Finest general: Stripe

Finest for companies needing an all-in-one fee resolution: Sq.

Finest for companies utilizing QuickBooks: QuickBooks Cash

Finest without spending a dime ACH funds: Melio

Finest for worldwide financial institution transfers: GoCardless

Automated Clearing Home (ACH) funds are digital financial institution transfers that transfer funds between accounts by the ACH community. In contrast to bank card transactions, ACH funds pull cash immediately from the client’s checking account and supply decrease processing charges. They are perfect for recurring funds and huge transactions. The truth is, the overall quantity of ACH funds for the second quarter of 2024 is $21.6 billion, a 7% improve over the identical interval in 2023.

A superb ACH fee processor ought to present simple integration along with your current methods, low transaction charges, customizable API help, and varied methods to just accept ACH funds. Moreover, good buyer help and clear settlement occasions are vital elements in guaranteeing easy operations.

High ACH fee processors comparability

Processing charges, API high quality, safety features, and fee capabilities are among the many key elements I thought-about when evaluating varied ACH fee processing corporations. All of the ACH processors that got here out on the prime of my checklist supply zero month-to-month charges.

Our ranking (out of 5)

Transaction charge

Methods to just accept ACH funds

Payout velocity

Stripe

4.32

0.8%, capped at $5

Cost hyperlinks

Invoicing

Recurring billing

Customized checkout web page

API & SDK integration

2–4 enterprise days

Sq.

4.19

1%, minimal of $1

Invoicing

Recurring billing

API & SDK integration

3–5 enterprise days

QuickBooks Cash

4.17

1%

Invoicing

Recurring billing

Identical day

Melio

4.07

None

Cost hyperlinks

Invoicing

Recurring billing

3–5 enterprise days

GoCardless

4.00

0.5% + $0.05, capped at $5

Cost hyperlinks

Invoicing

Recurring billing

API & SDK integrations

3–5 enterprise days

Stripe: Finest general

Our ranking: 4.32 out of 5

Picture: Stripe

Picture: Stripe

Stripe is a robust, developer-friendly fee processor identified for its sturdy API and seamless integration capabilities. It helps a variety of fee strategies, together with ACH, bank cards, and worldwide transactions. Companies looking for customization and scalability of their fee processing will discover Stripe extremely appropriate, whether or not it’s for ACH or bank card funds.

Why I selected Stripe

I chosen Stripe as one of the best general ACH fee processor. Its highly effective API and intensive developer assets make it particularly interesting for tech-savvy companies and builders. In comparison with different suppliers like QuickBooks Cash and GoCardless, Stripe presents way more flexibility, which permits companies to simply combine ACH funds into their current methods with minimal friction. Its scalability additionally units it other than Sq., making Stripe a greater match for corporations experiencing fast development or managing excessive transaction volumes.

Moreover, Stripe helps a variety of fee choices, comparable to bank card funds and cell pockets funds, not like GoCardless, which focuses totally on ACH. This versatility permits companies to supply a number of fee strategies by a single platform. Stripe’s mixture of superior instruments, safety features, and aggressive pricing makes it a best choice for companies that require each efficiency and suppleness.

Pricing

Month-to-month charges: $0 monthly.

ACH fee processing charge:

2–3 enterprise days settlement: 0.8%, capped at $5 per transaction.

Two-day settlement: 1.2% per transaction.

On the spot checking account validation: $1.50 per transaction.

Disputed funds: $15 per transaction.

Failed funds: $4 per transaction.

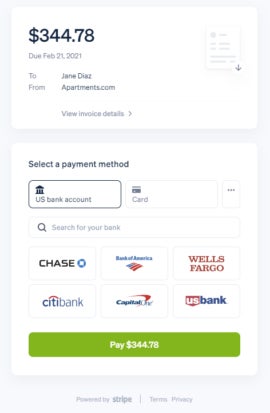

Stripe ACH fee web page. Picture: Stripe

Stripe ACH fee web page. Picture: Stripe

Options

Strong API and developer instruments.

Helps a number of fee strategies.

Superior safety.

Recurring billing.

Invoicing.

Cost hyperlinks.

Customized checkout pages.

Helps worldwide financial institution funds and a number of currencies.

Third-party integrations.

Professionals and cons

Professionals

Cons

Highly effective API.

Extra charges for different companies.

Clear pricing.

Sluggish settlement occasions.

Choices for fast verification.

Complicated setup for companies that choose an out-of-the-box resolution.

Associated: Finest fee gateways

Sq.: Finest for companies needing an all-in-one fee resolution

Our ranking: 4.19 out of 5

Picture: Sq.

Picture: Sq.

Sq. is a flexible fee processing platform identified for its easy-to-use instruments and built-in fee options. It offers an all-in-one system that helps each in-person and on-line transactions. Among the many fee strategies it accepts are ACH funds by Sq. Bill and Financial institution on File.

Why I selected Sq.

I selected Sq. as the best choice for companies needing an all-in-one fee resolution due to its user-friendly platform that helps each in-person and on-line transactions. In contrast to Stripe, which excels in customization and developer instruments, Sq. presents a extra streamlined, out-of-the-box setup, making it supreme for companies with out devoted tech groups.

Though Sq. solely accepts ACH funds by invoices and bank-on-file, its capability to deal with a number of fee strategies inside one system makes it a handy selection for companies that need simplicity. For corporations that prioritize ease of use and a unified resolution, Sq. offers the proper stability of performance and effectivity.

Pricing

Month-to-month charges: $0 monthly.

ACH fee processing charges: 1%, minimal of $1 per transaction.

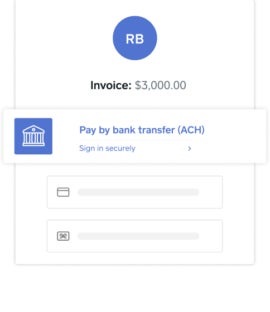

Sq. ACH fee by invoicing. Picture: Sq.

Sq. ACH fee by invoicing. Picture: Sq.

Options

All-in-one fee processing.

Sq. Invoices.

Recurring billing.

Financial institution on File.

Person-friendly dashboard.

Third-party integrations.

Fraud detection instruments.

Cellular app.

Stock administration.

Professionals and cons

Professionals

Cons

Person-friendly interface.

Restricted customizations.

All-in-one fee resolution.

Barely greater ACH transaction charges.

Cellular app.

ACH funds are solely by invoicing and recurring billing.

QuickBooks Cash: Finest for companies utilizing QuickBooks

Our ranking: 4.17 out of 5

Picture: QuickBooks

Picture: QuickBooks

QuickBooks Cash is a no-monthly-fee fee processing service from Intuit, the identical firm identified for the accounting software program QuickBooks On-line. It presents an easy pricing mannequin the place companies solely pay per transaction.

With QuickBooks Cash, customers can keep full management over their enterprise funds with out the trouble of intensive bookkeeping. The service consists of options comparable to a devoted enterprise checking account, the flexibility to ship invoices, and same-day deposits to enhance money stream. Moreover, companies can earn a aggressive 5.00% APY on their funds.

Why I selected QuickBooks Cash

QuickBooks Cash permits non-QuickBooks subscribers to just accept funds with out signing up for QuickBooks. Nevertheless, it’s nonetheless greatest for many who have already got QuickBooks or are planning to make use of it for his or her accounting wants. This integration streamlines monetary administration by routinely syncing fee information with accounting information, decreasing guide entry and minimizing errors—a bonus over different processors on this checklist that require extra guide monitoring or integration with different accounting instruments.

Customers can simply generate invoices, observe funds, and monitor money stream immediately throughout the QuickBooks ecosystem. In comparison with suppliers like Stripe, which excels in customization, QuickBooks Cash presents a extra simple method. Moreover, it comes with a QuickBooks Checking account and Visa debit card, permitting same-day deposits and making it invaluable for companies that want fast entry to their funds. Different additional perks of QuickBooks Cash is that it accepts PayPal and Venmo funds, one thing that different suppliers on this checklist can’t do.

Pricing

Month-to-month charges: $0 monthly.

ACH fee processing charges: 1% per transaction.

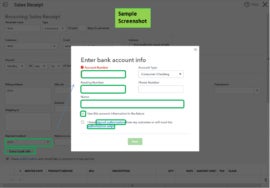

QuickBooks Cash fee web page. Picture: QuickBooks

QuickBooks Cash fee web page. Picture: QuickBooks

Options

Seamless integration with QuickBooks.

Devoted enterprise checking account.

Invoicing capabilities.

Recurring billing.

Identical-day deposits.

5.00% APY on funds.

Professionals and cons

Professionals

Cons

Seamless integration with QuickBooks.

ACH transaction charges are barely greater.

Accepts PayPal and Venmo funds.

Restricted customization choices.

Funds can earn curiosity.

No integration choices and not using a QuickBooks subscription.

What’s scorching at TechRepublic

Melio: Finest without spending a dime ACH funds

Our ranking: 4.07 out of 5

Picture: Melio

Picture: Melio

Melio is a flexible fee processing platform that enables companies to each settle for and ship ACH funds. Other than permitting retailers to just accept ACH funds from prospects, it additionally facilitates vendor funds by ACH transfers. This twin functionality permits companies to streamline their accounts payable and receivable processes, improve money stream administration, and keep higher management over their monetary operations, all from a user-friendly interface.

Why I selected Melio

Companies in search of a zero-cost technique to settle for ACH funds will discover Melio as the best choice. Other than not charging any month-to-month charges, Melio doesn’t have any ACH fee processing charges. That is in obtrusive distinction to different ACH processors on this checklist which have a processing charge per ACH transaction.

Other than being cost-effective, Melio has an easy interface and twin performance for each accepting and sending ACH funds, which simplifies monetary administration and improves operational effectivity. For companies trying to reduce bills whereas maximizing fee flexibility, Melio is a superb selection.

Pricing

Month-to-month charge: $0 monthly.

ACH fee processing charges: $0 per transaction.

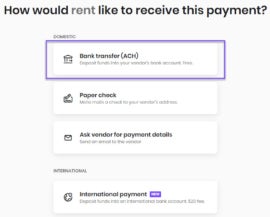

Melio fee web page. Picture: Melio

Melio fee web page. Picture: Melio

Options

Free ACH funds.

Twin fee performance.

Bill administration.

Cost scheduling.

Third-party integrations.

Money stream insights.

Cellular interface.

Professionals and cons

Professionals

Cons

Free ACH fee processing.

Restricted customizations.

Limitless customers.

No superior fraud prevention instruments.

Permits companies to pay distributors.

Funds are by invoicing solely.

GoCardless: Finest for worldwide financial institution transfers

Our ranking: 4.00 out of 5

![]() Picture: GoCardless

Picture: GoCardless

GoCardless is a fee processing platform specializing in ACH and financial institution debit funds, providing companies a easy technique to accumulate recurring and one-off funds immediately from prospects’ financial institution accounts. Designed for companies that function internationally, GoCardless offers seamless cross-border fee capabilities and ensures low transaction charges in comparison with conventional bank card processing. Its streamlined method makes it supreme for companies specializing in financial institution transfers slightly than card funds, notably for recurring billing and subscription fashions.

Why I selected GoCardless

GoCardless is a superb possibility for companies targeted on recurring ACH and worldwide financial institution funds. In contrast to different suppliers like Stripe or Sq., GoCardless is constructed particularly for dealing with direct financial institution funds, which makes it a fantastic resolution for corporations prioritizing ACH over bank cards. Its worldwide capabilities additionally set it aside, permitting companies to simply accumulate funds from prospects in a number of nations with out incurring hefty charges usually related to cross-border transactions.

GoCardless additionally excels in subscription billing administration, providing instruments that simplify recurring funds, making it supreme for companies with long-term buyer relationships.

Pricing

Month-to-month charge: $0 monthly.

ACH fee processing charges:

Commonplace:

Home: 0.5% + $0.05, capped at $5 per transaction.

Worldwide: 1.5% + $0.05 per transaction.

Superior:

Home: 0.75% + $0.05, capped at $6.25 per transaction.

Worldwide: 1.75% + $0.05 per transaction.

Professional:

Home: 0.90% + $0.05, capped at $7 per transaction.

Worldwide: 1.90% + $0.05 per transaction.

Refund charge: $0.50 per transaction.

Chargeback charge: $5.00 per transaction.

Failure charge: $5.00 per transaction.

Customized identify on prospects’ financial institution statements: $25 monthly.

GoCardless dashboard. Picture: GoCardless

GoCardless dashboard. Picture: GoCardless

Options

Invoicing.

Recurring funds.

Customized fee pages.

Worldwide fee help.

Third-party integrations.

ACH and financial institution debit funds solely.

Developer-friendly API.

Cost failure administration.

Customizable fee schedule.

Professionals and cons

Professionals

Cons

World fee capabilities.

Restricted fee strategies.

Developer-friendly APIs.

Restricted customizations.

Automated fee failure dealing with.

Advantages of ACH Cost Processing

ACH fee processing presents a number of benefits that make it a beautiful possibility for companies trying to cut back prices and streamline operations. Listed here are some key advantages:

Decrease charges: ACH funds price considerably lower than bank card transactions.

Preferrred for recurring funds: Good for subscriptions and huge transactions as a result of reliability.

Decrease chargeback threat: Affords extra fee stability in comparison with bank card funds.

Much less fee failure: In contrast to bank cards whose particulars change periodically, checking account particulars change much less incessantly.

Higher safety: ACH transactions require safe encryption and are topic to stringent rules.

How do I select one of the best ACH fee processor

Choosing the precise ACH fee processor includes a number of key concerns:

Transaction charges: Examine the prices related to every processor, together with per-transaction charges and any month-to-month expenses.

Integration capabilities: Make sure the processor can simply combine along with your current methods, comparable to accounting software program or e-commerce platforms.

Person expertise: Search for a user-friendly interface that simplifies fee processing for each your crew and prospects.

Buyer help: Consider the provision and high quality of buyer help to help with any points which will come up.

Safety features: Prioritize processors that supply sturdy safety measures to guard delicate monetary info.

Methodology

In compiling this checklist of one of the best ACH fee processors, I prioritized options that ship effectivity, safety, and ease of use for mid- to large-sized companies. Every processor was evaluated based mostly on particular standards: integration and developer instruments (30%), pricing and contract (30%), options (25%), and consumer expertise and buyer help (15%).

My analysis concerned a complete overview of product documentation, pricing info, consumer evaluations, and hands-on testing the place doable. The purpose was to suggest ACH fee processors that present a powerful mixture of affordability, performance, and sturdy help, guaranteeing companies can streamline their fee operations successfully.