The prospect of rising interest rates has been especially hard on the Russell 2000 small-cap index, in large part because of the high proportion of small-caps that aren’t making money.

During the market selloff of recent weeks, investors have been shedding speculative investments from tech stocks to cryptocurrencies.

Speculative investments with their promise of higher returns thrived in the ultra-low-rate environment of 2021. Now that the Federal Reserve may raise interest rates as soon as March to combat inflation, investors are less comfortable with risk.

The companies in small-cap index funds tend to have less-diversified business lines and more of a chance of not turning a profit.

Companies making up 31% of the Russell 2000 were unprofitable as of the end of 2021, according to an analysis from Jefferies of earnings over the previous 12 months. By contrast, 5.7% of the Russell 1000 index of larger firms was made up of companies without earnings.

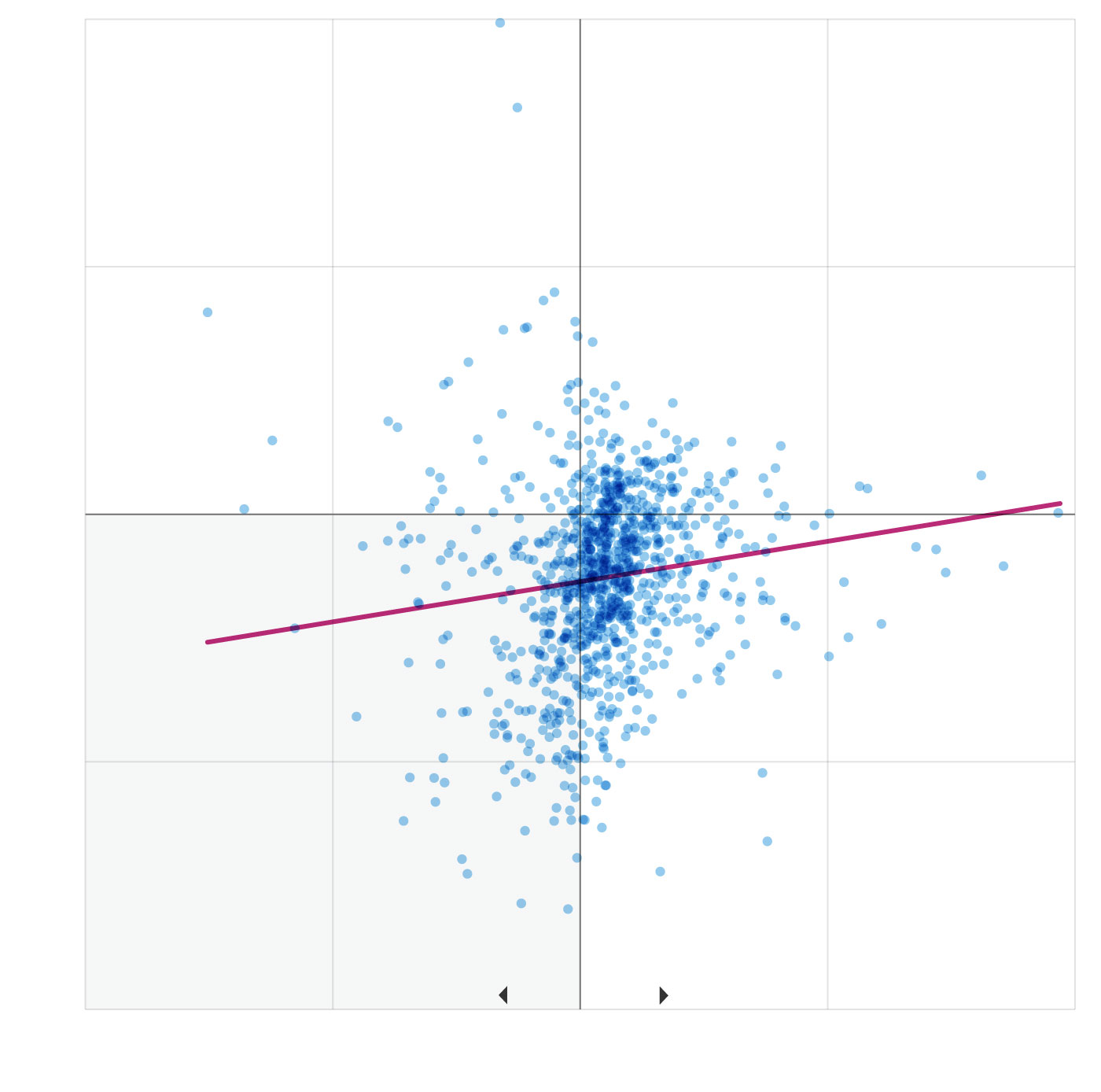

Russell 2000 stocks, share-price performance this year and net income in the past 12 months

PRICE PERFORMANCE, YTD

Trend line

Unprofitable

decliners

NET INCOME, LAST 12 MONTHS (BILLIONS)

PRICE PERFORMANCE, YTD

Trend line

Unprofitable

decliners

NET INCOME, LAST 12 MONTHS (BILLIONS)

PRICE PERFORMANCE, YTD

Trend line

Unprofitable

decliners

NET INCOME, LAST 12 MONTHS (BILLIONS)

PRICE PERFORMANCE, YTD

Trend line

Unprofitable

decliners

NET INCOME, LAST 12 MONTHS (BILLIONS)

Unprofitable

gainers

Profitable

gainers

PRICE PERFORMANCE, YTD

Trend line

Unprofitable

decliners

Profitable

decliners

NET INCOME, LAST 12 MONTHS (BILLIONS)

That disparity has been apparent in the performances of the indexes in recent weeks. Even with a stronger start to the week than other major U.S. stock indexes, the Russell 2000 has dropped 18% since its record close in November. The Russell 1000, by contrast, is down 9.6% from its record, according to FactSet.

“The nonearners are the riskiest of risky stocks,” said Steven DeSanctis, small- and midcap strategist at Jefferies. “These stocks generally do awful, very poorly, in front of a Fed hike.”

SHARE YOUR THOUGHTS

How do you think investors will approach companies that aren’t turning a profit in 2022? Join the conversation below.

Within the Russell 2000, shares of companies without earnings have fallen further this year than has the index as a whole, according to Mr. DeSanctis. News early this month that the Federal Reserve might raise interest rates as soon as March has shifted investors’ calculations within the stock market, making far-off earnings less attractive.

Small-cap companies with net losses over the past 12 months, according to FactSet, include online fashion company Stitch Fix Inc., SFIX -1.79% cosmetics company Revlon Inc., drugstore chain Rite Aid Corp. and biopharmaceutical company Cytokinetics Inc. CYTK -3.15%

Shares of Stitch Fix and Revlon have slid 16% year to date, while Rite Aid shares have lost 28% and Cytokinetics shares have fallen 33%.

Shares of companies that promise high growth have also lagged behind the broad stock market year to date. The Russell 1000 growth index, for example, is down 14% in 2022, while the Russell 1000 value index has dropped 4%. Growth stocks are losing out to value stocks among the small-caps as well.

Write to Karen Langley at [email protected]

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared in the January 26, 2022, print edition as ‘Russell 2000 Sags as Profitless Firms Fade.’