

“After an intensive search, we ended up with a California Fair Plan, which is kind of the last resort for people who can’t get insurance elsewhere…So our premiums went from 70,000 to 170,000. Our coverage was $45 million — liability coverage and wildfire insurance for our homeowner’s association, common area and our buildings. And…the fair plan has a maximum coverage of 20 million,” stated Archer.

THE AVERAGE DOWN PAYMENT FOR THE TYPICAL US HOME REACHES $127.750: ZILLOW

This implies much less protection for more cash.

“We’ve seen some people’s insurance go from $2,000 to $6,000 a year for their homeowner’s policy, some to eight. And these aren’t big houses. These are kind of normal,” stated Rick Dinger, president of Crescenta Valley Insurance coverage.

HOME INSURANCE RATES HAVE SURGED NEARLY 40% SINCE 2019 – BUT THEY’RE RISING FASTEST IN THESE STATES

Of the highest 12 insurance coverage corporations within the state, solely 5 are nonetheless writing new insurance policies. One native insurance coverage firm blames California’s laws.

“Right now there’s a ton of regulations for an insurance carrier. If they want to raise the rates, they submit the rates. The Department of Insurance, it can take three years. Well, those rates, they’re worthless. But, you know, they’re outdated. They’re not really where they need to be. And a lot of times, the insurance commissioner would come back and wouldn’t give them the rate they need,” stated Dinger.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Trying forward, the Nationwide Interagency Hearth Heart tasks components of Southern California and Texas to have an above regular danger for November.