The Claman Countdown panelists Kenny Polcari and John Stoltzfus analyze how the market will reply to huge strikes.

Billionaire hedge fund supervisor Ray Dalio warned in an interview on Sunday that he is involved concerning the financial system experiencing one thing “worse than a recession” if the commerce warfare sparks a breakdown of the broader monetary system.

Dalio, the co-chief funding officer of the world’s largest hedge fund, Bridgewater Associates, mentioned in an look on NBC’s “Meet the Press with Kristen Welker” that President Donald Trump’s tariffs have been “very disruptive” and are “like throwing rocks into the production system.”

Welker requested Dalio if Trump’s tariffs are prone to trigger a recession, and he replied, “I think that right now we are at a decision-making point and very close to a recession. And I’m worried about something worse than a recession if this isn’t handled well.”

Dalio mentioned that whereas recessions happen repeatedly, what seems to be occurring is “much more profound” as there’s a “breaking down of the monetary order” involving the greenback, together with a breakdown of the home and the world order.

BILLIONAIRE HEDGE FUND MANAGER CALLS FOR US TRADE DEAL WITH CHINA: ‘WIN-WIN’

Billionaire Ray Dalio advised NBC the financial system might face one thing “worse than a recession” if present headwinds aren’t dealt with nicely. (Hollie Adams/Bloomberg by way of Getty Pictures / Getty Pictures)

“Such times are very much like the 1930s,” Dalio mentioned.

“I’ve studied history, and this repeats over and over again. So if you take tariffs, if you take debt, if you take the rising power challenging existing power, if you take those factors, those changes in the orders, the systems, are very, very disruptive.”

Welker adopted up and requested him for his prediction of the place the nation is heading, after crediting Dalio for appropriately predicting the 2008 monetary disaster. Dalio famous that the U.S. federal authorities is at a important juncture with its price range deficit, which has been projected to surge to 7% of gross home product (GDP) if tax and spending insurance policies aren’t reformed.

BILLIONAIRE HEDGE FUND MANAGER WARNS OF ‘ECONOMIC HEART ATTACK’ FOR US ECONOMY

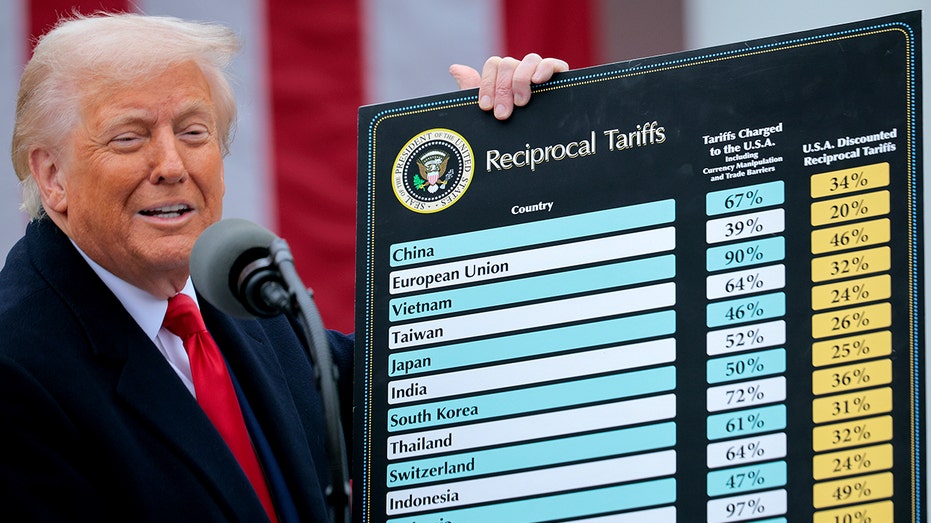

President Donald Trump introduced sweeping tariffs on U.S. buying and selling companions. (Chip Somodevilla/Getty Pictures / Getty Pictures)

“If it could be reduced to about 3% of GDP, and these trade deficits and so on are managed in the right way, this could all be managed very well,” Dalio defined, including that he is encouraging members of Congress to chop the deficit to three% of GDP.

Dalio has outlined methods for policymakers to stabilize the debt at that degree and has referred to as for Congress to tackle the problem in a bipartisan method like within the Nineties, when the federal authorities final ran a surplus.

He added that if the U.S. would not stabilize the deficit, it’ll doubtless trigger rates of interest on the nationwide debt to rise and exacerbate the nation’s fiscal and financial challenges.

CBO SAYS US BUDGET DEFICITS TO WIDEN, NATIONAL DEBT TO SURGE TO 156% OF GDP

Tariffs are taxes on imported items which are paid by the importer, which regularly passes these increased prices on to customers by means of increased costs. (Qian Weizhong/VCG by way of Getty Pictures / Getty Pictures)

“If they don’t, we’re going to have a supply/demand problem for debt at the same time as we have these other problems. And the results of that will be worse than a normal recession,” Dalio mentioned.

Welker requested Dalio in one other follow-up query what he views as a worst-case state of affairs for the financial system.

“To be very specific, the value of money, internal conflict that is not the normal democracy as we know it, and international conflict in a way that is highly disruptive to the world economy and could even be a military conflict just as these breakdowns have occurred before,” Dalio mentioned.

GET FOX BUSINESS ON THE GO BY CLICKING HERE