The Kobeissi Letter editor-in-chief Adam Kobeissi argues recession fears are overblown regardless of the uptick in volatility on ‘Making Cash.’

Traders within the behemoth SPDR expertise sector fund is perhaps stunned to be taught that till final week their publicity to Nvidia was roughly 4 occasions that of Apple, regardless of their comparable market values.

That disparity was expensive for shareholders of the $70 billion State Road fund as a result of Apple inventory has outperformed Nvidia by 10 proportion factors within the third quarter. And, it compelled S&P Dow Jones Indices to tear up its rulebook to account for the rising would possibly of the largest tech firms.

Ticker Safety Final Change Change % AAPL APPLE INC. 232.90 +5.11

+2.24%

MSFT MICROSOFT CORP. 430.30 +2.28

+0.53%

NVDA NVIDIA CORP. 121.44 +0.04

+0.03%

XLK TECHNOLOGY SELECT SECTOR SPDR ETF 225.76 +0.66

+0.29%

The valuations of Apple, Microsoft and Nvidia, the three largest U.S. firms by market worth, have soared above $3 trillion this yr. Collectively, the businesses make up greater than 60% of the market worth of the S&P 500’s information-technology sector—and that conflicts with fund-concentration guidelines that restrict the mixed contribution of the largest firms to 50%.

Time has proven that passive investing, or monitoring indexes, sometimes presents the most effective return for buyers, whereas additionally limiting their danger. However the discrepancy throughout the SPDR fund—one of many world’s greatest exchange-traded funds—reveals that it doesn’t at all times work the way in which buyers count on. The rise of a handful of huge tech shares has modified the market in ways in which few buyers would have predicted even a decade in the past.

THE ETF REPORT: FOXBUSINESS.COM

“The original rules had operated fine and fair for basically the entire life of these funds,” stated Matthew Bartolini, head of Americas analysis for State Road’s SPDR ETF enterprise. “What really brought this to public lexicon was the rise of Nvidia. This is the first time you’ve ever had three stocks with a market cap over $3 trillion in the same sector.”

WILL US RETURN TO EASY MONEY ERA?

Below federal securities guidelines, not more than 25% of a fund’s belongings will be invested in a single inventory, and the sum of the weights of any firms that individually exceeded 5% of the fund’s belongings can’t prime 50%.

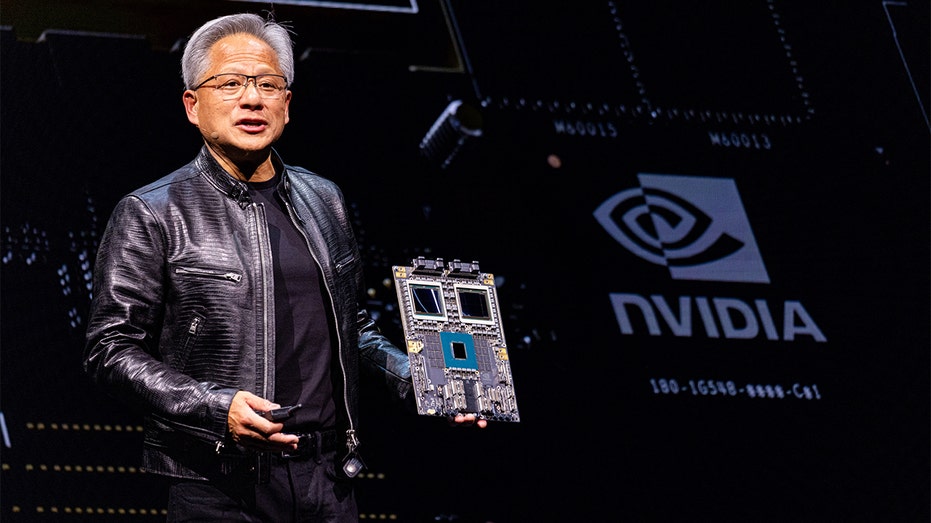

Jensen Huang, co-founder and CEO of Nvidia Corp., offers a chat in Taipei, Taiwan. (Annabelle Chih/Bloomberg by way of Getty Pictures / Getty Pictures)

To adjust to the 50% rule, S&P had historically capped the burden of the smallest constituent with a higher than 5% weight till an index was again beneath the focus threshold.

In early June, for instance, Microsoft and Apple every had a roughly 22% weight within the SPDR fund, which tracks S&P’s tech sector index. Regardless that the market caps of the three firms have been comparable, Nvidia had only a 6% weight in order that the 50% barrier wouldn’t be triggered.

Issues acquired particularly wonky when it was time for the index’s scheduled June rebalance. Nvidia had simply sneaked previous Apple’s market cap on the time. In consequence, Nvidia’s weight jumped to roughly 21%, and Apple’s was demoted to about 4.5%. Microsoft was the most important U.S. firm on the time and had a roughly 21% weighting as nicely.

Apple Inc. signage on the firm’s Fifth Avenue retailer in New York, US, on Wednesday, Might 15, 2024. Apple Inc. launched a brand new synthetic intelligence-focused iPad Professional and a bigger iPad Air, aiming to reinvigorate a pill lineup that has languished o (Photographer: Michael Nagle/Bloomberg by way of Getty Pictures / Getty Pictures)

Index-tracking funds needed to promote tens of billions of {dollars} in Apple shares and purchase Nvidia inventory instead. Within the case of the SPDR fund, that sum made up about 15% of its belongings. Including to the discord, Broadcom —the subsequent greatest inventory within the fund—had roughly the identical weight as Apple, regardless of Apple dwarfing the chip maker’s market cap by about 4 occasions.

Many buyers in well-liked tech index funds probably didn’t notice the discrepancies, stated Zachary Evens, an analyst at Morningstar.

“I think many investors would be surprised to see the third stock in the index receive such a disproportionately low weight,” Evens stated. “And the ones who knew about it were growing increasingly discontent.”

To deal with the difficulty, S&P modified its methodology to adjust to the foundations forward of its Sept. 20 rebalance. The index supplier lowered the weights of all three firms proportional to their market cap, till they collectively comprised lower than 50% of the SPDR fund.

Had the foundations not been modified, the fund would have as soon as once more executed an enormous swap between Nvidia and Apple shares as a result of Apple is once more the most important U.S. firm, adopted by Microsoft after which Nvidia.

The rise of different huge firms corresponding to Alphabet, Meta Platforms and Amazon.com didn’t create an issue for the SPDR fund as a result of they aren’t categorized as tech firms by S&P. These shares are within the communication-services and consumer-discretionary teams.

Focus points are most outstanding in sector indexes that supply buyers targeted publicity. The tech-heavy Nasdaq-100 Index did an unscheduled particular rebalance in July 2023—its first since 2011—to make sure that its greatest firms didn’t exceed 50% of the benchmark when mixed.

The thresholds are in place to permit funding autos corresponding to mutual funds and ETFs to keep up their standing as regulated funding firms that may move earnings by way of to shareholders as an alternative of being taxed like an everyday firm.