General Electric Co. ’s plan to break itself into three separate companies reserves a scaled back role for GE Digital, a technology venture that was once at the forefront of the company’s strategy to reinvent itself as a software powerhouse, industry analysts say.

Rather than driving a company-wide transformation, an ambitious goal set roughly six years ago by former Chief Executive Jeffrey Immelt, GE Digital will instead be tucked into a combined power and energy business, the company said Tuesday. GE also announced plans to spin off two separate healthcare and jet-engine manufacturing companies.

“Their digital business had the highest of potential but went sideways,” said Tim Crawford, chief information officer strategic adviser at Los Angeles-based advisory firm Avoa. “I think a lot of that could be tied back to being part of a large company culture that GE Digital was trying to and needed to break free of,” Mr. Crawford said.

Many chief information officers and other corporate information-technology chiefs were reluctant to invest in GE Digital, said Ray Wang, founder and principal analyst at IT consulting firm Constellation Research Inc. Early on, he said, many enterprise technology chiefs found the company’s new digital services focused too heavily on hardware, rather than software applications. “As they tried to build cloud data centers, they didn’t understand the power of building platforms,” Mr. Wang said.

The company did not respond to requests for comment.

GE Digital on Tuesday announced the opening of a new microgrid research lab at the University of Central Florida in partnership with Florida Power & Light Co., a power-utility firm.

Here’s a look at how GE Digital has evolved over the years.

2013: An industrial internet. GE launches Predix, calling it a “first-of-its-kind industrial strength platform that provides a standard and secure way to connect machines, industrial big data and people.” The platform is designed to capture and analyze large amounts of data from industrial machines, using predictive analytics to improve efficiency.

2015: “What’s the matter with Owen.” The company launches GE Digital, pulling together its Software Center, global IT and commercial software teams, and the Wurldtech industrial-security unit. Mr. Immelt, who was then CEO, predicts GE will be a “top 10 software company” by 2020.

Chasing millennials, the company runs ads featuring a fictional new-GE hire named Owen, who tells befuddled friends and family that he is “writing a new language for machines.” “So you’re going to work on a train?” a friend asks in one ad. The spots encourage viewers to check out GE’s jobs website.

A digital locomotive. Mr. Immelt says the company’s focus on digital business strengthened the case for organic growth over large acquisitions.“We were massive outsourcers,” Mr. Immelt says. “And then you wake up one day and realize the locomotive you used to sell is a data center and you have to change,” he says.

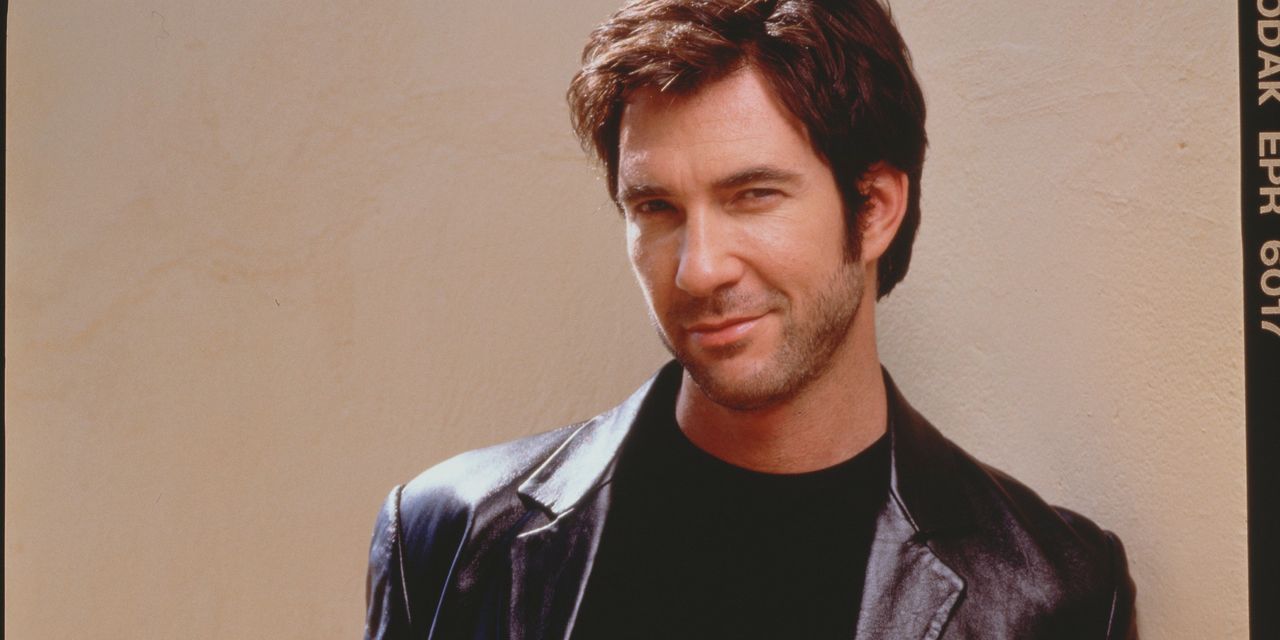

Bill Ruh, then CEO of GE Digital, speaks in 2016.

Photo: Chris Ratcliffe/Bloomberg News

2016: Digital twins everywhere. Core to GE Digital is the concept of the digital twin, a software model of a physical entity, such as a wind turbine. Bill Ruh, corporate chief digital officer and CEO of GE Digital, says he even envisions a time when people have their own digital twin to help track health, predict disease and other benefits. “I believe we will end up with healthcare being the ultimate digital twin,” he says.

Shout out to the CIOs. “The CIO has to be the hero of the story,” Mr. Ruh tells an audience at the 2016 Gartner Symposium/ITxpo in Orlando, Fla. “The model for the future is that the IT organization is going to shift to being the digital enabler for every industry,” Mr. Ruh says.

Enter Microsoft’s cloud expert. Steven Martin, former general manager and chief data scientist for Microsoft Corp.’s Cloud and Enterprise group, is tapped to lead digital transformation for GE’s $11 billion electrification, grid and controls business. He reports to Mr. Ruh and GE Energy Connections chief Russell Stokes.

Getting Wise. GE acquires Wise.io Inc., a machine learning firm in Berkeley, Calif., and Bit Stew Systems Inc., which enables the “ingestion” of masses of data for industrial applications. Mr. Ruh says the acquisitions are helping the company build up Predix. “It really is about transforming the service business,” Mr. Ruh says. GE sets a target of hitting $15 billion in software sales by 2020, with roughly half of that revenue coming from sales of Predix applications to the electricity industry, the company says.

2017: Customer number one. “The goal is to make GE the poster child of how to use Predix and how to use digital technology to make industrial companies more productive,” says GE Chief Information Officer Jim Fowler.

Changing focus. John Flannery, who replaced Mr. Immelt as CEO after the company’s stock began a multiyear decline, declares that GE Digital will be more focused and only work in industries where GE is already present.

2018: The selloff. Private-equity firm Silver Lake, which is known for its investments in technology and media companies, agrees to buy a majority stake in ServiceMax, a GE Digital unit whose software helps with inventory management and scheduling service technicians. GE says it will form a new company focused on industrial Internet of Things software that will be wholly owned by GE but run as an independent business. As part of the changes, Mr. Ruh says he will step down as chief executive of GE Digital.

2020: Running at a loss. Larry Culp replaces Mr. Flannery as GE CEO, saying the company’s digital business is “getting close to break-even.”

2021: The spinoff. GE on Tuesday said it will split into three public companies, folding GE Digital into a combined energy and power business.

Write to Angus Loten at [email protected]

Copyright ©2021 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8