The Chinese real-estate giant skipped interest payments on $1 billion in U.S. dollar bonds on Sept. 23, and has a 30-day grace period before its bondholders can call a default. Evergrande also didn’t pay the coupon on another set of dollar bonds last week. The 25-year-old company is China’s largest issuer of junk bonds, with more than $19 billion in dollar debt outstanding.

Representatives of investment bank Moelis MC 0.84% & Co. and law firm Kirkland & Ellis LLP, which are advising a group of Evergrande bondholders, held an online meeting Friday that was attended by hundreds of investors, including managers of hedge funds, mutual funds and major banks.

“We had a few calls with advisers, but no meaningful dialogue with the company or additional information,” Bert Grisel, a Moelis managing director, told hundreds of meeting attendees. “We have about two weeks left, there is absolutely a situation of urgency” to press the issue, he said.

So far, Evergrande isn’t engaging with the bondholders’ advisers, according to a person familiar with the matter. Multiple legal letters were sent to the company since the first bond payment was missed. Evergrande responded this week, but without providing any meaningful information, they said.

Evergrande and its advisers—which include U.S. restructuring specialist Houlihan Lokey HLI -0.21% —also haven’t been forthcoming about the company’s recently disclosed asset-sale plans, which could adversely affect the recovery prospects for international bondholders, according to Moelis and Kirkland & Ellis.

Prices of some of Evergrande’s dollar bonds have plunged to between 15 cents and 25 cents on the dollar, deeply distressed levels that indicate offshore creditors are pessimistic about how much money they can recover from the company.

Evergrande reported the equivalent of more than $300 billion in liabilities at the end of June, including about $89 billion in interest-bearing debt. The developer recently said it has had trouble paying contractors and building-materials suppliers, leading to construction delays. It also owes large sums of money to its employees and individual investors in China to whom it sold investment products.

A committee of bondholders being advised by Moelis and Kirkland & Ellis includes global funds, asset managers and distressed investors that together hold Evergrande debt with a face value of $2.5 billion. Moelis said it is in touch with more noteholders holding a similar amount, which could bring the total notional amount represented to $5 billion. One purpose of Friday’s call was to corral support from more Evergrande bondholders.

Evergrande disclosed in late September that it struck a deal with a Chinese state-owned enterprise to sell part of its stake in Shengjing Bank Co. for the equivalent of $1.55 billion. The commercial bank demanded that Evergrande use net proceeds from the stake sale to repay what the developer owes it, according to a regulatory filing.

“That is a transaction that could be perceived as preferential treatment of that creditor,” Mr. Grisel said Friday.

Earlier this week, Evergrande’s property-management unit said that it could be subject to a takeover bid, another deal that could raise cash for the parent company.

“What we don’t want is to have a situation where so-called offshore assets are being monetized in some way and the value of those assets being leaked to other parties, whether that be onshore or elsewhere,” Neil McDonald, a restructuring partner at Kirkland & Ellis said during the investor call.

Mr. McDonald said that he had reminded Evergrande and its advisers of its fiduciary duties, which require them to preserve assets and treat creditors equally. He added that Kirkland & Ellis has been working with law firm Harneys as part of a contingency plan in the event that Evergrande fails to protect creditor rights.

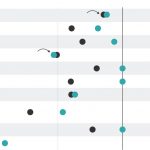

Prices of many Chinese property developers’ bonds have tumbled after Evergrande missed its interest payments and Fantasia Holdings Group Co. , another Shenzhen-headquartered developer, failed to repay a $206 million five-year dollar bond.

The selloff intensified over the past few days, as dozens of developers’ junk-rated bonds gapped lower in price amid fears of more defaults. Weak September sales numbers contributed to the market malaise.

Chinese property developer Kaisa Group Holdings ’ 9.375% bonds due in 2024 tumbled 28 points from the beginning of the week, wiping out a third of its value, according to Tradeweb. Dollar bonds sold by Redsun Properties Group lost 16 points this week. The yield on an ICE BofA index of Chinese companies’ high-yield bonds reached 19.8% on Thursday, its highest in more than a decade.

Write to Frances Yoon at [email protected], Anna Hirtenstein at [email protected] and Julie Steinberg at [email protected]

Copyright ©2021 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8