Never take liquidity for granted.

The ability to convert securities into cash promptly, at a price close to the last trade, isn’t a permanent property of markets; it’s a privilege that can disappear almost instantly at the worst possible time.

Like water itself, market liquidity can evaporate in an instant. Many traders learned that in January when Robinhood and other brokerages restricted trading in such hot stocks as GameStop Corp. GME 0.33% and AMC Entertainment Holdings Inc. AMC -2.49% Liquidity also dried up instantly during the “flash crash” of May 6, 2010. In the financial crisis of 2008-09, even ultrasafe money-market funds temporarily suspended giving shareholders their money back on demand.

Small investors just learned that old lesson anew when a regulation went into effect late last month, disrupting trading in thousands of stocks and bonds.

Scott Wetzel, 64 years old, is a retired business-information executive in the Seattle area whose portfolio consists partly of bonds and income-producing stocks. Several trade at OTC Markets Group, the main over-the-counter marketplace.

The OTC market is the catchall of stock trading in the U.S. and is primarily the province of individual investors. Nearly 12,000 stocks not listed on a national exchange like Nasdaq or the New York Stock Exchange trade there. You can buy shares in Adidas AG , Air Canada or Grayscale Bitcoin Trust. You can also get scammed by fly-by-night schemes run by unscrupulous stock promoters.

Historically, on the OTC, legitimate and illegitimate companies alike often chose not to make their financial statements public.

For years, Mr. Wetzel has relished the hefty dividends and interest some solid OTC companies paid him. Then, on Oct. 1, the market price of his preferred stock issued by Ladenburg Thalmann Financial Services Inc., an investment bank and brokerage, fell 23%.

This week, the preferred had fallen so far that its $2 dividend would yield 18% annually to anyone who could buy at its price of about $11 per share.

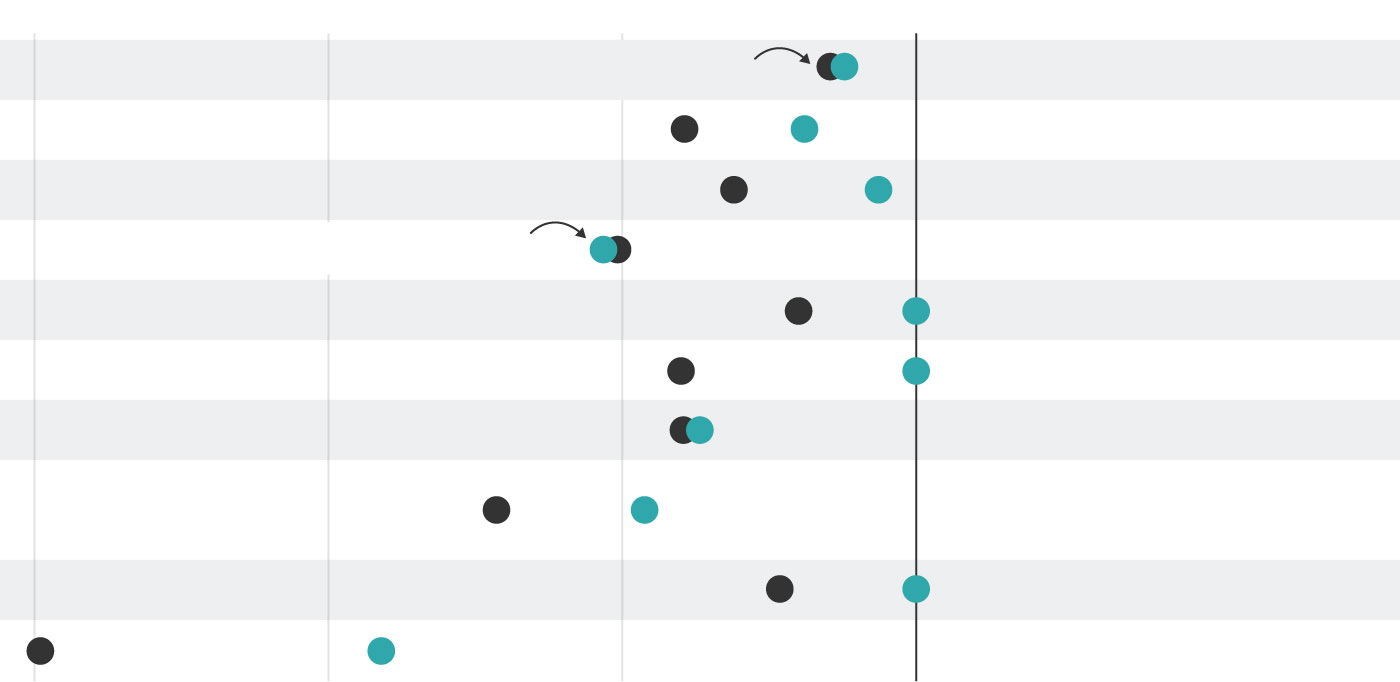

Illiquidity Blues

Many stocks and bonds traded over-the-counter on OTC Markets fell sharply when a new Securities and Exchange Commission rule restricted trading in them. Here’s a sample.

Change Sept. 1 to Oct. 5

AMG Capital Trust II

AmTrust Financial Services

Boston Sand & Gravel

Change Sept. 27 to Oct. 5

Canandaigua National

Connecticut Natural Gas

Dayton & Michigan Railroad

HCB Financial

Ladenburg Thalmann Financial

Services preferred

Northfield Precision Instrument

Youngevity International

Change Sept. 1 to Oct. 5

Change Sept. 27 to Oct. 5

AMG Capital Trust II

AmTrust Financial Services

Boston Sand & Gravel

Canandaigua National

Connecticut Natural Gas

Dayton & Michigan Railroad

HCB Financial

Ladenburg Thalmann Financial Services preferred

Northfield Precision Instrument

Youngevity International

Change Sept. 1 to Oct. 5

Change Sept. 27 to Oct. 5

AMG Capital Trust II

AmTrust Financial Services

Boston Sand & Gravel

Canandaigua National

Connecticut Natural Gas

Dayton & Michigan Railroad

HCB Financial

Ladenburg Thalmann Financial

Services preferred

Northfield Precision Instrument

Youngevity International

Confident that it was still a good investment, Mr. Wetzel tried to buy more at the drastically lower price. His broker said he could only sell, not buy.

That’s because a rule from the Securities and Exchange Commission went into effect at the end of September, generally preventing brokers from providing public price quotations on securities issued by companies that don’t release current financial information. Ladenburg, acquired by privately held Advisor Group Inc. in early 2020, no longer provides financial statements to the general public.

Under the SEC rule, many brokers have stopped offering price quotes on Ladenburg and thousands of other companies that don’t provide public information. And OTC Markets has classified Ladenburg’s securities as ineligible for public quotation.

Just like that, Mr. Wetzel’s holding was flash-frozen. He would love to buy more of what he believes is a bargain, but can’t. The last week of September, online forums like Silicon Investor and InnovativeIncomeInvestor.com erupted in complaints and commiseration from individual holders of OTC securities that became unbuyable in the blink of an eye.

“We find ourselves in a situation where there are real opportunities sitting in front of us,” says Mr. Wetzel, “but we can’t take advantage of them!”

The SEC intended the rule to protect individual investors “in these markets where retail presence is significant and, unfortunately, pump-and-dump and other frauds are too common,” then-SEC Chairman Jay Clayton said last year.

There’s a chance the regulation might protect small investors from fraud, but it was half-baked. The result is pandemonium. Small investors are enraged and professionals are trading what those individuals no longer can.

David Waters, who runs Alluvial Capital Management LLC, an investment firm in Sewickley, Pa., has been buying—because his brokers will still permit him, as a professional investor, to purchase any OTC securities under the SEC rule. “It’s created an opportunity for professionals at the expense of retail investors,” he says. “It’s an unfair transfer of value.”

The SEC declined to comment.

For a close-up of the chaos, look at the preferred shares of Golar LNG Partners LP, an energy company. At their par value of $25 per share, they pay an 8.75% annual dividend.

SHARE YOUR THOUGHTS

Have you ever been stuck holding an investment longer than you wanted? Tell us about it in the comments below.

On Sept. 27, categorized as a “Pink Current” stock, eligible for public quotes on OTC Markets, Golar closed at $22.60. The next morning, OTC Markets designated it as an Expert Market security, effectively unavailable to individual buyers. The shares slumped 11.5% in intraday trading.

On Sept. 29, OTC Markets reclassified Golar as “Pink Current,” and the stock shot as high as $25.75 in four days.

However, on Oct. 5, OTC Markets switched the stock back to Expert status. It fell 11% in two days.

“We didn’t just do this on a whim,” says Jason Paltrowitz, an executive vice president at OTC Markets. While declining to comment on Golar specifically, he says that under trading volume and financial tests in the SEC rule, securities may move back and forth between the Pink and Expert market tiers. Fewer than 1% of OTC Market stocks have done that, he says.

Roughly 2,700 securities became newly eligible for public price quotations on OTC Markets after the trading platform determined they met the new rule’s requirements. At the same time, OTC Markets stopped offering public quotes for about 2,200 stocks.

“If [small investors] were not paying attention to that rule change, they’d better be happy with what they own, because they may be stuck with it for a very long time,” says Robert Forster, a former hedge-fund portfolio manager who sometimes trades over the counter. “You owned a publicly traded security; now you’re a private-equity holder. Congratulations! You own it forever.”

Warren Buffett often counsels investors to buy stocks they’d be happy owning if they couldn’t sell for years. Every once in a while the market turns that adage into reality.

Write to Jason Zweig at [email protected]

Copyright ©2021 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

-Reviewer-Photo-SOURCE-Matthew-Korfhage.jpg?w=420&resize=420,280&ssl=1)