BlackRock CIO of World Mounted Earnings Rick Rieder analyzes U.S. financial efficiency as some observers fear a couple of recession.

BlackRock CEO Larry Fink’s annual letter to buyers continued the agency’s shift away from politically controversial matters like range, fairness and inclusion (DEI) in addition to surroundings, social and governance (ESG) insurance policies.

Fink launched his annual chairman’s letter to buyers on Monday, and the 2025 version of the letter omitted probably controversial references to DEI, ESG and local weather change. This comes after BlackRock in February introduced a shift away from inside DEI insurance policies and dropped such references from its annual report, as a substitute specializing in connectivity and inclusivity.

When the annual report was launched, BlackRock informed FOX Enterprise the agency is “committed to creating an environment that supports top talent and fosters diverse perspectives to avoid groupthink.”

Within the letter to buyers, BlackRock’s Fink included a piece that touted the ability of economic markets and outlined the necessity to develop entry to parts of the market which were closed off to many buyers, in addition to growing participation in markets.

BLACKROCK FLIPS SCRIPT ON DEI POLICIES IN COMPANY-WIDE EMAIL: ‘ANNOUNCING SEVERAL CHANGES’

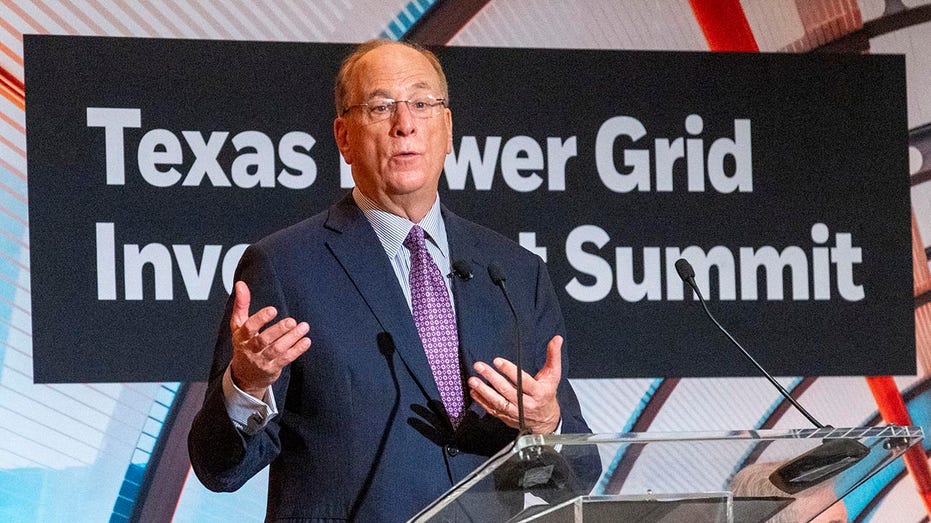

BlackRock CEO Larry Fink’s annual letter to buyers continued the agency’s shift away from politically controversial matters like range, fairness and inclusion (DEI) in addition to surroundings, social and governance (ESG) insurance policies. (Kirk Sides/Houston Chronicle by way of Getty Pictures / Getty Pictures)

“Today, many countries have twin, inverted economies: one where wealth builds on wealth; another where hardship builds on hardship. The divide has reshaped our politics, our policies, even our sense of what’s possible. Protectionism has returned with force. The unspoken assumption is that capitalism didn’t work and it’s time to try something new,” Fink wrote.

“But there’s another way to look at it: Capitalism did work – just for too few people.”

Ticker Safety Final Change Change % BLK BLACKROCK INC. 944.08 -2.40

-0.25%

“Markets, like everything humans build, aren’t perfect. They reflect us – unfinished, sometimes flawed, but always improvable. The solution isn’t to abandon markets; it’s to expand them, to finish the market democratization that began 400 years ago and let more people own a meaningful stake in the growth happening around them,” he defined.

To that finish, Fink wrote that BlackRock is trying to democratize investing by serving to present buyers entry elements of economic markets they have been restricted from, in addition to by enabling extra folks to get began as buyers. A kind of areas is non-public markets, that are at present inaccessible to most buyers.

BLACKROCK DROPS DEI REFERENCES FROM ANNUAL REPORT

BlackRock has moved away from its previous deal with DEI insurance policies and ESG investing. (Angus Mordant/Bloomberg by way of Getty Pictures / Getty Pictures)

“Most of us associate ‘markets’ with public markets – stocks, bonds, commodities,” Fink defined. “But you generally cannot buy shares in a new high-speed rail line or a next-generation power grid on the London or New York Stock Exchange. Instead, infrastructure projects are typically investable only through private markets.”

“Assets that will define the future – data centers, ports, power grids, the world’s fastest-growing private companies – aren’t available to most investors. They’re in private markets, locked behind high walls, with gates that open only for the wealthiest or largest market participants,” he wrote.

“The reason for the exclusivity has always been risk. Illiquidity. Complexity. That’s why only certain investors are allowed in. But nothing in finance is immutable. Private markets don’t have to be as risky. Or opaque. Or out of reach,” Fink stated.

BLACKROCK INKS $23B DEAL FOR PANAMA CANAL PORTS

BlackRock just lately introduced a deal to buy two ports on the Panama Canal, in addition to a variety of different ports world wide. (Justin Sullivan/Getty Pictures / Getty Pictures)

He famous that BlackRock up to now 14 months acquired two corporations in fast-growing areas of personal markets, together with infrastructure and personal credit score, together with one other agency with a deal with information and analytics to enhance measurements of danger and spot alternatives in non-public markets.

Fink urged that elevated entry to investing in non-public markets may enhance buyers’ portfolios by way of elevated diversification, writing, “The beauty of investing in private markets isn’t about owning a particular bridge, tunnel, or mid-sized company. It’s how these assets complement your stocks and bonds – diversification.”

That would shift the long run normal portfolio from a basic 60/40 mixture of shares and bonds, respectively, to a 50/30/20 mixture of shares, bonds and personal belongings — corresponding to a mixture of actual property, infrastructure and personal credit score, Fink wrote.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“With cleaner, more timely data, it becomes possible to index private markets just like we do now with the S&P 500. Once that happens, private markets will be accessible, simple markets. Easy to buy. Easy to track. And that means capital will flow more freely throughout the economy,” Fink defined. “The prosperity flywheel will spin faster, generating more growth – not just for the global economy or large institutional investors, but for investors of all sizes around the world.”