U.S. Agriculture Secretary Brooke Rollins discusses how President Donald Trumps immigration insurance policies and tariffs are affecting Americas farmers on Mornings with Maria.

The continued commerce dispute with China has created critical headwinds for American farmers, with soybean producers having misplaced entry to the world’s largest marketplace for the commodity.

China halted purchases of American soybeans this spring in retaliation for the Trump administration’s tariffs, as a method of seeking to achieve leverage in commerce talks by shifting its purchases away from U.S. producers to international locations corresponding to Brazil and Argentina. China is the world’s main importer of soybeans, bringing in 61% of the world’s traded soybean provides over the past 5 advertising years, in line with information from the American Soybean Affiliation (ASA).

The group mentioned the U.S. has traditionally served as a main provider for China, as American soybean farmers exported a median of 28% of their crop to China earlier than the 2018 commerce struggle. That determine dropped to a low of 11% within the 2018-19 crop 12 months, however recovered through the pandemic, reaching 31% in 2020-21 earlier than declining to 22% in 2023-24.

“We rely on trade with other countries, specifically China, to buy our soybeans,” Brad Arnold, a multigenerational soybean farmer in southwestern Missouri, instructed FOX Enterprise in an interview. He mentioned that China’s halt on U.S. soybean purchases “has huge impacts on our business and our bottom line.”

TRUMP DEFENDS TARIFFS, SAYS US HAS BEEN ‘THE KING OF BEING SCREWED’ BY TRADE IMBALANCE

U.S. soybean farmers are struggling to seek out new markets for his or her crop after China reduce off purchases amid an ongoing commerce dispute. (Ben Brewer/Bloomberg by way of Getty Photos / Getty Photos)

“There are domestic uses for soybeans, looking at renewable diesel, biodiesel specifically produced from soybeans,” Arnold mentioned. “In the grand scheme of things, that’s such a small percentage currently, you know it’s going to take a customer like China to buy beans to make a noticeable impact. You can’t take our number one customer, shut them off and just overnight find a replacement.”

Arnold mentioned that farmers would favor to have entry to promoting their crops available on the market, versus doubtlessly receiving reduction from the federal government, explaining they “have long-term investments and commitments into land and equipment,” Arnold mentioned. “It’s not like you can quit farming one day and then all of a sudden go do something else. There’s a huge financial commitment tied up in not only the year-to-year efforts, but the land also.”

TRUMP ANNOUNCES 25% TARIFF ON MEDIUM- AND HEAVY-DUTY TRUCKS

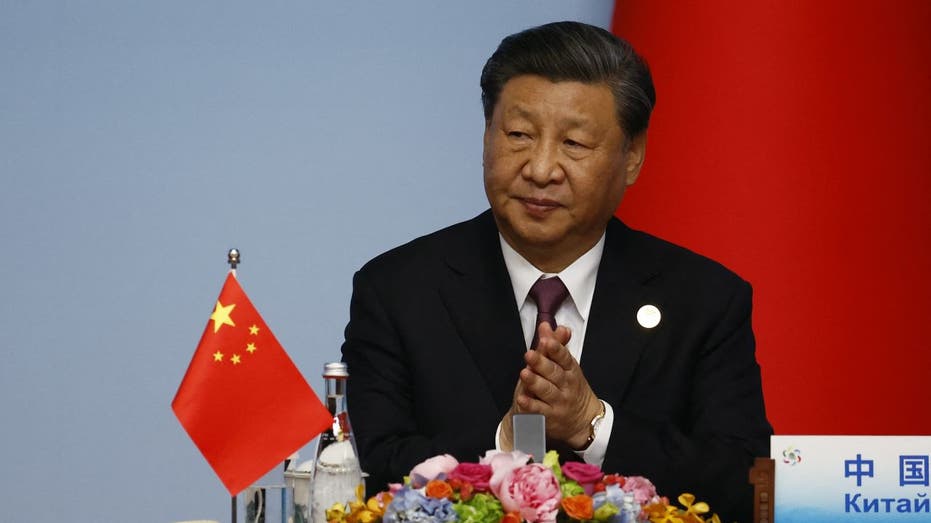

China imposed retaliatory tariffs on the U.S. and halted soybean purchases amid the continuing commerce dispute. (FLORENCE LO/POOL/AFP by way of Getty Photos / Getty Photos)

Arnold added that farmers want a decision to the continuing commerce dispute to assist them compete on a degree enjoying discipline.

“I feel like this is a manmade or a political situation that we’re in right now. President Trump is trying to do what’s right with China and hold them accountable, and I think that’s good,” he defined. “But we can’t lose sight of the fact that, you know, we’re hurting people and hurting farmers in playing hardball.”

Scott Gerlt, chief economist for the ASA, instructed FOX Enterprise in an interview that soybean farmers will likely be in want of commerce assist quickly given the timing of the harvest. He mentioned that whereas older farmers who might personal their land or tools outright is probably not in as a lot want, youthful farmers who need to hire the land they farm and have working notes are dealing with much more threat.

HOW MUCH DID TRADE WAR RELIEF COST DURING TRUMP’S FIRST TERM?

Soybean farmers could also be in line for federal commerce reduction from the Trump administration. (Scott Olson/Getty Photos / Getty Photos)

“Having dependable trading partners is better in the long run. Trade aid can get farmers through short-term, help keep them in business and get to the next year,” he mentioned. “But the problem is, if we’re not in the markets now, that’s just a further signal to South America to keep expanding.”

Gerlt mentioned that South American soybean producers in Argentina and Brazil are prone to benefit from China’s demand for soybeans amid the nation’s commerce dispute with the U.S., which might have longer-term impacts on American farmers.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“Brazil expands nearly every year and has the capacity to keep expanding,” Gerlt mentioned, noting that it poses a longer-term menace to the market share of U.S. farmers if American soybeans aren’t competing within the international market. “The lack of a trade deal and sitting out of the market has very long-run effects.”