J.P. Morgan Asset Administration chief international strategist David Kelly assesses the state of the economic system, American exceptionalism and extra on Making Cash.

Client confidence fell greater than anticipated in November and hit the bottom stage since this spring, based on the newest knowledge from The Convention Board.

The Convention Board reported that its shopper confidence index declined to 88.7 in November from an upwardly revised 95.5 studying in October.

That was nicely beneath the 93.4 studying that economists polled by LSEG projected for November, and reached the bottom stage since April.

“Consumers’ write-in responses pertaining to factors affecting the economy continued to be led by references to prices and inflation, tariffs and trade, and politics, with increased mentions of the federal government shutdown,” mentioned Dana Peterson, chief economist at The Convention Board.

NEARLY 1 IN 4 AMERICAN HOUSEHOLDS LIVING PAYCHECK TO PAYCHECK, REPORT REVEALS

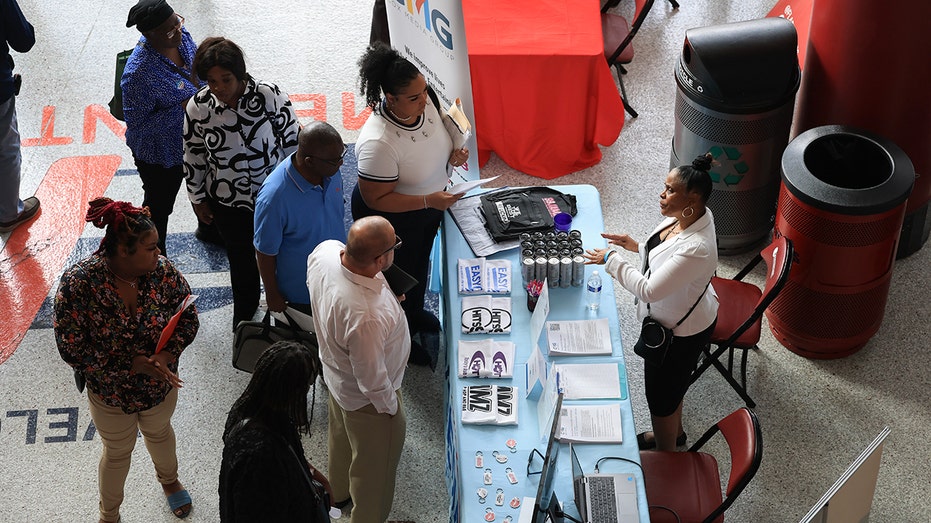

The Convention Board’s Client Confidence Index fell greater than anticipated in November. (Thomas Trutschel/Photothek by way of Getty Photographs)

“Mentions of the labor market eased somewhat but still stood out among all other frequent themes not already cited. The overall tone from November write-ins was slightly more negative than in October,” Peterson mentioned.

Client confidence declined for practically all revenue ranges, as shoppers incomes lower than $15,000 have been the one revenue bracket to see an enchancment in confidence whilst they remained the least optimistic revenue group.

Confidence additionally declined throughout political teams, with the sharpest decline amongst unbiased voters. Amongst age teams, shopper confidence improved amongst these underneath 35 years outdated, however fell for these above that threshold and respondents aged 55 and up remained probably the most downbeat.

US ADDED 119K JOBS IN SEPTEMBER, DELAYED JOBS REPORT SHOWS

The Convention Board’s Expectations Index has been beneath a recession indicator for 10 months. (Joe Raedle)

The report confirmed that customers’ expectations about inflation over the following 12 months remained elevated in November, with the median rising to 4.8%.

For 10 consecutive months, The Convention Board’s Expectations Index has been beneath 80, which is the edge underneath which the gauge indicators a recession is forward.

DECEMBER INTEREST RATE CUT IN DOUBT AS FED MINUTES SHOW POLICYMAKERS DIVIDED

Customers have been downbeat about inflation and costs. (Victor J. Blue/Bloomberg by way of Getty Photographs)

All three elements of the Expectations Index deteriorated in November, with a notable improve in pessimism about enterprise circumstances six months from now.

The Current State of affairs Index additionally declined as shoppers have been pessimistic about present enterprise and labor market circumstances.

“The Consumer Confidence Index was much lower than expected in November, with Americans mentioning the shutdown, prices, inflation, trade, tariffs and the political situation as factors in the decline,” mentioned Raymond James chief economist Eugenio Aleman. “This result is in line with our weaker consumer demand expectation during the last quarter of the year.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Jeffrey Roach, chief economist for LPL Monetary, mentioned that, “Despite the lapse in official job data, the weakening complementary metrics such as this one will put pressure on the Fed to cut rates in December and continue cutting in 2026.”