BlackRock U.S. head of fairness ETFs Jay Jacobs explains why extra traders ought to activate energetic investing and analyzes market efficiency as shares slip to kick off December on ‘The Claman Countdown.’

The exchange-traded fund business is having a file yr, with property already hitting over $1 trillion, and energetic managers are driving an enormous a part of that development.

“Third-quarter activity confirmed what we’ve seen building over the past several years: Active ETFs continue to drive innovation and flows,” wrote Dan Aronson, managing director, ETF consumer product specialist group, in Janus Henderson’s “ETF Pulse” by the third quarter.

Energetic managers may be a part of the decision-making relating to which shares to incorporate utilizing the comfort of an ETF.

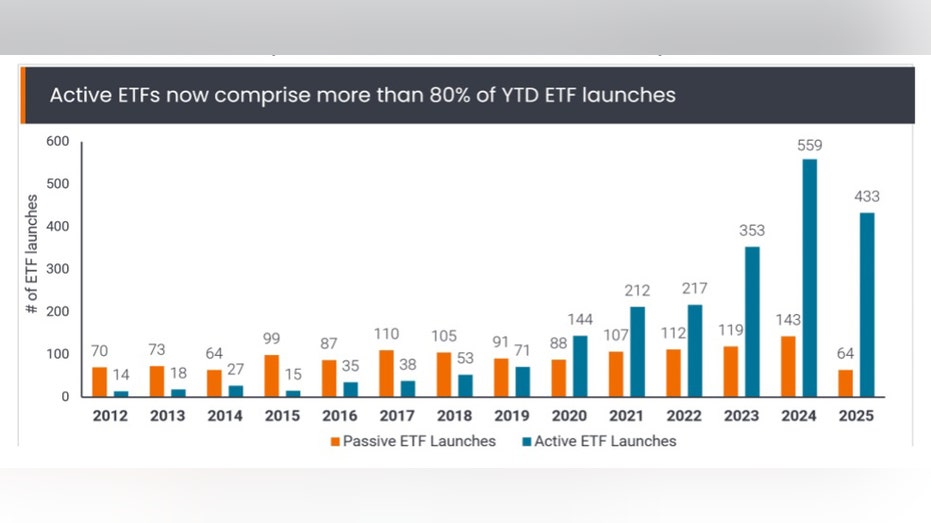

Energetic ETFs account for 80% of year-to-date launches, with property underneath administration rising 38% in comparison with 6% for passive ETFs, he famous. New launches are balanced between fastened revenue and equities.

Janus Henderson reviews robust exercise amongst energetic ETFs (Janus Henderson Buyers )

Nevertheless, not all funds are created equal. Common property underneath administration are round $120 million for funds between two and three years outdated, in comparison with simply $40 million for newer funds.

ETFS: NEWS & ANALYSIS

A snapshot of energetic ETF fund flows and property underneath administration. (Janus Henderson )

Nonetheless, BlackRock, the world’s largest asset supervisor, sees loads of ETF development forward in 2026.

BILLIONAIRE JOINS MICHAEL DELL IN BACKING TRUMP SAVINGS ACCOUNTS

Ticker Safety Final Change Change % BLK BLACKROCK INC. 1,064.85 -3.63

-0.34%

Merchants work on the ground of the New York Inventory Change. (Michael M. Santiago/Getty Photos)

Prime Energetic ETFs: VettaFiTicker Safety Final Change Change % JEPI JP MORGAN ETF TRUST EQUITY PREMIUM INC ETF USD 57.24 -0.28

-0.49%

DFAC DIMENSIONAL ETF TRUST US CORE EQUITY 2 ETF 39.14 -0.29

-0.74%

JPST JPMORGAN ULTRA-SHORT INCOME ETF – USD DIS 50.67 0.00

0.00%

GOLDMAN SACHS TALKS SMALL CAP STOCKS

“We’re optimistic, but people need to be nimble. I think this is where active management can provide a ton of value to navigate where we are seeing the markets up, but we are also seeing a lot more dispersion across stocks,” Jay Jacobs, BlackRock U.S. head of fairness ETFs, instructed FOX Enterprise’ Liz Claman. “There are some bigger winners and some bigger losers. Being able to play the stock markets the right way can really help drive investor returns in 2026.”