Dub CEO and founder Steven Wang discusses his mission of making equality for each investor in America on Varney & Co.

Legendary investor Warren Buffett railed in opposition to President Donald Trump’s tariffs on Saturday and the tumultuous approach during which the president has rolled them out.

Buffett, 94, the chairman and CEO of Berkshire Hathaway, criticized the Trump administration’s use of tariffs as a commerce technique, arguing that using commerce as a “weapon” has antagonized worldwide relations and destabilized international markets.

“Balanced trade is good for the world,” and “trade should not be a weapon,” Buffett stated at Berkshire Hathaway’s annual assembly in Omaha, Nebraska, which attracts some 40,000 folks yearly who need to hear from the billionaire magnate, together with former Secretary of State Hillary Clinton, who was additionally current.

Legendary investor Warren Buffett, left, railed in opposition to President Donald Trump’s tariffs on Saturday and the tumultuous approach during which the president has rolled them out. Trump is pictured signing an govt order on tariffs. (REUTERS/Scott Morgan/, left, ANDREW CABALLERO-REYNOLDS / AFP, proper, / Reuters Photographs)

WARREN BUFFETT SAYS TARIFFS ARE AN ECONOMIC ‘ACT OF WAR’: ‘TOOTH FAIRY DOESN’T PAY ‘EM’

“I don’t think it’s a good idea to design a world where a few countries say, ha ha ha, we’ve won,” Buffett added. “I do think that the more prosperous the rest of the world becomes, … the more prosperous we’ll become.”

“The Oracle of Omaha” emphasised the significance of balanced and mutually helpful commerce for all nations.

“It’s a big mistake in my view when you have 7.5 billion people who don’t like you very well, and you have 300 million who are crowing about how they have done,” Buffet added.

“We should be looking to trade with the rest of the world. We should do what we do best and they should do what they do best,” he stated.

Trump has argues that his tariffs are motivated by making commerce fairer for the USA.

However regardless of considerations in regards to the course of the U.S. economic system and the nation itself, Buffett retained his conventional optimism, saying criticism of insurance policies and the individuals who make them is par for the course.

“We’re always in the process of change,” he stated. “I would not get discouraged… We’re all pretty lucky.”

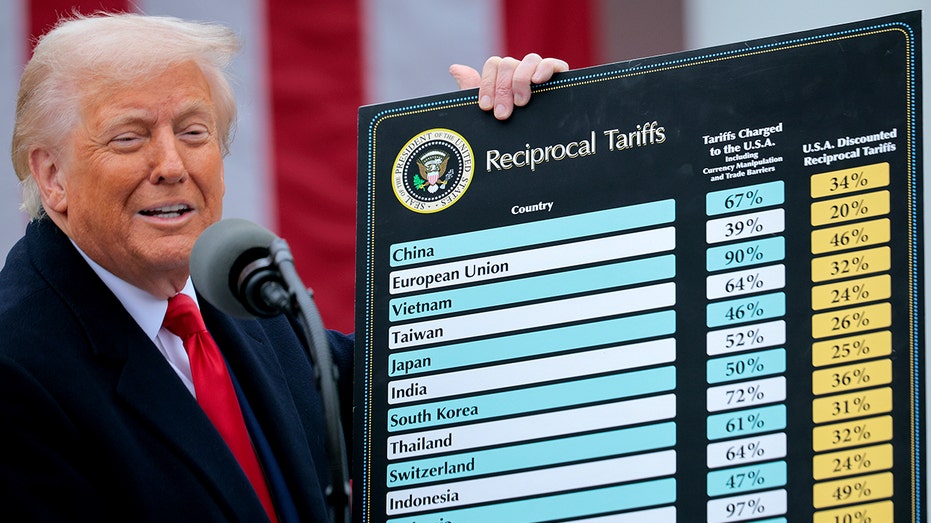

President Donald Trump speaks throughout a “Make America Wealthy Again” commerce announcement occasion within the Rose Backyard on the White Home on April 2, 2025 in Washington, DC. (Chip Somodevilla/Getty Photos / Getty Photos)

WARREN BUFFETT, IN ANNUAL LETTER, TOUTS BERKSHIRE HATHAWAY’S SUCCESS

It’s not the primary time the legendary investor has sounded off in opposition to the tariffs. In March, forward of Trump’s official tariff announcement, Buffet stated. Tariffs are “an act of war to some degree” and famous the U.S. has a variety of expertise with them.

“Over time, they are a tax on goods. I mean, the Tooth Fairy doesn’t pay ’em!” Buffett jokingly stated. “And then what? You always have to ask that question in economics. You always say, ‘And then what?'”

Berkshire Hathaway, a large holding firm that owns or invests in dozens of well-known companies together with Geico, Dairy Queen, Apple, Coca-Cola and American Specific, reported a major decline in first-quarter earnings, incomes $4.6 billion, down from $12.7 billion the earlier yr.

Working earnings additionally decreased by 14% to $9.6 billion, reflecting unrealized losses on shares equivalent to Apple, with $860 million in insurance coverage losses from Southern California wildfires being a significant factor, the corporate stated.

BNSF railroad, which is majority owned by Berkshire, noticed earnings enhancements.

Berkshire’s money stake grew from $334.2 billion at year-end. The corporate repurchased no inventory for a 3rd straight quarter and was a internet vendor of shares for a tenth straight quarter.

Shareholders attend the Berkshire Hathaway Inc annual shareholders’ assembly, in Omaha, Nebraska, U.S., Could 3, 2025. (REUTERS/Brendan McDermid / Reuters Photographs)

Buffett downplayed considerations about Berkshire’s money, saying the corporate “came close” to spending $10 billion lately, however that purchasing alternatives do not are available an orderly vogue. That ought to occur over 5 years, he stated, however not essentially tomorrow.

WARREN BUFFETT, IN ANNUAL LETTER, TOUTS BERKSHIRE HATHAWAY’S SUCCESS

Berkshire’s share value has up to now weathered a turbulent interval for markets, rising 18.9% this yr whereas the Commonplace & Poor’s 500 was down 3.3%.

Buffett reaffirmed his dedication to main Berkshire for so long as his well being permits. He stated he continues to take pleasure in investing and has no plans to retire.

Reuters contributed to this report.