New York business owners are saving billions of dollars in taxes by using a state-approved system for sidestepping the $10,000 federal cap on state and local tax deductions.

Owners of closely held businesses paid the state $11 billion in pass-through entity taxes by the end of 2021, according to the state’s Department of Tax and Finance. Pass-through businesses usually don’t pay income taxes directly but pass income and deductions through to their owners’ individual returns.

By paying New York’s new pass-through entity tax, those business owners shifted their state income taxes from their individual tax returns—where the cap would pinch them—to their business filings, where the cap doesn’t affect them.

The total represents about one-sixth of New York’s projected personal income tax revenue for the fiscal year ending March 31. The result: If those business owners had an average federal tax rate of 32%, they would be saving more than $3 billion.

New York’s effort to help business owners dodge the cap marks the latest and most effective step by high-tax states to fight back against the $10,000 limit on deducting SALT, or state and local taxes, from federal income. Congress created the cap over Democratic objections in the 2017 tax law, and lawsuits and other workarounds have fallen short. Federal legislation to raise the cap is mired in intra-Democratic party fights in Washington.

In the meantime, some of New York’s largest law, financial and accounting firms routed their partners’ income through the state’s workaround, which took effect last year. Nearly 96,000 filers used the program, the tax department said.

“That’s a big number,” said James Wetzler, a former New York tax commissioner. The take-up is much greater than other workarounds, he said, including a program that lets employers pay federally deductible payroll taxes to help their employees have lower income taxes. That program had 328 users in 2021, according to the state. The Trump administration nixed another workaround that relied on people making charitable contributions in lieu of taxes.

Tax department spokesman James Gazzale declined to comment beyond providing the 2021 figures.

New York Assemblywoman Amy Paulin, a Democrat from Westchester County, sponsored legislation to create the workaround that was eventually adopted last year as part of the state budget. She said the extensive use of the pass-through program showed the inconsistency in the 2017 federal law.

“You had to be a fool not to take advantage,” she said. “New York was harmed in the change to SALT and this was one way of remedying some of that harm. Otherwise, our high earners are going to flee.”

States such as Connecticut and Wisconsin enacted similar laws earlier. The move by New York, the home of many of the highest-income business owners, is particularly important.

Details vary by state, but here’s generally how the workarounds operate. States impose taxes—often optional—on pass-through entities such as partnerships and S corporations, a tax designation for certain closely held businesses. Those taxes are paid and get subtracted before income flows to business owners, effectively creating an unlimited deduction.

The laws use tax credits or other mechanisms to absolve owners of individual income-tax liabilities from business income. Thus, they satisfy state income-tax obligations without generating income-tax deductions subject to the federal cap.

State revenue is virtually unchanged, because the entity-level tax replaces personal income taxes at roughly similar rates. Business owners win because every $100,000 of newly deductible state taxes reduces federal taxes by as much as $37,000. The federal government loses money.

The workarounds put pass-through businesses on a more level footing with corporations, which fully deduct corporate income taxes.

New York has a top-heavy income-tax base where the highest-earning 2% of filers account for about half of revenue. A significant chunk now flows through this alternate path available to owners of pass-through businesses.

The state’s top income-tax rate rose to 10.9% for income over $25 million for tax year 2021.

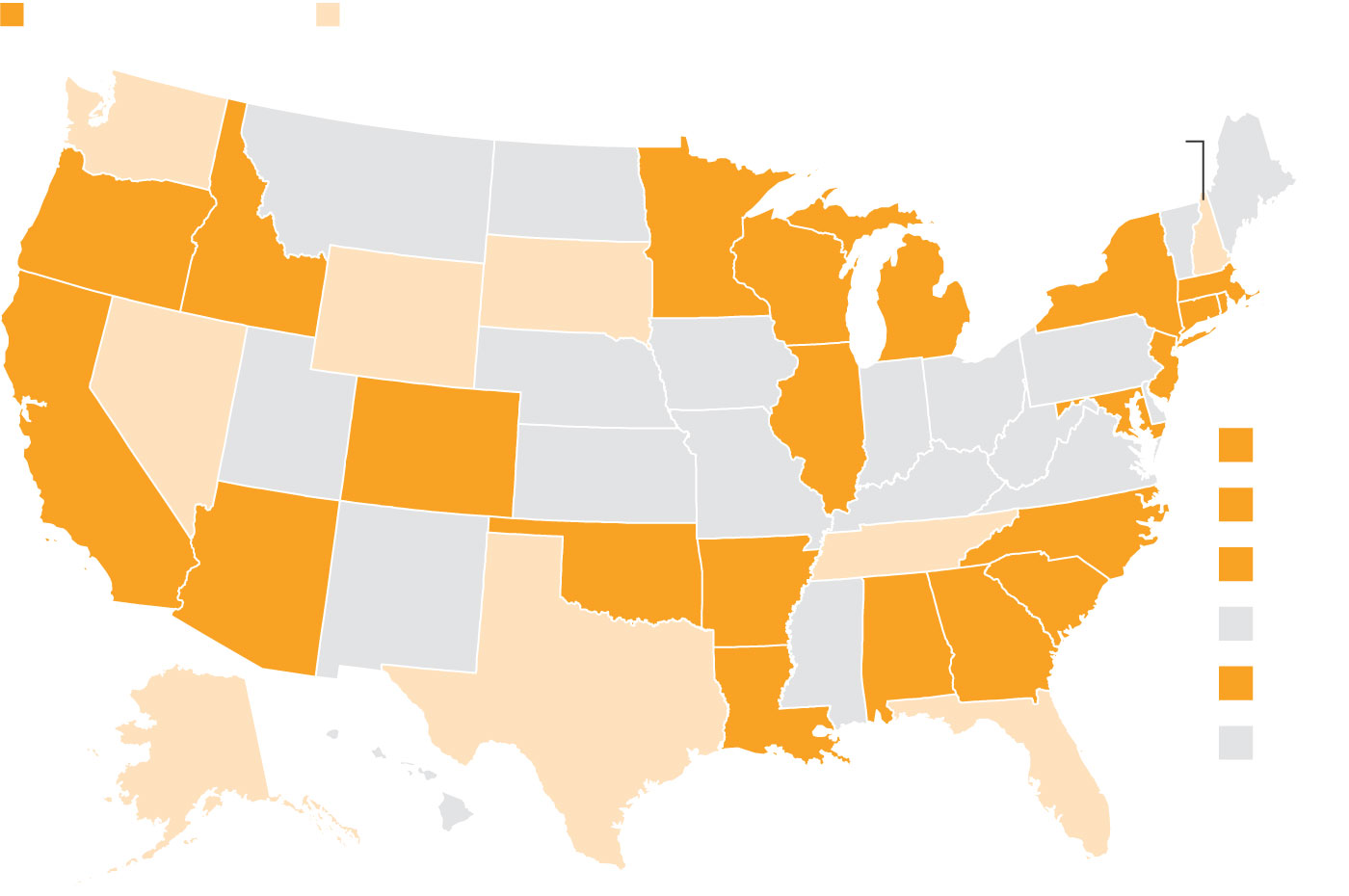

New York is one of 22 states that have adopted similar systems to help pass-through business owners get around the $10,000 cap, according to the Main Street Employers coalition, a business group pushing the idea. Congress created the cap to generate money to pay for tax rate cuts. Republicans say the old unlimited deduction subsidized high-tax states, because federal taxpayers were picking up part of the cost of state tax increases.

Most states either have enacted a way for business owners to get around the $10,000 cap on the state and local tax deduction or don’t have an income tax.

Have workarounds

Without broad individual income taxes

Have workarounds

Without broad individual income taxes

Have workarounds

Without broad individual income taxes

Democrats rode opposition to the cap to political gains in New York and New Jersey in 2018 but they haven’t been able to repeal or increase it yet. The House passed a bill last year that would raise the cap to $80,000, but it remains stalled in the Senate along with the rest of President Biden’s Build Back Better agenda.

New York and several other states also filed a federal lawsuit alleging that the cap is unconstitutional. That’s failed at the district and appeals court levels. Last week, the states asked the Supreme Court to hear the case.

This pass-through workaround to the cap, by contrast to other approaches, has been bipartisan and spread across Republican and Democratic states. The Treasury Department blessed it in 2020. The Biden administration, which has mostly left the issue to Congress, hasn’t shown any public interest in reversing that decision to strengthen enforcement of the limit.

“The cap is still, for the most part, doing its job. It’s just unfortunate that states are going to such lengths to try to protect their high earners from paying federal taxes,” said Marc Goldwein, senior vice president at the Committee for a Responsible Federal Budget in Washington. “It seems like win-win-win when you don’t account for the federal revenue part of it.”

Kathryn Wylde, president and chief executive of the business group Partnership for New York City, said the program was highly effective for the state and called on New York City to make a similar allowance for its local income tax.

“These are accounting firms, legal firms, financial firms—and they’re many of the people who New York state is most at risk of losing based on the very high tax burden they have with very limited deductions,” she said.

Write to Richard Rubin at [email protected] and Jimmy Vielkind at [email protected]

Copyright ©2022 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

-SOURCE-Parker-Hall.jpg?w=420&resize=420,280&ssl=1)