Bilt Rewards founder and CEO Ankur Jain unpacks personalised reward affords on ‘The Claman Countdown.’

Bilt, a loyalty program designed to assist members make the most of their largest bills for rewards factors and construct a path towards homeownership, is now tackling scholar debt.

On Wednesday, Bilt launched two new initiatives that might help with two of probably the most important monetary burdens dealing with college students: loans and school housing.

Bilt members will now have the ability to redeem the factors they’ve earned on scholar loans serviced by Nelnet, MOHELA, Sallie Mae, Aidvantage and Navient, although extra servicers will change into accessible within the coming months. Each 1,000 Bilt factors may be redeemed for $10 towards scholar mortgage funds.

HERE’S HOW YOU CAN EARN POINTS WHEN PURCHASING A HOME

Via a partnership with main scholar housing firm American Campus Communities (ACC), Bilt members may even have the ability to earn rewards factors on their housing funds whereas constructing credit score historical past.

Baylor College’s U Pointe on Speight and The Union properties would be the first to undertake this program in Could. Nevertheless, Bilt has plans to develop this initiative to the broader ACC portfolio within the coming months. In whole, it could serve almost 140,000 college students.

(Michael Okoniewski/Bloomberg through Getty Photos)

“Research shows that student debt is now the second-largest form of consumer debt in America,” Bilt founder and CEO Ankur Jain mentioned.

By permitting members to make the most of their factors to pay down their mortgage funds, Jain mentioned the corporate is “addressing a critical financial need while continuing to differentiate our program as offering the most valuable and flexible points currency in the industry.”

The initiatives spotlight how the corporate needs to spice up its worth proposition for a youthful technology by increasing its “network of homes and looking for ways to help our members maximize value from their largest monthly expenses,” Jain mentioned.

(Paras Griffin/Getty Photos)

For the reason that firm’s inception in 2019, Jain has been quickly constructing and increasing the corporate’s rewards platform. What started as a strategy to earn factors for lease funds has advanced right into a broader ecosystem that lets customers earn rewards for on a regular basis bills, whether or not it’s purchasing at a neighborhood pharmacy, paying lease, and even shopping for a house, whereas serving to them construct their credit score.

Final fall, the corporate partnered with Walgreens to assist members use their unused Versatile Spending Account and Well being Financial savings Account funds for eligible purchases whereas additionally incomes factors on all Walgreens transactions.

YOUR NEXT WALGREENS TRIP MAY NOT COST YOU AS MUCH. HERE’S WHY.

As we speak, Bilt members can earn factors on lease funds on greater than 4.5 million houses nationwide. The platform additionally affords rewards when members signal or renew a lease.

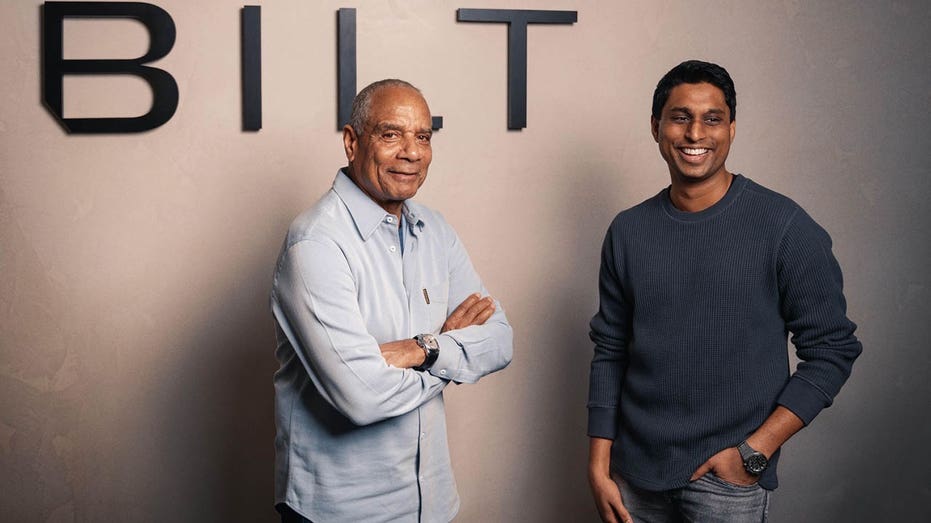

Bilt founder Ankur Jain and Chair Ken Chenault (Bilt)

In November, it launched a program permitting folks to even earn factors when buying a house, which the corporate touted was an business first.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

These factors may be redeemed for journey, eating and health courses. Bilt factors may be redeemed for journey, eating and health courses and towards eligible scholar mortgage funds on the Bilt web site or the Bilt cellular app. The app is free for customers to enroll.