Consumer perception of current economic conditions in December was almost even with April 2020 levels, when sentiment bottomed out following the first major restrictions to control the coronavirus pandemic.

While Americans’ feelings about their personal finances slid through much of 2021, concerns about buying conditions—amid continuing worries about inflation—fell drastically for much of the year.

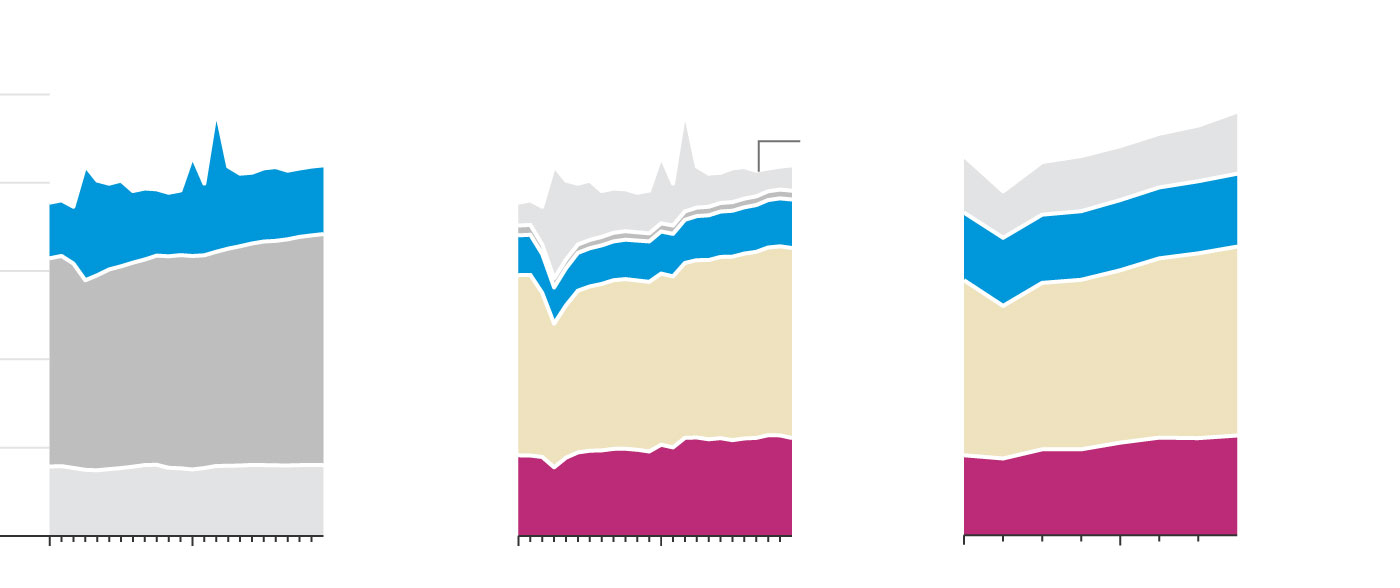

Household income has declined from spikes that occurred as the government distributed pandemic-related stimulus. Still, many Americans have seen wages and benefits increase, as the economy rebounded from earlier disruptions from the pandemic.

At the same time, decades-high levels of inflation have tempered enthusiasm for spending.

The University of Michigan has seen less enthusiasm for large purchases during the pandemic, with 41% of consumers citing high prices as a reason not to buy in December. Uncertainty and a lack of affordability were the leading causes for hesitance throughout much of 2020.

Since the pandemic began, a sharp increase of Americans buying goods has helped offset slower spending in the larger services economy. At the end of 2021, service spending was picking up speed but could be hampered by the rise in cases from the more infectious Omicron variant.

Personal income…

…fuels spending…

…contributing to GDP

Rest of

economy

Government

benefits

Government

spending

Employee

pay and

benefits

Consumer

services

Consumer

services

Consumer

goods

Consumer

goods

Other

income

Personal income…

…fuels spending…

…contributing to GDP

Rest of

economy

Gov’t

benefits

Gov’t

spending

Employee

pay and

benefits

Consumer

services

Consumer

services

Consumer

goods

Consumer

goods

Other

income

Personal income…

…fuels spending…

…contributing to GDP

Rest of

economy

Gov’t

benefits

Gov’t

spending

Employee

pay and

benefits

Consumer

services

Consumer

services

Consumer

goods

Consumer

goods

Other

income

Personal income…

Government

benefits

Employee

pay and

benefits

Other

income

…fuels spending…

Consumer

services

Consumer

goods

…contributing to GDP

Rest of

economy

Government

spending

Consumer

services

Consumer

goods

Personal income…

Government

benefits

Employee

pay and

benefits

Other

income

…fuels spending…

Consumer

services

Consumer

goods

…contributing to GDP

Rest of

economy

Government

spending

Consumer

services

Consumer

goods

The rapid economic growth, driven by consumer spending, means that the U.S. economy has largely rebounded. It was within $150 billion of Federal Reserve U.S. gross domestic product projections made before the pandemic hit.

Supply constraints caused by the pandemic and high consumer demand has helped to drive up prices. This imbalance in the economy is dragging down Americans’ confidence to make purchases but could be short-lived. A Wall Street Journal survey of economists shows this rate is expected to rapidly fall, landing around a lower but still elevated 3% annual growth in 2022.

Demand for labor is still high, despite growing employment costs. Industries hit hard by the pandemic, such as leisure and hospitality businesses, have since seen large wage gains and a steep climb in payrolls. Leisure and hospitality jobs have recovered 2.6 million positions in 2021.

Likewise, retail jobs have outpaced the overall labor market, while those jobs have been more expensive to fill. Continued recovery in hiring for in-person services and shopping—at a time when the Great Resignation has driven up the costs of workers—shows that businesses think there will be room to grow.

Change in the number of employees*, since end of 2019

Employment Cost Index, change since the end of 2019

Leisure and

hospitality

Total

private

Service

providing

All private

workers

Leisure and

hospitality

Goods

producing

Change in the number of employees*, since end of 2019

Employment Cost Index, change since the end of 2019

Leisure and

hospitality

Total

private

Service

providing

All private

workers

Leisure and

hospitality

Goods

producing

Change in the number of employees*, since end of 2019

Employment Cost Index, change since the end of 2019

Leisure and

hospitality

Total

private

Service

providing

All private

workers

Leisure and

hospitality

Goods

producing

Employment Cost Index, change since the end of 2019

Leisure and

hospitality

Service

providing

All private

workers

Goods

producing

Change in the number of employees*, since end of 2019

Total

private

Leisure and

hospitality

Employment Cost Index, change since the end of 2019

Leisure and

hospitality

Service

providing

All private

workers

Goods

producing

Change in the number of employees*, since end of 2019

Total

private

Leisure and

hospitality

Following the rapid growth seen last year, the outlook for GDP growth is expected to return to more typical levels, according to many economists from The Wall Street Journal Economic Forecasting Survey.

WSJ Economists Survey forecasts for GDP , annual change

= 1 forecast

Median

forecasts

GDP ANNUAL CHANGE (%)

= 1 forecast

Median

forecasts

GDP ANNUAL CHANGE (%)

= 1 forecast

Median

forecasts

GDP ANNUAL CHANGE (%)

= 1 forecast

Median

forecasts

GDP ANNUAL CHANGE (%)

= 1 forecast

Median

forecasts

GDP ANNUAL CHANGE (%)

Write to Danny Dougherty at [email protected] and Andrew Barnett at [email protected]

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared in the February 2, 2022, print edition as ‘Inflation Fuels Consumer Pessimism.’