A few months ago, Mike Washburn’s cryptocurrency investment looked like a winner.

Now he’s just hoping to get his money back.

Mr. Washburn, a 35-year-old plumber in Otsego, Minn., had $100,000 in an account at Celsius Network LLC, one of the largest lenders in the cryptocurrency world. Recently widowed, Mr. Washburn said he and his two children moved in with his parents, and he planned to buy a house with his savings. The Celsius account offered him yield higher than would a traditional bank account, and the company was well-known in the crypto community.

On Sunday evening, though, Celsius said it was no longer allowing customers to withdraw cash from their accounts. On Tuesday night, The Wall Street Journal reported that Celsius hired restructuring attorneys to help handle its mounting financial problems.

Now, Mr. Washburn is anxiously waiting to hear what happens to his account.

“If I don’t ever see that money again, it will set me and my children back by years,” Mr. Washburn said.

“Deep down I don’t believe there’s going to be a good outcome, but I hope I’m wrong,” he said.

Prices for bitcoin and other cryptocurrencies have been plummeting as interest rates rise and risky assets turn unpopular. The difficult market is forcing once-highflying digital-currency companies to slash jobs, halt mergers and bar clients from withdrawing digital investments, shocking investors.

Individual investors might not have realized when they put money in Celsius that they were giving the company an unsecured loan with little legal protection. Crypto companies such as Celsius look like banks in some ways, but they lack the investor oversight and legal protections built into banks and brokerages.

In a blog post Sunday evening, Celsius said it was pausing all withdrawals, swaps and transfers between accounts, citing “extreme market conditions.” The move froze $11.8 billion in customer assets, based on the company’s May report. On Wednesday afternoon, the assets were still frozen, and Celsius founder and chief executive Alex Mashinsky tweeted that the firm was “working nonstop” on the issue.

It is one of dozens of unregulated lenders that have emerged in recent years promising high returns to investors willing to lend their digital assets. Celsius, which claims about 1.7 million customers, paid customers annual percentage yields of up to 18.6% on cryptocurrency deposits. Higher interest rates were available to those willing to accept payment in Celsius’s own CEL token.

Mr. Mashinsky launched the company in 2017, marketing Celsius as a safe alternative to banks. The Ukrainian-born Mr. Mashinsky criticized banks for paying puny interest rates to clients, favoring T-shirts that underscored his message, including one that read, “Banks are not your friends.”

Like other lenders, Celsius accepted customer deposits of cryptocurrencies and lent them to other users, including market makers and exchanges, to earn a return. Celsius also puts customer deposits in high-yield, high-risk decentralized-finance investments.

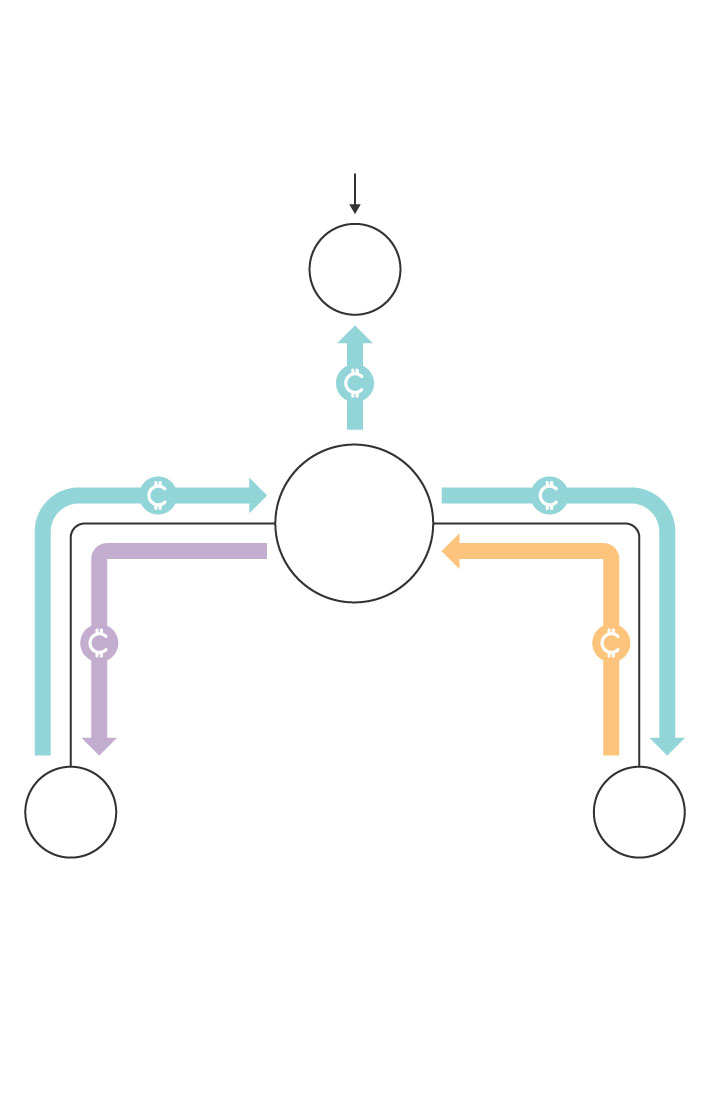

How Celsius’s crypto lending process works:

Celsius puts customer deposits in decentralized finance investments and lends out funds to other users (including to exchanges and market makers).

Customers lend money to Celsius in exchange for yield. (This is essentially an unsecured loan).

Celsius earns a return from borrowers and investments.

Celsius puts customer deposits in decentralized finance investments and lends out funds to other users (including to exchanges and market makers).

Customers lend money to Celsius in exchange for yield. (This is essentially an unsecured loan).

Celsius earns a return from borrowers and investments.

Celsius faced a challenge, however, in earning a return above the yield promised to clients while still allowing them to promptly withdraw their crypto investments. Celsius placed at least $470 million in an investment that had plunged in value, according to blockchain data and a person familiar with the matter. The terms of the investment product, managed by Lido Finance, prohibit Celsius from quickly removing its assets, adding to the difficulties.

Vasiliy Shapovalov, a Lido developer, said he didn’t think the token was very risky.

Celsius accepted ether from clients and used it to buy at least 409,000 “Lido staked ether” tokens, according to the person familiar with matter and blockchain data, that it in turn lent out to earn a high return. Historically, such tokens have had roughly the same value as ether because they represent the ether being used on the Ethereum platform to process transactions and maintain chain security. Celsius can’t exchange its staked ether holdings for ether until Ethereum makes the transition to its “proof of stake” model, but a deadline for that move has been consistently pushed back.

Lately, though, Lido-staked ether has been trading at a discount of about 5%, according to analytics company Dune Analytics. The decoupling began when cryptocurrency TerraUSD recently collapsed, motivating investors to pull out of the most speculative assets.

The fall in value in these tokens has presented a problem for Celsius. If its clients were to withdraw ether deposits en masse, the company would have to sell its staked ether holdings at a substantial loss.

Celsius’s fortunes seemed to shift quickly. On Friday, the company said it hadn’t had any issues meeting withdrawal requests and that it held “more than enough” ether to meet obligations.

Matt Novak, 35, of Sacramento, Calif., first became concerned over the weekend when he had trouble logging into his Celsius account. He tried again a few hours later with no luck.

Mr. Novak said his crypto investments in his Celsius account, about 5% in bitcoin and the rest in the cryptocurrency Polygon, represented about 60% of his retirement funds. They were worth about $93,000 early last week but were down to about $28,000 earlier this week, he said.

Mr. Novak, who runs a mortgage-marketing firm, said he was attracted by the 17.5% rate of return offered on his Polygon deposits at Celsius at that time. Before this week’s crypto meltdown he estimated he had gained at least 50% on his initial investment.

“Looking back, it seems too good to be true,” he said.

Celsius’s decision to freeze accounts sparked nervousness throughout the crypto world, helping to send bitcoin and ether down about 15% on Monday. The digital assets are down 53% and 68% in the past year to date.

“Halting customer withdrawals is a huge deal,” says Matthew Sigel, the head of digital assets research at Van Eck Associates, which manages three crypto funds. “It’s testing the market.”

Individual investors in other cryptocurrencies are feeling their own pressures as prices fall, with some receiving margin calls to provide more collateral for their leveraged digital-currency trades. On Tuesday, data provider CoinGlass said about $690 million of collateral pledged by about 160,223 retail traders had been liquidated over the previous 24 hours.

By Tuesday, Celsius’ CEL token had fallen 81% in the year to date, according to crypto research firm Messari. When the token was falling on Friday, Celsius said “the price of CEL is very often affected by market factors that are not related to the company’s performance.”

Later that day, news broke that Celsius hired restructuring attorneys from law firm Akin Gump Strauss Hauer & Feld LLP to look for possible financing options from investors and other strategic alternatives, including a financial restructuring.

Securities held for customers by a registered brokerage, like Fidelity Investments, can’t be touched in bankruptcy proceedings. Celsius isn’t a registered brokerage, though.

Securities and Exchange Commission Chairman Gary Gensler has warned that investors who own cryptocurrency through trading platforms like the largest U.S. crypto exchange, Coinbase Global Inc., aren’t protected the same way they would be if they invested through a registered brokerage. In March, the SEC released guidelines instructing publicly traded crypto firms to record the digital tokens they hold for customers as assets and their obligation to the customers as liabilities.

In April, Celsius stopped offering the products to “nonaccredited” investors, or those who don’t meet a certain wealth threshold, after being pressed by regulators.

In May, Coinbase said customers might lose access to their digital assets held on the exchange if the company ever goes bankrupt. The biggest uncertainty facing the crypto industry is whether digital tokens are securities like stocks and bonds. The question is being fought out in court.

Some of the larger, high-profile investors and crypto founders had been selling their investments over the past year, locking in profits well ahead of the recent selloff. Billionaire Mike Novogratz’s Galaxy Digital Holdings Ltd , has been a seller of various cryptocurrencies, according to company filings and people close to the matter. Earlier this year, Mr. Novogratz got a tattoo on his biceps of the cryptocurrency Luna and spoke positively of various cryptocurrencies at industry events.

Mr. Novogratz had told the Journal that while he had been publicly optimistic about the future of Luna and other cryptocurrencies, he made sure to include words of caution.

In recent days, digital-currency and blockchain companies have been laying off employees. On Monday, crypto lender BlockFi said it was reducing head count by about 20%. On Tuesday, Coinbase said it was cutting almost a fifth of its staff because the company had grown too quickly and a potential recession “could lead to another crypto winter.” Four top Coinbase officials have collectively pocketed more than $1 billion by selling shares since the cryptocurrency exchange’s public listing in Spring 2021. So far this year, the company’s shares have declined 78%.

“These Coinbase executives maintain large positions in the company, reflecting their commitment to our long-term opportunities,” a Coinbase spokesman said last month.

The Texas State Securities Board opened an investigation into Celsius over its decision to freeze customer accounts, Joseph Rotunda, the board’s director of enforcement, said Thursday. The board is working with New Jersey, Kentucky, Alabama and Washington. Reuters earlier reported on the opening the investigation.

Plunging cryptocurrency prices also are complicating the plans of firms that deal in bitcoin and related areas. So far this year, there have been 42 announced acquisitions of crypto-related companies, according to Dealogic. But it has been about two months since the last deal was announced, suggesting some companies may find it hard to reach or complete mergers until markets clear.

—Orla McCaffrey and Paul Vigna contributed to this article.

Write to Gregory Zuckerman at [email protected]

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8