‘The Claman Countdown’ panelists Kenny Polcari and Sam Stovall unpack market efficiency heading into the tip of the 12 months.

Regardless of subsequent rallies, the steep stock-market declines in early August and following volatility spotlight the harm that Biden-Harris administration insurance policies are inflicting on U.S. markets with dire penalties for the retirement financial savings of Individuals who usually are not authorities staff with pensions. These harmful insurance policies should be reversed as quickly as attainable to guard the retirement financial savings of common Individuals.

Underneath the Biden-Harris administration, the Securities and Change Fee (SEC) has continued Obama-era insurance policies which are steadily lowering the variety of public firms within the U.S. and drastically limiting the investing selections of common Individuals, together with of their 401(okay) or IRA retirement accounts.

In 2021, when many of the Trump administration’s insurance policies have been nonetheless in place, the U.S. had 1,035 preliminary public choices (IPO) of firm inventory, together with many transactions involving the merger of public particular goal acquisition automobiles (SPACs) with non-public firms. As soon as the Biden-Harris SEC applied its insurance policies, U.S. preliminary public choices plunged to 181 in 2022 and 154 final 12 months.

KEVIN O’LEARY COACHES VP HARRIS AFTER GIVING ‘WRONG’ ANSWER TO QUESTIONS ON ECONOMIC PLAN: ‘PAYING THE PRICE’

The Biden-Harris SEC’s insurance policies have actively discouraged firms from going public and have constructed on Obama-era insurance policies to proceed the long-term decline within the variety of U.S. public firms for the reason that Nineties.

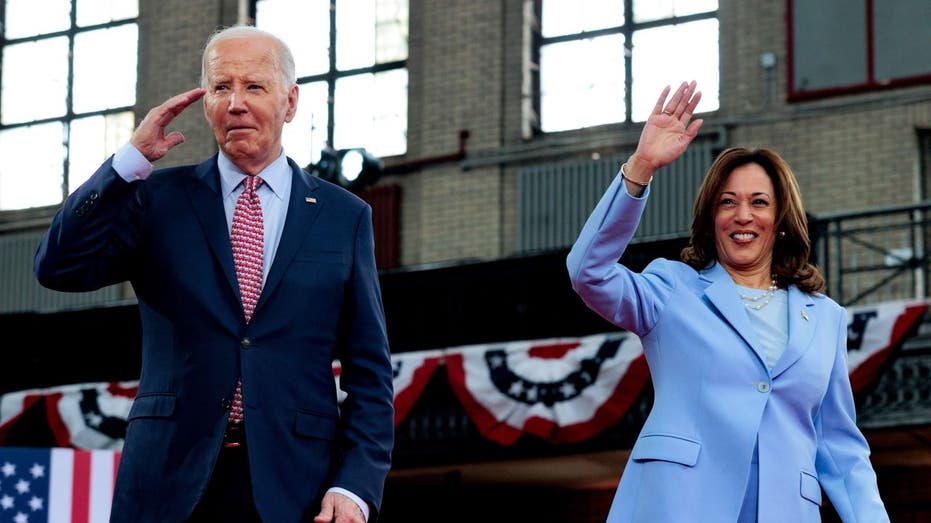

The Biden-Harris administration continued dangerous regulatory insurance policies promoted by the Obama administration. FILE: President Joe Biden and Vice President Kamala Harris arrive for a marketing campaign occasion at Girard Faculty in Philadelphia, Pa., on Might 29, 2024. (Photographer: Hannah Beier/Bloomberg through Getty Photographs / Getty Photographs)

In 2021, President Joe Biden appointed new leaders on the SEC who immediately asserted that SPACs have been funding firms that must be regulated like mutual funds regardless of many years of approving SPACs as public firms. The specter of such regulation, made and not using a regulation or a rulemaking continuing permitting for public remark, chilled the SPAC increase that had reversed the decline in public firms.

The Obama-era Dodd-Frank regulation required public firms to make varied disclosures on political sizzling matters such because the ratio of CEO pay to worker pay, the usage of “conflict minerals” or participation in “extractive resources” industries, all of which make it disagreeable and costly to be a public firm.

Requiring disclosure on points that sometimes don’t have any relationship to an organization incomes a return for its shareholders opens up a brand new income supply for the trial attorneys who file lawsuits towards public firms alleging that they bought such disclosure incorrect. These lawsuits are sometimes settled to keep away from litigation prices, thus growing the price of being a public firm.

The market plunges of August 5 and September 3 confirmed the devastating results of the decline within the variety of public firms. Regardless of a dwindling variety of public firms, right down to about 4,000 from a excessive of shut to eight,000 in 1996, biweekly reductions from employee’s paychecks proceed to pour into 401(okay) and IRA accounts that typically can solely put money into liquid securities like public shares.

Former White Home Council of Financial Advisers appearing chair Tomas Philipson analyzes Vice President Kamala Harris aiming to shut the polling hole with former President Trump on the economic system on ‘The Backside Line.’

No shock that the highest 10 shares within the S&P 500 index signify virtually one-third of the market worth of the index. The crowding of retirement financial savings into fewer and fewer shares signifies that steep market declines like August 5 and September 3 are significantly unsettling for older traders watching their financial savings dwindle. A rise within the variety of public firms would allow retirement traders to unfold out their threat by diversifying their investments into extra firms.

Maybe essentially the most dramatic illustration of the issue is the Wilshire 5000, an index that tracks the efficiency of the whole U.S. inventory market. Established in 1974 with — because the identify suggests — round 5,000 shares, that quantity has now dropped under 3,500.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

A current report in The Wall Road Journal attributed the decline to 20 years of low cost cash used to finance mergers amongst public firms. Whereas mergers are contributing to the decline, the dwindling provide of latest firms getting into the market through IPOs is the true perpetrator.

Why are IPOs changing into an endangered species? It’s unattractive and costly to be a public firm within the U.S., so entrepreneurs are reluctant to go public. Not content material with fast decline in public firms, the SEC continues to suggest new disclosure necessities, together with current proposals to require disclosure of Environmental Social and Governance points.

The Obama-era Dodd-Frank regulation required public firms to make varied disclosures on political sizzling matters such because the ratio of CEO pay to worker pay, the usage of “conflict minerals” or participation in “extractive resources” industries, all of which make it disagreeable and costly to be a public firm.

The Sarbanes-Oxley Act created the Public Firm Accounting Oversight Board which retains piling on increasingly accounting necessities. A public firm requires an costly military of attorneys and accountants to adjust to disclosure and accounting guidelines and if the corporate will get any of this incorrect, it’s topic to strike fits or hostile hearings in Congress.

Furthermore, the expansion of personal fairness funds (fueled by investments from pension plans for state and native authorities employees) offers a prepared path for promising non-public firms that want to keep non-public to promote their shares to such funds relatively than pursuing an IPO.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

As with so many different points, widespread sense insurance policies to revive the vibrancy of U.S. public inventory markets are available. The SEC should take away the regulatory uncertainty surrounding SPACs, together with reforming them if mandatory, and scale back the disclosure and accounting burdens on all public firms to deliver down the excessive price of being a public firm.

These steps will encourage profitable non-public firms to entry the general public markets for capital to construct their companies and provides on a regular basis Individuals the possibility to put money into these modern firms.

Norm Champ is a former director of the Division of Funding Administration on the U.S. Securities and Change Fee and creator of “Going Public: My Adventures Inside the SEC and How to Prevent the Next Devastating Crisis” (McGraw-Hill 2017).