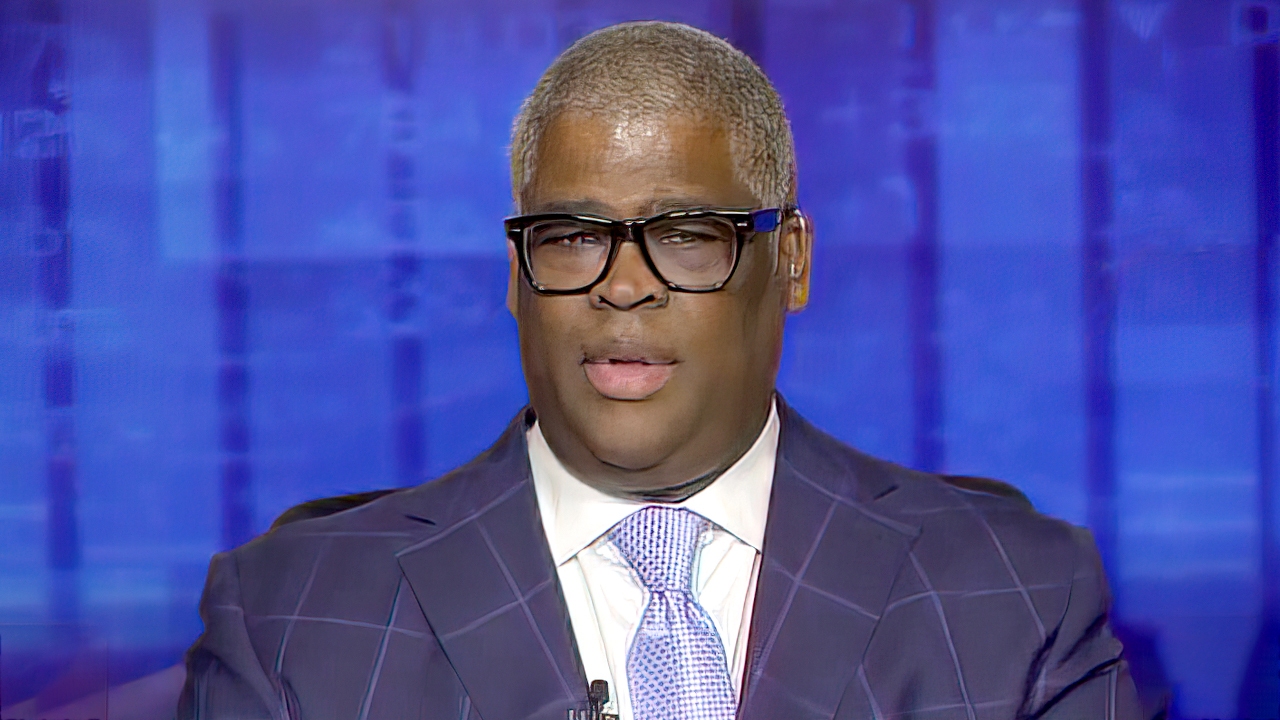

‘Making Cash’ host Charles Payne discusses the widespread influence of the stronger-than-expected April jobs report.

Investing out there is a lifelong endeavor — the earlier you begin, the higher off you’ll be.

Wanting on the final hundred years, it looks as if a straightforward choice. For the reason that late Seventies, anybody would take all of the features within the S&P 500 in opposition to the occasional loss. Traders aged 18 to 81 are lucky to stay on this period.

Traders at present are already carving out:

A distinct strategy

A distinct confidence

THE BEGINNING OF TRUMP’S ‘GOLDEN AGE’ IS HERE AND PUTTING ‘MORE MONEY’ IN YOUR POCKET, LABOR SECRETARY SAYS

As a substitute of reacting emotionally and indefinitely suspending funding plans resulting from market volatility, the recent bear market offers the proper timing to get in.

I’m imploring everybody to be able to confront a state of affairs head-on and to be opportunistic.

That is greater than shopping for the dip. Lengthy-term traders ought to be constructing positions proper now and everybody ought to be a long-term investor.

I intention so that you can thrive in periodic corrections and bear markets, not merely survive them.

That is greater than shopping for the dip. Lengthy-term traders ought to be constructing positions proper now and everybody ought to be a long-term investor.

An outdated saying suggests success comes from time invested out there fairly than timing the market. That is true, particularly in case you are a passive investor. However there’s a a lot larger return for these genuinely ready to grab the second.

‘Making Cash’ host Charles Payne discusses the place the U.S. and world markets may go this 12 months.

U.S. family wealth within the inventory market now makes up 170% of disposable revenue. The highest 10% of American households personal 87% of all shares. Paradoxically, the highest 10% % is hoping the present turmoil will make you hand over and promote your portfolio now. Sooner or later, the specialists will run the cash whilst you vote within the curiosity of companies over Primary Avenue.

Common of us have realized that the inventory market is how one can get wealthy. The American lifestyle revolves across the financialization of the financial system and the inventory market. We stopped investing in elements and in individuals, and as a substitute, cash makes cash.

There have been 35 recessions in america since 1854. Throughout this time, we fueled a increase that lifted the nation previous the U.Ok. The Second Industrial Revolution created main cities and disposable revenue and triggered the American Century.

Taking a look at latest years, what stands out?

CLICK HERE TO READ MORE ON FOX BUSINESS

Fewer and shorter recessions. The system is designed to bounce again rapidly. And together with the rebound within the financial system comes the rebound within the inventory market.

The repair is in.

So, when the inventory market is tumbling, and Wall Avenue and the monetary media go into overdrive, urging individuals to promote, it’s essential to take into account two different options.

Keep out there and carry on passively investing.Keep out there and purchase the dip.

I do know you might be good sufficient, however there’s a distinction between information and smarts; the secret is tangible expertise.

I all the time crack up at memes of outdated of us having a blast doing every kind of loopy issues with no care on the earth as a result of they purchased their $5 million home for 12 raspberries in 1947.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Child boomers are nonetheless shopping for extra houses than millennials and Gen Z has utterly given up.

I get the bitter sarcasm as a result of at present’s younger adults imagine they’ll by no means have the prospect to purchase the American Dream. I perceive that, and I share your frustration.

If doable, I’m certain you wish to journey to the previous and purchase a home. H.G. Wells printed “The Time Machine” in 1895, a profound e-book with a deep message. A number of movies have been tailored from the e-book, notably the Nineteen Sixties model starring Rod Taylor. What I like in regards to the story is the power to return in time and into the longer term.

What if you happen to might try this in actual life and be part of the boomers, scooping up all these homes for fruit? You should utilize a time machine to construct wealth within the inventory market.

Whenever you have a look at a long-term market chart, the pullbacks look scary. However any longer, it’s best to deal with them like going again in time and shopping for nice shares at costs that can profoundly change your life.

CLICK HERE FOR MORE FROM CHARLE PAYNE