Buyers are plowing cash right into a broad swath of belongings placing the ETF trade within the driver’s seat of what could also be one other file 12 months.

BlackRock, the world’s largest asset supervisor overseeing $10 trillion, took a victory lap this week, touting possession of a number of the quickest rising exchange-traded funds in historical past.

“Our digital assets ETPs and active ETFs have grown from practically zero to 10 in 2023 to over $100 billion in digital assets and over $80 billion in active ETFs. The rapid growth of these premium categories is another proof point of our success in scaling distribution and quickly adapting to new offerings and in new markets,” mentioned CEO Larry Fink on the corporate’s earnings name this week.

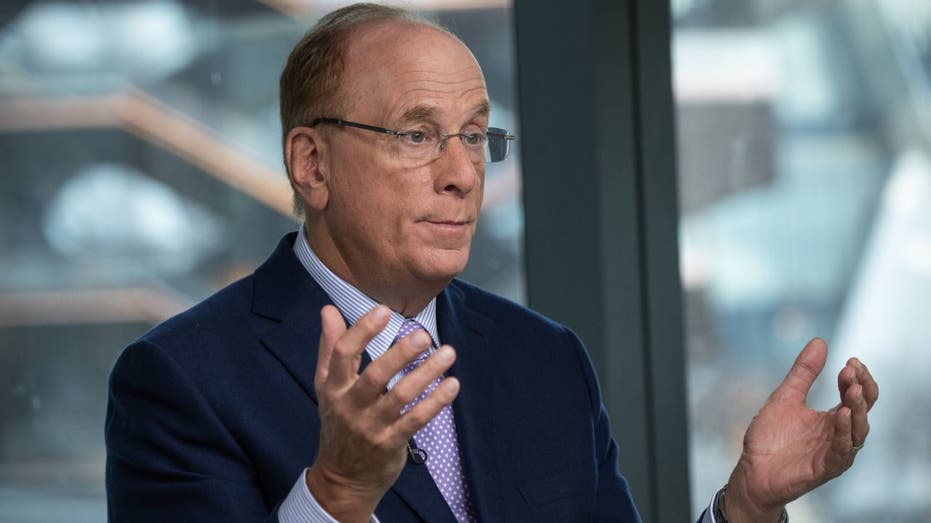

Larry Fink, chairman and CEO of BlackRock Inc. which is the world’s largest asset supervisor overseeing $10 trillion globally. (Photographer: Victor J. Blue/Bloomberg by way of Getty Pictures / Getty Pictures)

The star: iShares Bitcoin ETF – ticker IBIT – is now the biggest crypto ETF, which supplies buyers publicity to the cryptocurrency with out having to personal it instantly. Property topped $100 billion earlier this month however have dipped with Bitcoin’s drop.

Ticker Safety Final Change Change % IBIT ISHARES BITCOIN TRUST – USD ACC 60.47 -0.96

-1.56%

The most important crypto by market worth hit a file $126,272.76 on Oct. 6, 2025, and has since slipped beneath $110,000.

BITCOIN SAFE HAVEN, INVESTOR SAYS

Escalating tensions over the previous week between the U.S. and China are hurting sentiment for digital belongings. This as gold popped to a recent file excessive of $4,280.20 an oz.

One other standout, iShares Ethereum ETF -ticker ETHA with belongings round $16 billion.

AMERICANS FAVOR TRUMP’S $1,000 BABY SAVINGS PLAN

Ticker Safety Final Change Change % ETHA ISHARES ETHEREUM TRUST NPV 28.94 -0.30

-1.03%

“Our flagship offerings in IBIT and ETHA were among the top five inflowing products in the ETP industry,” Martin Small, CFO and world head of company technique detailed on the decision. Like bitcoin, etherem has dipped to the $3,800 stage from its excessive of $4,955.23 reached on Aug. 24, 2025.

LIVE CRYPTOCURRENCY PRICES: HERE

Nonetheless, bitcoin and etherem have every superior about 14% this 12 months, barely outperforming the S&P 500’s 13% rise as of Friday.

BlackRock shares are up 14% 12 months so far.

CLICK HERE TO GET FOX BUSINESS ON THE GO