HONG KONG—As Western tech companies halt sales to Russia following its invasion of Ukraine, their Chinese rivals have an opportunity to capitalize on their departure. Doing so won’t be easy in the face of growing logistical, financial and legal hurdles.

Chinese tech giants, however, have stayed silent and show no signs of joining the exit. Many have built strong ties in Russia over recent decades, capturing more than 40% of the market for some tech products. They often take their cue from Beijing, which has declared its opposition to U.S. sanctions.

While Russia is a small tech market by global standards—it accounts for about 2% of global smartphone and PC shipments—it is Europe’s largest phone market and a competitive tech battleground where Western brands vie with Chinese rivals for top billing.

China’s Xiaomi Corp. is Russia’s No. 2 phone seller, sandwiched between South Korea’s market leader Samsung and third-place Apple, according to market tracker Counterpoint Research. Hong Kong-based Lenovo Group Ltd. is the second-largest PC seller in Russia. behind HP, which led the market last year with a 21% share, according to International Data Corp. Huawei Technologies Co., based in Shenzhen, is Russia’s top telecom-equipment vendor and competes with Ericsson for 5G contracts.

The U.S. and its allies imposed an array of financial sanctions and export controls on Russia and its ally Belarus in response to Russia’s invasion of Ukraine. They include a ban on exports to Russia’s defense sector and complex restrictions on the export to Russia of foreign products made using U.S. equipment, software or blueprints.

The rules contain carve-outs for some consumer electronics such as PCs and cellphones, experts say, potentially opening the door for some of these Chinese sellers to make gains if they stick around, but doing so won’t be easy, analysts said.

“It’s a huge opening,” said Tarun Pathak, an analyst at Counterpoint, but he cautioned that the companies face more hurdles to ramping up sales in Russia. “We see things getting a bit tough.”

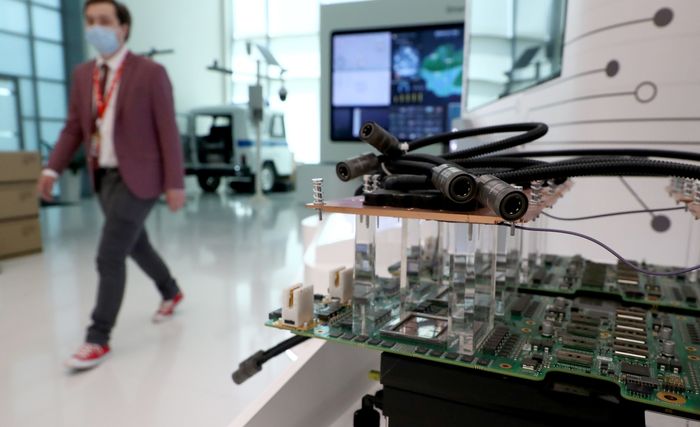

Cables and circuit boards on display at a Huawei showroom in Moscow.

Photo: Anton Novoderezhkin/Zuma Press

Obstacles facing Chinese companies include logistical snarls in Russia, complications with payments from financial sanctions, and the risk of running afoul of the shifting and highly complex U.S. and allied export controls, even inadvertently.

“Chinese companies, like any other, don’t want to face unpaid invoices, major logistical challenges or be exposed even indirectly to sanctions or sanctioned entities or individuals, and that list is growing all the time,” said Duncan Clark, chairman of the investment-advisory firm BDA China.

The sanctions barring the export of products made using U.S. technology are modeled on those Washington successfully applied to Huawei in 2020. After they took effect, companies around the world—even in China—were forced to halt sales to the telecom giant because of the widespread presence of American equipment and software in high-tech supply chains.

Beijing last year passed a law aimed at countering foreign sanctions against Chinese people and companies, but tech firms that flout the Western export rules risk penalties by those countries.

“Chinese companies have much more to lose than to gain by violating sanctions,” analysts at Gavekal Dragonomics said in a research report. “For most Chinese companies, Russia is just too small of a market for the business to be worth the risk of getting cut off from developed markets or being sanctioned itself.”

On Wednesday, the Chinese state-run newspaper Global Times published an article describing an opportunity for Chinese smartphone and automobile companies in Russia following the departure of their U.S. rivals. The article has since been taken down.

Chinese companies controlled about 41% of the Russian smartphone market last year, according to Counterpoint Research. They include Xiaomi and other fast-growing brands, Honor Device Co. and Realme Chongqing Mobile Telecommunications Corp. Apple’s decision to suspend sales potentially puts its 14% share of the market up for grabs. The companies didn’t respond to requests for comment.

Lenovo, the world’s largest PC company, was a target of outrage last week on Chinese social media following an unsourced Belarusian media report that it was joining Western tech companies in halting sales to Russia. Lenovo, which hasn’t commented on the report, didn’t respond to requests for comment.

HP, which controlled 21% of the Russian market last year, according to IDC, has said its decision to halt sales in Russia will result in a hit to second-quarter earnings. Dell was Russia’s No. 6 seller at just under 5%.

For China’s big telecom-equipment sellers, there are different risks. The carve-outs for smartphone and other consumer-gadget makers doesn’t generally extend to telecom equipment, said Kevin Wolf, a former Commerce Department official and a partner at law firm Akin Gump Strauss Hauer & Feld in Washington.

That means Huawei may not be able to readily grab market share in Russia from Swedish rival Ericsson. The Chinese company has been building 5G networks there and has deep ties to the market, which it entered in the 1990s. Huawei declined to comment.

—Raffaele Huang contributed to this article.

Write to Dan Strumpf at [email protected]

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8