FOX Enterprise Cheryl Casone joined Fox & Buddies First to debate the insurance coverage disaster in California as wildfires devastate Los Angeles and the broader issues in regards to the business shifting ahead.

The lethal wildfires that hit Southern California this week destroyed a major variety of houses after some main insurance coverage firms pulled again on providing insurance policies within the Golden State in recent times because of the rising dangers of wildfires in addition to a difficult regulatory setting.

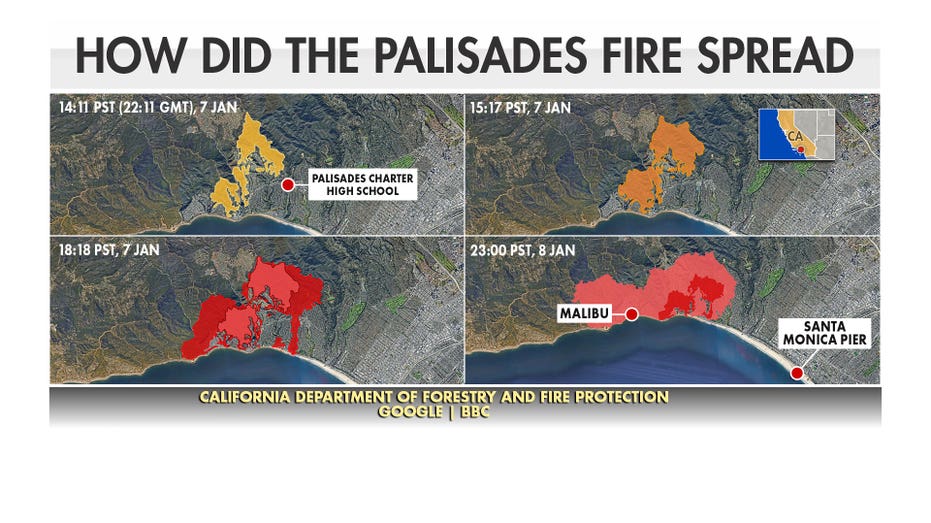

A number of ongoing wildfires, together with the Palisades Hearth and Eaton Hearth, have devastated communities within the Los Angeles space, together with Pacific Palisades and Altadena. The fires have burned almost 30,000 acres amid a Santa Ana wind occasion, with at the very least 130,000 individuals within the space underneath evacuation orders. At the least 5 individuals have been killed within the blazes, and greater than 1,000 buildings have been destroyed.

State Farm, the most important house insurance coverage firm in California, introduced in March 2024 that it will discontinue protection of 72,000 house and residence insurance policies in the summertime. The corporate cited inflation, regulatory prices and growing threat of catastrophes for its choice and had beforehand stopped accepting new purposes within the state.

A number of different main insurers, together with All State, Farmers and USAA, have additionally in recent times curbed new coverage purposes in California as a part of an effort to restrict their publicity to insurance policies that carry what they see as undue threat given what the state’s regulators have allowed them to cost policyholders. Comparable causes of escalating threat, excessive restore prices and rising reinsurance premiums have been cited in these choices.

CALIFORNIA WILDFIRES DEVASTATE LOS ANGELES COUNTY, KILLING 5 AND THREATENING THOUSANDS OF HOMES

Plumes of smoke are seen as a brush fireplace burns in Pacific Palisades, California, on Jan. 7, 2025. A quick-moving brushfire in a Los Angeles suburb burned buildings and sparked evacuations Tuesday as “life-threatening” winds whipped the area. Extra th (DAVID SWANSON/AFP by way of Getty Pictures / Getty Pictures)

This week’s wildfires introduced new consideration to the problem of insurers not taking over new insurance policies or declining to resume earlier insurance policies in California communities at excessive threat of wildfires, as outstanding leisure business figures referred to as out the strikes within the wake of the catastrophe.

James Woods, an actor who owns a home within the Southern California space scorched by the Palisades Hearth, wrote on X that “one of the major insurances [sic] companies canceled all the policies in our neighborhood about four months ago.”

Actor Rob Schnieder criticized State Farm in a publish on X and wrote, “Screw you and all your phoney [sic] commercials!! You are a pile of crap for canceling insurance policies of Californians! I will never use State Farm insurance ever again!”

A State Farm spokesperson mentioned in an announcement to FOX Enterprise, “Our number one priority right now is the safety of our customers, agents and employees impacted by the fires and assisting our customers in the midst of this tragedy.”

STATE FARM CUTS 72,000 CALIFORNIA HOME INSURANCE POLICIES: ‘DECISION WAS NOT MADE LIGHTLY’

The state of California’s house insurance coverage market has struggled partially resulting from regulatory constraints on what firms can cost policyholders in premiums, in addition to mounting publicity resulting from wildfires and different extreme climate occasions which have induced payouts to climb and strained the reinsurance market.

California voters accredited Proposition 103 in 1988, which was meant to guard insurance coverage policyholders from unfair price hikes by requiring that insurers receive approval from the California Division of Insurance coverage for any will increase past 7%. The legislation additionally caps price hikes and spreads any will increase out over a interval of three years.

CALIFORNIA WILDFIRES PROMPT SCRUTINY OF FEDERAL, STATE RULES HAMPERING MITIGATION EFFORTS

Firefighters battle the flames from the Palisades Hearth burning the Theatre Palisades throughout a strong windstorm on Jan. 8, 2025 within the Pacific Palisades neighborhood of Los Angeles. (Apu Gomes/Getty Pictures / Getty Pictures)

Whereas insurers can and do obtain approvals for bigger will increase – State Farm secured a 20% enhance in house and auto premiums in January 2024 and subsequently requested a 30% enhance for house insurance policies final summer time – the method could be time-consuming and the dimensions of price hikes accredited by the regulator might not be enough for insurers to proceed providing insurance policies whereas preserving their monetary stability.

By curbing insurers’ potential to lift charges to account for growing threat, it retains insurance policy artificially low for customers. Which means insurance coverage firms face a call between conserving that extra monetary publicity on their books or taking steps to restrict their publicity or leaving the market.

The state of California gives what’s referred to as the FAIR Plan as an insurer of final resort for customers who had been unable to safe a plan on the non-public market. Nonetheless, the insurance policies are nonetheless costly and insurers are elevating issues in regards to the sustainability of the FAIR Plan’s development.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The FAIR Plan’s publicity elevated by $174 billion, or greater than 61%, from September 2023 to September 2024, when its residential publicity reached $458 billion. The variety of dwelling insurance policies in power underneath the FAIR Plan rose from 320,581 to 451,799 in that interval, whereas they’ve elevated by 248,902 or 123% since September 2020.

“The FAIR Plan continues to grow in size as consumers find themselves without coverage. As a result, we have doubled in size in the last three years,” FAIR Plan President Victoria Roach mentioned at a listening to in March. “As the numbers climb, our financial stability comes more into question.”