Making Cash host Charles Payne discusses Wall Streets interpretation of President Donald Trumps tariffs.

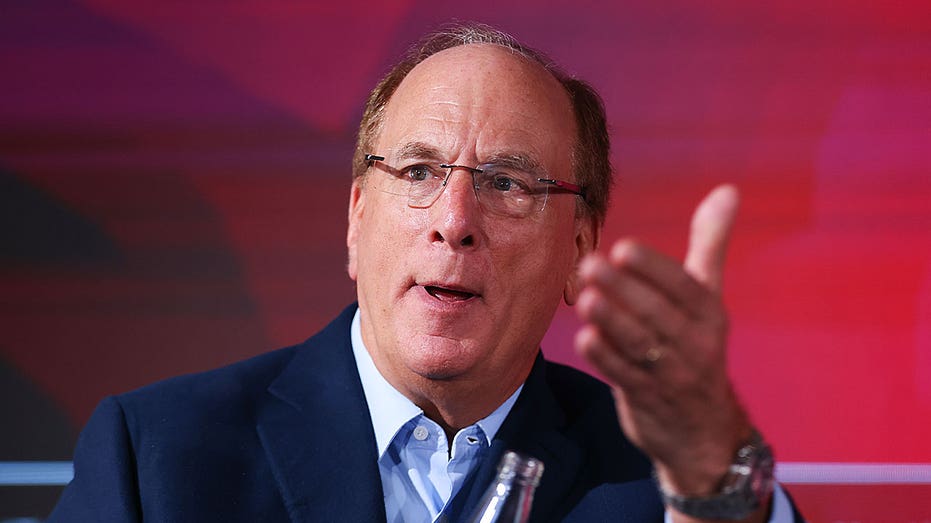

BlackRock CEO Larry Fink stated that the inventory market may see declines deepen by one other 20% amid uncertainty over President Donald Trump’s tariffs and that CEOs are telling him they assume the U.S. financial system is probably going already in a recession.

“Most CEOs I talk to would say we are probably in a recession right now,” Fink advised the Financial Membership of New York on Monday. Tariffs are anticipated to make all kinds of merchandise costlier, exacerbating inflationary pressures which have been persistent in latest months.

Regardless of turmoil available in the market, Fink stated that weak point does create a shopping for alternative over the long term regardless of the potential for additional declines.

“I would say in the long run, this is more of a buying opportunity than it is a selling opportunity. That doesn’t mean we can’t fall another 20% from here, too,” Fink stated.

BLACKROCK CEO FINK’S LETTER TO INVESTORS DUMPS DEI, TOUTS EXPANSION OF MARKET ACCESS

BlackRock CEO Larry Fink stated CEOs he talks to assume the U.S. has already entered a recession. (Hollie Adams/Bloomberg by way of Getty Photos / Getty Photos)

“The economy is weakening as we speak,” Fink stated, including that he sees the financial system slowing additional within the coming months with inflation prone to be elevated.

Given his considerations about inflation, Fink stated he sees no likelihood that the Federal Reserve will minimize rates of interest 4 or 5 instances this yr as a result of outlook for inflation, which might be made tougher as tariffs take impact and international governments retaliate.

Trump’s tariff announcement on April 2 induced markets to plunge within the ensuing days, with the Dow Jones Industrial Common, S&P 500 and Nasdaq composite all down greater than 9% prior to now 5 buying and selling days and greater than 10% during the last month.

GOLDMAN SACHS INCREASES RECESSION PROBABILITY, WARNS OF FURTHER DOWNGRADE IF MORE TARIFFS TAKE EFFECT

BlackRock put in a bid to purchase two ports on the Panama Canal from a Hong Kong-based agency. (Justin Sullivan/Getty Photos / Getty Photos)

Fink additionally mentioned BlackRock’s bid to purchase a pair of ports on the Panama Canal together with dozens of different world ports from Hong Kong-based agency CK Hutchison.

He stated the deal faces 9 extra months of regulatory evaluate from the Chinese language authorities, which has been important of the transaction, which might see BlackRock purchase the ports of Balboa and Cristobal on the Panama Canal plus 43 ports in 23 different nations.

Ticker Safety Final Change Change % BLK BLACKROCK INC. 818.12 -4.50

-0.55%

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The deal is valued at $22.8 billion, and the businesses have emphasised that the deal was purely business in nature amid geopolitical considerations about China’s investments in amenities across the Panama Canal.

Reuters contributed to this report.