‘Making Money’ host Charles Payne discusses whether or not the inventory market is a coiled spring able to explode or hitting the summer season doldrums.

Design software program maker Figma will debut with shares indicated to open at greater than triple their preliminary public providing (IPO) value, with the deal oversubscribed.

Figma CEO Dylan Discipline co-founded the agency and has served as CEO since 2012, changing into chair of the board of administrators in April 2025.

The corporate’s biography of Fields included in a regulatory submitting with the Securities and Alternate Fee (SEC) famous he attended Brown College for 2½ years earlier than he accepted a Thiel Fellowship from investor Peter Thiel’s basis to pursue entrepreneurial initiatives.

Discipline acquired a $100,000 grant by way of the Thiel Fellowship that was conditioned on him leaving college for at the very least two years to work full-time on the corporate, which he based in 2012. He dropped out of Brown, the place he was learning math and laptop science, to simply accept the grant and pursue his work on Figma.

ADOBE SCRAPS $20B ACQUISITION OF DESIGN PLATFORM FIGMA AFTER FACING REGULATORY HURDLES

Figma Inc. signage through the firm’s preliminary public providing on the New York Inventory Alternate Thursday, July 31, 2025. (Michael Nagle/Bloomberg through Getty Pictures / Getty Pictures)

Figma will debut on the New York Inventory Alternate, and if the inventory begins to commerce within the vary of $95 to $100 per share on the NYSE as was indicated early Thursday, it may probably worth the corporate at almost $59 billion. The corporate valued its IPO at $33 a share.

That will far exceed the $20 billion buyout take care of Adobe that fell by way of in December 2023. It comes amid robust investor curiosity in latest tech IPOs, which have spurred optimism round new choices from high-growth and AI-focused companies.

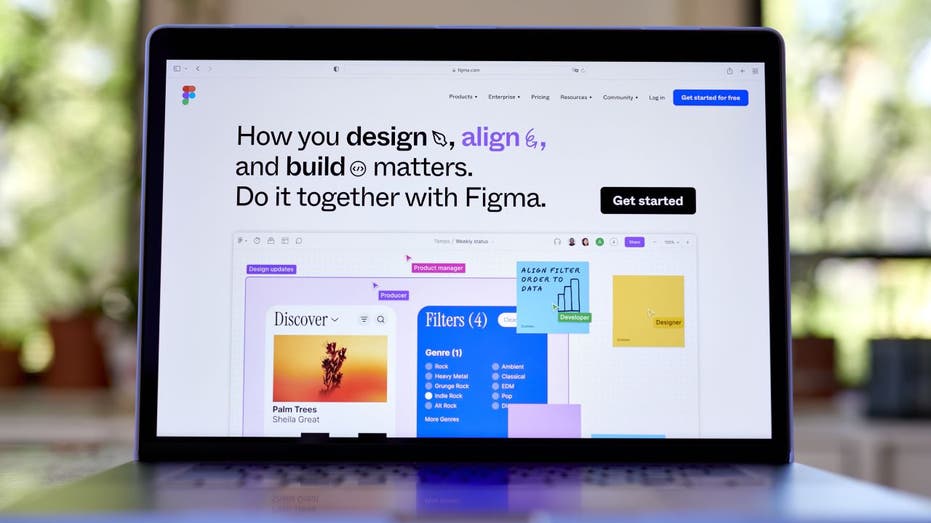

Figma makes collaborative design software program that is used to construct web sites, apps and digital merchandise. A few of its prospects embrace streaming large Netflix, journey lodging agency Airbnb and language studying app Duolingo.

STABLECOIN GIANT CIRCLE TARGETS $6.7B VALUATION IN IPO

Dylan Discipline, co-founder and CEO of Figma Inc., middle, rings the opening bell through the firm’s preliminary public providing on the ground of the New York Inventory Alternate July 31, 2025. (Michael Nagle/Bloomberg through Getty Pictures / Getty Pictures)

As the corporate goes public, Discipline will stay CEO and chair of the board at Figma.

“We believe Mr. Field is qualified to serve as a member of our Board of Directors because of his operational expertise, industry knowledge, leadership, and the continuity that he brings to our Board of Directors as our Co-Founder, Chief Executive Officer, and President,” the corporate wrote.

GOLDMAN SACHS CEO SAYS MARKETS WILL ‘SETTLE DOWN’ AFTER A ‘RESET OF EXPECTATIONS’

Figma is a design software program platform that caters to individuals with quite a lot of ability ranges. (Gabby Jones/Bloomberg through Getty Pictures / Getty Pictures)

Silicon Valley enterprise capital companies, together with Kleiner Perkins and Sequoia, are amongst Figma’s distinguished backers.

The corporate famous intense competitors within the design software program area, notably amid the fast adoption of synthetic intelligence (AI), which may function a headwind that impacts its market share.

“We’ve embedded different flavors of AI — both to lower the floor (and) allow more people to participate in the design process — while also raising the ceiling for individuals (and) for companies to have even more high craft in what they’re creating,” CFO Praveer Melwani stated within the IPO submitting.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The lead underwriters of the IPO are Morgan Stanley, Goldman Sachs, Allen & Co. and J.P. Morgan.

Reuters contributed to this report.