US rates of interest have been slashed for the primary time in additional than 4 years – by greater than many anticipated – amid fears the world’s largest financial system is flagging.

The US central financial institution, the Federal Reserve, introduced rates of interest down by 0.5 proportion factors to 4.75% to five%.

In contrast to the UK, the US rate of interest is a spread to information lenders relatively than a single proportion.

Bringing down inflation to 2% is a main aim of the Fed and it has used rates of interest to attract cash out of the financial system by making borrowing extra expensive since 2022, when the Ukraine/Russia worth shock hit.

Current figures present the Fed isn’t removed from its inflation goal – with the primary measure hitting 2.5% in August, the bottom fee in three years.

However indicators of a weakening financial system emerged final month as information on job creation led to recession fears.

The Fed signalled in its assertion that whereas it was assured on each the inflation and progress outlooks, a slowdown within the tempo of hiring was a trigger for concern.

Just one member of its rate-setting committee dissented on the 0.5 proportion level discount. Monetary market individuals had been cut up on whether or not it will go for the 0.25 possibility as an alternative.

US shares rallied within the wake of the choice, with the Dow Jones Industrial Common and broader S&P 500 each up by greater than 0.5% from flat positions moments earlier than the speed resolution was revealed.

12:20

Trump criticises Harris on financial system

The greenback was buying and selling a cent decrease versus sterling at $1.32.

Some market analysts mentioned the Fed’s transfer confirmed Fed chair Jay Powell and his fellow policymakers had been too gradual to react to the employment slowdown.

He instructed reporters: “We’re going to be making choices assembly by assembly, primarily based on the incoming information and the evolving outlook, the steadiness of dangers… it’s a technique of recalibrating our coverage stance away from the place we had it a 12 months in the past, when inflation was excessive and unemployment low, to a spot that’s extra applicable given the place we are actually and the place we anticipate to be.

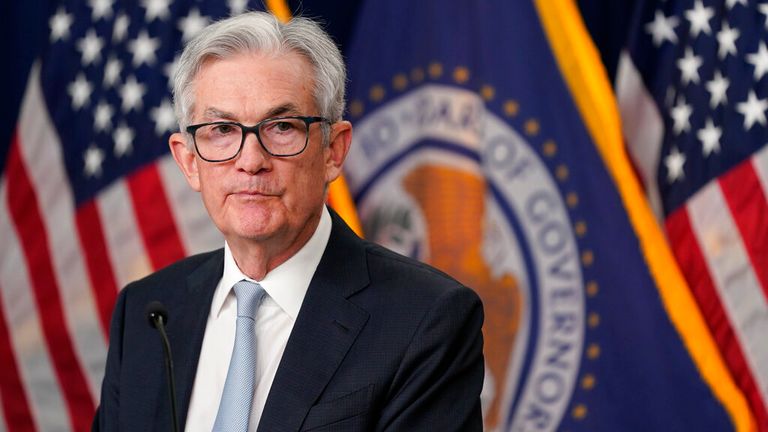

Picture:Federal Reserve Chairman Jerome Powell Pic: AP

Picture:Federal Reserve Chairman Jerome Powell Pic: AP

“That process will time time”, he added, saying there could be no “rush”.

Michael Sheehan, fund supervisor of mounted revenue at EdenTree Funding Administration, mentioned: “Kicking off this chopping cycle with a 50 foundation level discount will undoubtedly vindicate those that had argued that the Fed had fallen behind the curve.

“Any doubts that this chopping cycle could be any much less dramatic than earlier ones have been firmly laid to relaxation.

“We anticipate this bigger minimize of fifty foundation factors to spice up danger property within the brief time period. The important thing for markets, and certainly the Federal Reserve, will likely be how far the softening of the labour market has to run.

“Powell will be hoping that taking aggressive action early will go some way to curtailing a substantial weakening and achieve the elusive soft landing.”

What concerning the UK?

It comes because the UK central financial institution the Financial institution of England meets on Thursday to make its personal rate of interest resolution.

Whereas the Financial institution will give attention to UK financial information – and on Wednesday afternoon was anticipated by markets to carry charges – it might be influenced by US decision-making.

Decrease exports can gradual inflation, that means the Financial institution might be extra prone to minimize.

12:20

12:20