The Huge Cash Present panel analyzes the housing market panorama.

Treasury Secretary Scott Bessent stated the U.S. housing market is one subset of the economic system which may be in recession due to excessive rates of interest as he continues to name for the Fed to chop charges.

Bessent stated in an look on CNN that he thinks “we are in good shape, but I think that there are sectors of the economy that are in recession,” including that “the Fed has caused a lot of distributional problems with their policies.”

The treasury secretary went on to say that “if the Fed brings down mortgage rates, then they can end this housing recession.” Bessent added that lower-income shoppers are bearing the brunt of the downturn, in his view, as a result of they’ve extra debt than belongings.

The Federal Reserve reduce its benchmark federal funds charge final month for the second time this yr, although mortgage charges are usually influenced extra by long-term bond yields than the short-term charge.

FED CUTS INTEREST RATES FOR SECOND TIME THIS YEAR AMID LABOR MARKET WEAKNESS

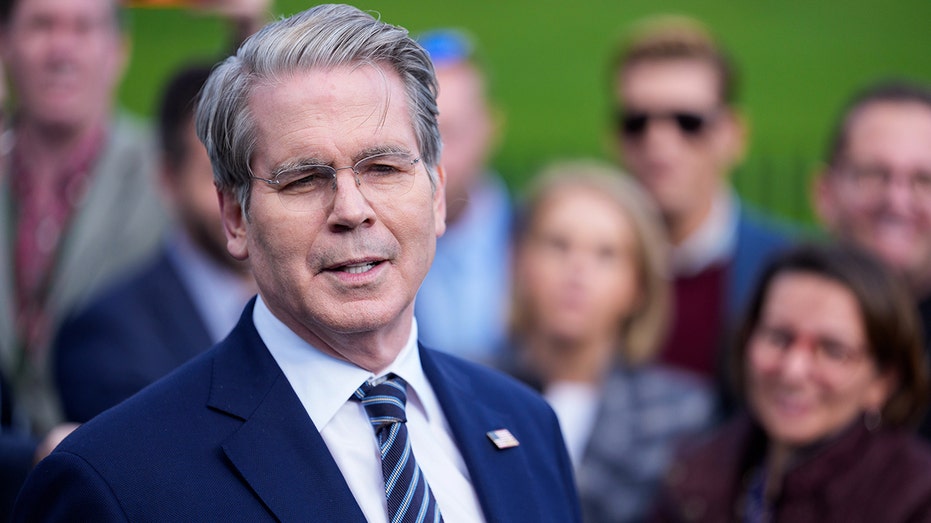

Treasury Secretary Scott Bessent stated the housing sector is in a recession and blamed the Fed’s rate of interest coverage. (Aaron Schwartz/CNP/Bloomberg by way of / Getty Photographs)

Jessica Lautz, deputy chief economist and vice chairman of analysis for the Nationwide Affiliation of Realtors, informed FOX Enterprise, “Lower mortgage rates could help home buyers with housing affordability and small changes in mortgage interest rates in recent months have improved home buyers’ ability to purchase in combination with higher wages.”

“However, the fed funds rate and mortgage interest rates do not move in lockstep,” she added.

Mortgage charges fell for the fourth consecutive week to the bottom degree in over a yr, with information from Freddie Mac displaying the typical 30-year mounted mortgage was 6.17%.

NEARLY 1 IN 5 AMERICAN HOMES SLASH PRICES AS BUYERS GAIN UPPER HAND IN SHIFTING MARKET

Lautz famous that dwelling gross sales have stalled for the final two and a half years at round 4 million current houses bought yearly, whereas the U.S. averaged about 5 million houses bought yearly earlier than the COVID-19 pandemic.

She added that “while home sales are stalled, home prices continue to rise” and likewise famous that householders are promoting and buying and selling houses much less often, about as soon as each 11 years, versus the historic common of six to seven years.

INFLATION REMAINED WELL ABOVE THE FED’S TARGET IN SEPTEMBER AHEAD OF RATE CUT DECISION

Federal Reserve Chair Jerome Powell stated that there’s uncertainty concerning the central financial institution’s rate-cutting plans forward of the following financial coverage assembly in December. (Jim Watson/AFP/Getty Photographs)

Lautz additionally stated the housing market is “seeing a tale of two cities” with respect to how high- and low-income shoppers are faring within the housing market.

“Homeowners continue to build housing wealth and can make trades using housing equity. While all cash home buyers are seeing all-time highs, first-time home buyers have dropped to a historic low, with the age of first-time buyers now hitting 40,” Lautz stated. “The luxury home market is growing as housing wealth and the stock market continue to grow.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Reuters contributed to this report.