Former Leuthold Group chief funding strategist Jim Paulsen discusses how lengthy it should take for the inventory market to stabilize after President Donald Trump’s tariffs on ‘Making Cash.’

Buyers are on a rollercoaster experience and never the enjoyable sort with the U.S. inventory market beneath excessive volatility amid heavy promoting as President Trump stands agency, wielding his broad tariff technique towards most of our buying and selling companions.

Bear Markets & Correction Territory

The S&P 500 briefly hit a bear market on Monday, following the Nasdaq Composite, which fell into bear market territory or down 20% from its most up-to-date all-time highs on Friday. The Dow Jones Industrial Common is shy of its personal as of Monday’s shut.

This because the CBOE’s Volatility Index, or VIX for brief, which measures volatility, spiked to the very best degree in 5 years, hovering at a degree of 46.

Don’t Panic

Whereas unnerving for a lot of Important Avenue traders watching their portfolios, 401(okay)s or retirement accounts, promoting right into a selloff is an enormous no-no for long-term traders.

“You never sell in a panic, you never ever sell in a panic” stated Ken Fisher, founder, Fisher Investments which oversees $295 billion in property, throughout an interview on Varney & Co.

Panic Promoting Will Price You

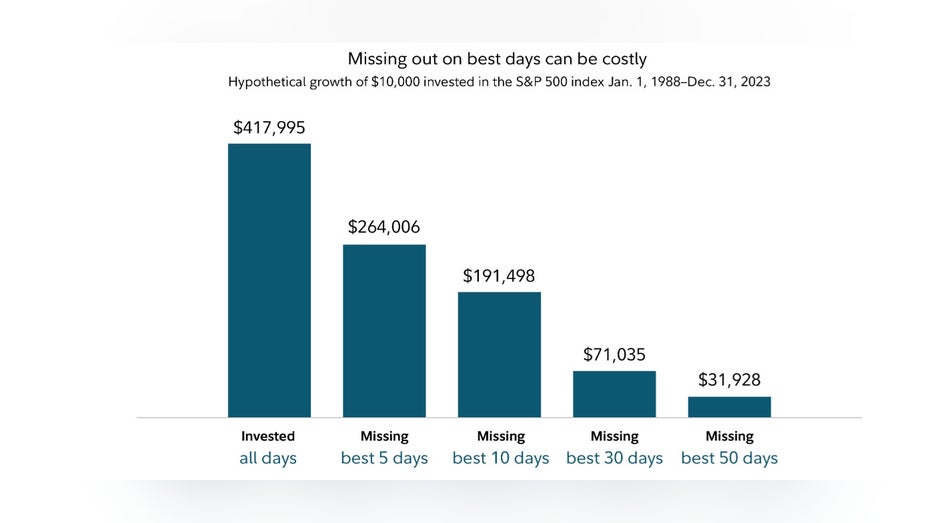

Those that might interact in panic promoting will lose out when the market rebounds, in keeping with an evaluation by Constancy shared with FOX Enterprise.

For instance, $10,000 invested within the S&P 500 from January 1, 1988 via December 31, 2023, would miss out on features of greater than $264,000 by lacking simply the most effective 5 days of investing.

Lacking Out on Greatest Days Can Be Pricey (Constancy Investments )

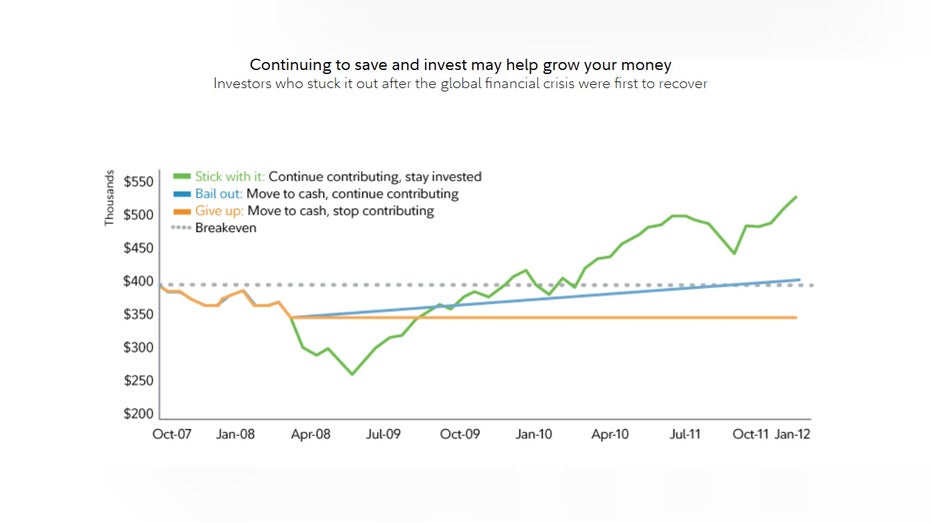

Moreover, the agency notes that “Historically, every severe downturn has eventually given way to further growth” with the agency exhibiting hypothetical choices made throughout the International Monetary Disaster from 2007 via 2012 for a portfolio with a 70% inventory/30% bond combine and an account stability of $400,000 and a office contribution plan of $15,000.

“It took 52 months for investments to return to the highs set before the Global Financial Crisis” Constancy wrote. Those that stayed the course noticed their account stability rise by about $500,000. Those that moved to money and cease contributing noticed their balances drop to round $350,000.

Buyers who caught it out after the worldwide monetary disaster have been first to recuperate (Constancy )

“You are seeing target prices being dropped for the year, earnings estimates being dropped, the whole gamut. I think it’s good to buy in times of fear like this. This is when the risk is probably less and the upside is greater” stated Jim Paulsen, former Chief Funding Strategist at Wells Fargo.

State of Play?

That stated, the tariff push is in its early days and its unclear when and the way the mud will settle. Corporations together with Goldman Sachs and JPMorgan have dialed up their possibilities of a U.S. recession with JPMorgan CEO Jamie Dimon delivering a warning on Monday.

FED CHARI POWELL SAYS TARIFFS LIKELY TO CAUSE INFLATION TO RISE, COULD BE PERSISTENT

“As for the short-term, we are likely to see inflationary outcomes, not only on imported goods but on domestic prices, and input costs rise and demand increases on domestic products. How this plays out on different products will partially depend on their substitutability and price elasticity. Whether or not the menu of tariffs causes a recession remains in question, but it will slow growth down,” he wrote in his annual letter to shareholders.

READ MORE FROM FOX BUSINESS

Final week, Federal Reserve Chairman Jerome Powell reiterated an analogous sentiment.