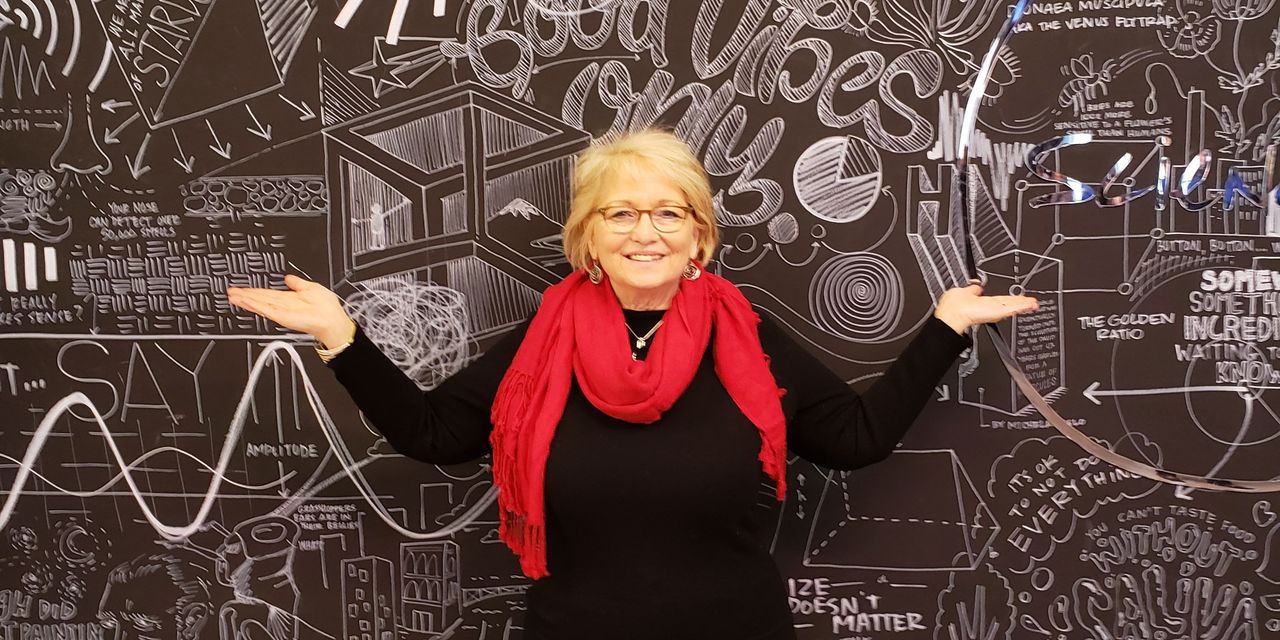

Rosemary Spielmann had hoped to be retired by now. But her husband’s illness and the wrench it threw at their finances have altered that plan.

Mrs. Spielmann, 65 years old, makes $53,400 a year working as an administrative assistant in Arden Hills, Minn., a suburb of St. Paul. She loves her job, though she wishes for more flexibility.

Her 74-year-old husband was diagnosed with dementia in 2019, and he now lives in a memory-care facility. Most of his care cost is covered by his pension of $3,981 monthly (which has a 100% survivor benefit), his monthly Social Security benefit of $1,848, and Minnesota’s Medical Assistance program.

Once her husband’s retirement benefits were going completely to pay for his care costs, the family home was no longer affordable, Mrs. Spielmann says. She sold the house last summer for $580,000, paying off the mortgage and other debt and buying a used car. She now lives in a $260,000 townhome with a $100,000, 30-year mortgage at 2.6%. Her new monthly payments for mortgage, insurance, property taxes and homeowner’s association fees total $971.

Other monthly expenses include: $366 for her husband’s health insurance and dental care, $105 to his care facility; $200 for phone, gas, electric and internet and $410 for food. She had cut out Audible and Netflix subscriptions to pare expenses further, Mrs. Spielmann says, but she found she missed them too much. So she recently added them back for a total of $30. Mrs. Spielmann also spends $75 a month for her dog’s care.

SHARE YOUR STORY

Tell us about your financial goals or a setback you are working through at [email protected]. We may feature you in a future Game Plan column.

She will be the beneficiary of her husband’s $30,000 whole life policy, which is fully paid off. But she dropped her own life-insurance plan because of the costly premiums.

“As I reduce, the person I am is fitting into the life I’ve been given, versus trying to keep the life I don’t fit into anymore,” Mrs. Spielmann says.

She doesn’t have credit-card debt. She has an emergency fund of $39,900 in a money-market account, and retirement savings worth about $90,000 total, including a 401(k) with $24,000 and IRAs worth $46,400. She also has a health savings account with $15,000.

She expects to receive about $1,200 in monthly Social Security benefits when she reaches full retirement age this summer, and about $1,052 from her own pension. She has prepaid funeral plans for her husband and herself, and her own estate-planning documents are in order.

Thanks to her steps to economize, Mrs. Spielmann has about $2,700 per month available for home improvements and is able to offer occasional help to her four adult children. She also makes an extra mortgage payment each quarter—a strategy that she hopes will enable her to retire once the home is paid for, whatever is happening with her husband. She would like one day to be able to travel and perhaps go back to school to study counseling.

Advice from a pro

Benjamin C. Olson, a wealth adviser with Guardian Wealth Strategies in Minneapolis, says, “Good decisions made years ago are giving her choices today.”

Among those decisions: the 100% survivor benefit on her husband’s pension. If he predeceases his wife, she’ll receive it, plus his full Social Security benefit, on top of her own pension. Together, this would add up to $6,880 a month, which should allow her to retire comfortably, based on her current household budget.

But in the short term, Mr. Olson agrees, Mrs. Spielmann’s finances are tight.

She has done a good job of reducing expenses, he says, but she should consider immediately filing for her own Social Security benefit. Although her full retirement age of 66 and 4 months isn’t until July, she is missing out on “free money” between now and then. It won’t matter if she loses out on a few dollars a month by filing early, he says, because when her husband passes, she’ll be entitled to his full $1,848, far in excess of her own benefit of $1,200.

Also, Mr. Olson says, she might want to think about moving to part-time work soon. Yes, she would lose her employer’s healthcare coverage, but she is eligible for Medicare. Working a few less hours could preserve her earning power while giving her a lot more flexibility in terms of her precious personal time.

“I love her hard work, focus and commitment, and I just don’t want her aggressive financial goals to distract from the potentially short season she has with her husband,” Mr. Olson says.

Ms. Gallegos is an editor for The Wall Street Journal in New York. Email her at [email protected].

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8