Views of the economic system, whereas nonetheless web detrimental, ticked again up a bit, together with extra constructive scores of the inventory market. Most People count on costs to go up within the coming months, nonetheless, which is dampening their outlook going ahead and for a lot of — particularly at decrease revenue ranges — their plans for purchases.

Two-thirds assume the costs of issues they purchase will go up both a bit of or quite a bit. That’s way over those that count on costs to only maintain regular.

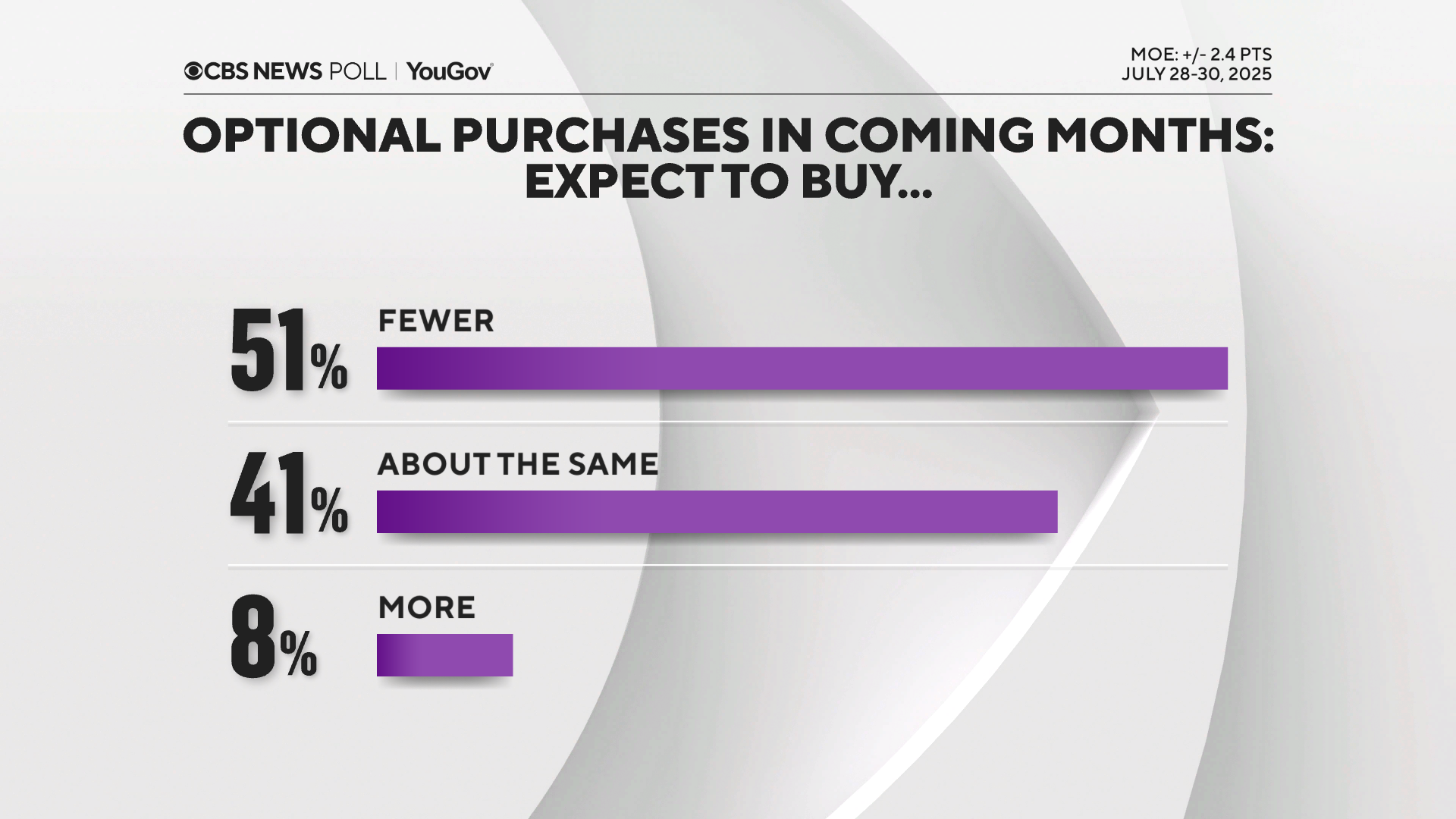

They could be evaluating from latest expertise, as most proceed to say costs have nonetheless been rising. The outlook for costs has an impression on planning too: for elective or discretionary spending, half the nation says it plans to purchase fewer such issues within the coming months.

That’s particularly the case for individuals who say their incomes are usually not conserving tempo with inflation.

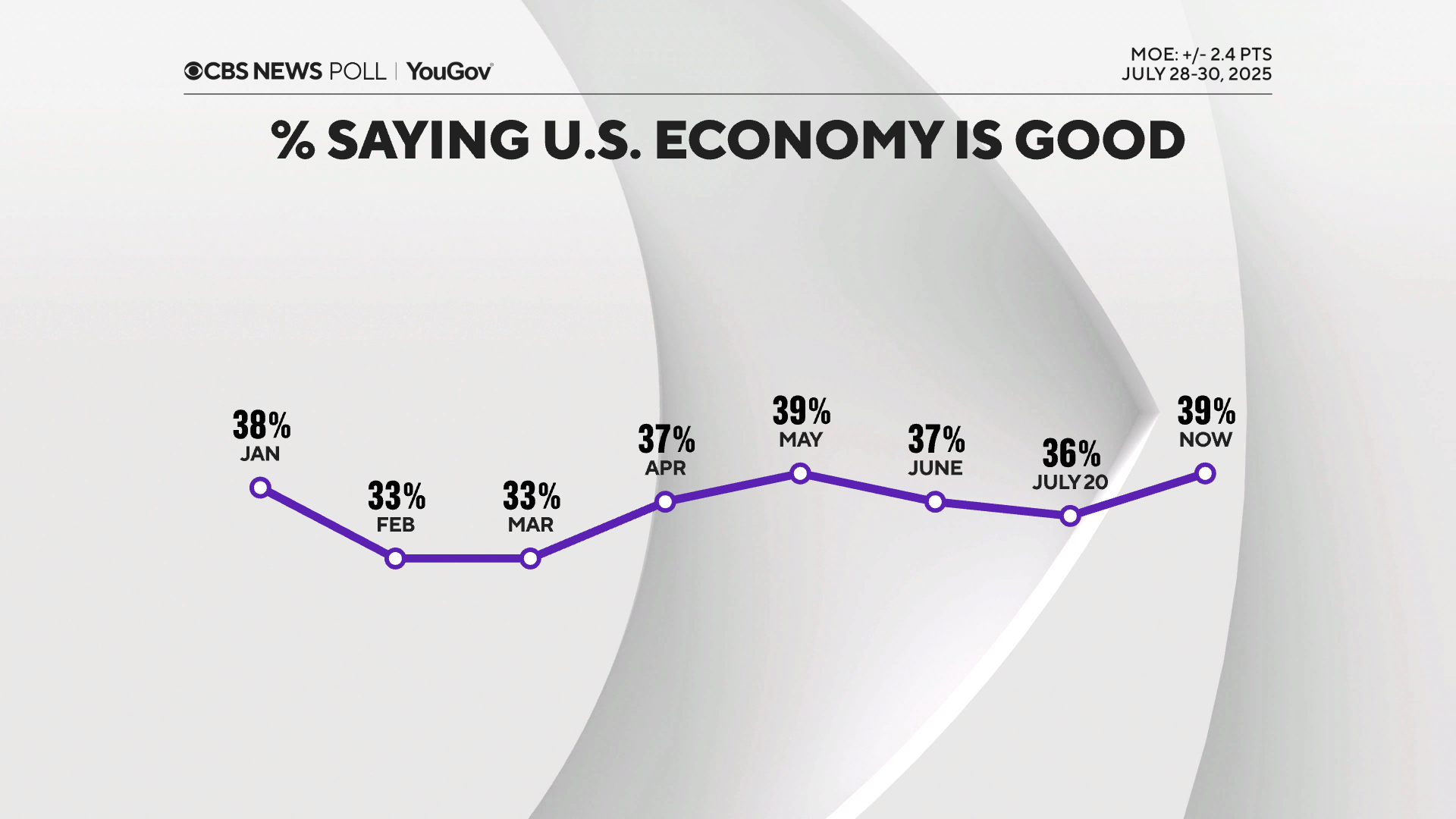

Views of the present economic system general, whereas nonetheless web detrimental, are again to the place they have been in Might, after ticking down a bit of this summer season.

The inventory market’s rise has extra individuals score its situation positively together with that.

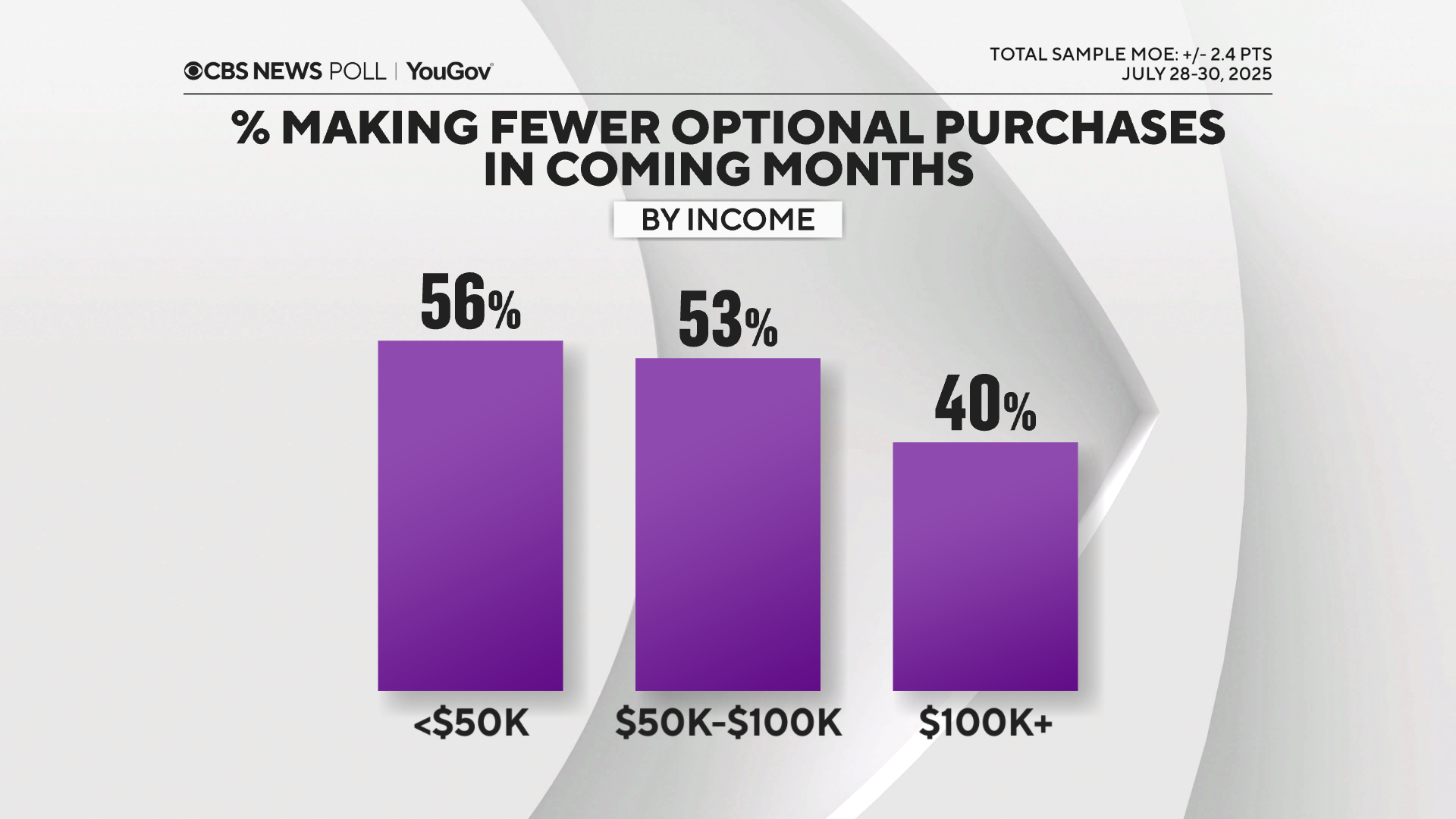

However that additionally speaks to the continuing variations between individuals of various revenue ranges. Folks with increased incomes are extra apt to say the market’s strikes impression them.

Over latest years the inventory market’s ups and downs haven’t linked that strongly with views of the economic system; People have usually reported that inflation and costs have extra impression, and never all People personal shares. That stated, because the market has pushed to latest highs of late, right now People who say their funds are impacted by the market are additionally extra more likely to say these funds are good. Additionally they give higher scores to the nationwide economic system.

Purchases and planning

Quite a lot of the economic system will depend on spending, after all. 1 / 4 of People say they’re planning a big buy — one thing they should save for or to finance — within the coming months.

Folks in comparably decrease revenue ranges are much less constructive concerning the state of the economic system and extra inclined to be reducing again on elective purchases.

The elements that impression choices about giant purchases, usually, are their financial savings stage and their outlook for inflation, much more so than issues like rates of interest (although that may be a issue too), and rather more than the inventory market.

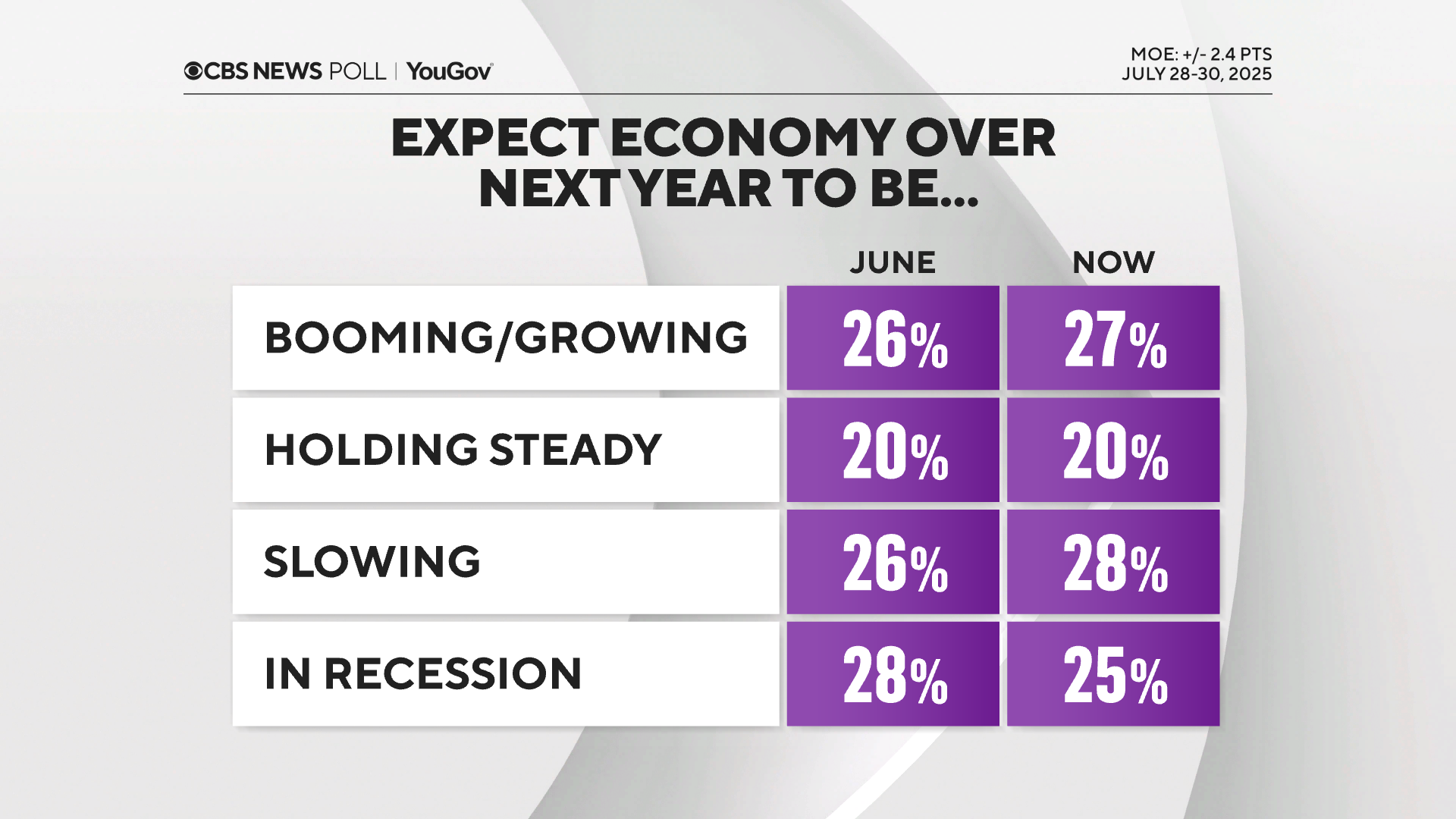

On a wider time horizon, the share that characterize the U.S. as headed for an outright recession over the following 12 months is down a bit from June, however pessimism — those that assume it’s headed for both a slowdown or recession — continues to outnumber the extra optimistic group that foresees development or a growth.

Toplines